Page 148 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 148

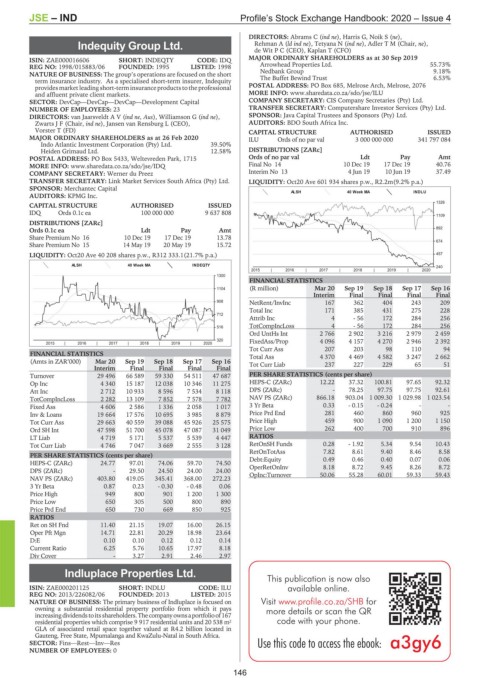

JSE – IND Profile’s Stock Exchange Handbook: 2020 – Issue 4

DIRECTORS: Abrams C (ind ne), Harris G, Noik S (ne),

Indequity Group Ltd. Rehman A (ld ind ne), Tetyana N (ind ne), Adler T M (Chair, ne),

de Wit P C (CEO), Kaplan T (CFO)

IND

ISIN: ZAE000016606 SHORT: INDEQTY CODE: IDQ MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

REG NO: 1998/015883/06 FOUNDED: 1995 LISTED: 1998 Arrowhead Properties Ltd. 55.73%

NATURE OF BUSINESS: The group’s operations are focused on the short Nedbank Group 9.18%

term insurance industry. As a specialised short-term insurer, Indequity The Buffet Bewind Trust 6.53%

provides market leading short-term insurance products to the professional POSTAL ADDRESS: PO Box 685, Melrose Arch, Melrose, 2076

and affluent private client markets. MORE INFO: www.sharedata.co.za/sdo/jse/ILU

SECTOR: DevCap—DevCap—DevCap—Development Capital COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

NUMBER OF EMPLOYEES: 23 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: van JaarsveldtAV(ind ne, Aus), Williamson G (ind ne), SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Zwarts J F (Chair, ind ne), Jansen van Rensburg L (CEO), AUDITORS: BDO South Africa Inc.

Vorster T (FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 26 Feb 2020 ILU Ords of no par val 3 000 000 000 341 797 084

Indo Atlantic Investment Corporation (Pty) Ltd. 39.50%

Heiden Grimaud Ltd. 12.58% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 5433, Weltevreden Park, 1715 Ords of no par val Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/IDQ Final No 14 10 Dec 19 17 Dec 19 40.76

COMPANY SECRETARY: Werner du Preez Interim No 13 4 Jun 19 10 Jun 19 37.49

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. LIQUIDITY: Oct20 Ave 601 934 shares p.w., R2.2m(9.2% p.a.)

SPONSOR: Merchantec Capital

AUDITORS: KPMG Inc. ALSH 40 Week MA INDLU

1326

CAPITAL STRUCTURE AUTHORISED ISSUED

IDQ Ords 0.1c ea 100 000 000 9 637 808

1109

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt 892

Share Premium No 16 10 Dec 19 17 Dec 19 13.78

Share Premium No 15 14 May 19 20 May 19 15.72 674

LIQUIDITY: Oct20 Ave 40 208 shares p.w., R312 333.1(21.7% p.a.) 457

ALSH 40 Week MA INDEQTY 240

2015 | 2016 | 2017 | 2018 | 2019 | 2020

1300

FINANCIAL STATISTICS

1104 (R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

Interim Final Final Final Final

908 NetRent/InvInc 167 362 404 243 209

Total Inc 171 385 431 275 228

712

Attrib Inc 4 - 56 172 284 256

516 TotCompIncLoss 4 - 56 172 284 256

Ord UntHs Int 2 766 2 902 3 216 2 979 2 459

320 FixedAss/Prop 4 096 4 157 4 270 2 946 2 392

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Tot Curr Ass 207 203 98 110 94

FINANCIAL STATISTICS Total Ass 4 370 4 469 4 582 3 247 2 662

(Amts in ZAR’000) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 Tot Curr Liab 237 227 229 65 51

Interim Final Final Final Final

Turnover 29 496 66 589 59 330 54 511 47 687 PER SHARE STATISTICS (cents per share)

Op Inc 4 340 15 187 12 038 10 346 11 275 HEPS-C (ZARc) 12.22 37.32 100.81 97.65 92.32

Att Inc 2 712 10 933 8 596 7 534 8 118 DPS (ZARc) - 78.25 97.75 97.75 92.61

TotCompIncLoss 2 282 13 109 7 852 7 578 7 782 NAV PS (ZARc) 866.18 903.04 1 009.30 1 029.98 1 023.54

Fixed Ass 4 606 2 586 1 336 2 058 1 017 3 Yr Beta 0.33 - 0.15 - 0.24 - -

Inv & Loans 19 664 17 576 10 695 3 985 8 879 Price Prd End 281 460 860 960 925

Tot Curr Ass 29 663 40 559 39 088 45 926 25 575 Price High 459 900 1 090 1 200 1 150

Ord SH Int 47 598 51 700 45 078 47 087 31 049 Price Low 262 400 700 910 896

LT Liab 4 719 5 171 5 537 5 539 4 447 RATIOS

Tot Curr Liab 4 746 7 047 3 669 2 555 3 128 RetOnSH Funds 0.28 - 1.92 5.34 9.54 10.43

RetOnTotAss 7.82 8.61 9.40 8.46 8.58

PER SHARE STATISTICS (cents per share)

Debt:Equity 0.49 0.46 0.40 0.07 0.06

HEPS-C (ZARc) 24.77 97.01 74.06 59.70 74.50

8.26

9.45

8.72

8.18

8.72

DPS (ZARc) - 29.50 24.50 24.00 24.00 OperRetOnInv 50.06 55.28 60.01 59.33 59.43

OpInc:Turnover

NAV PS (ZARc) 403.80 419.05 345.41 368.00 272.23

3 Yr Beta 0.87 0.23 - 0.30 - 0.48 0.06

Price High 949 800 901 1 200 1 300

Price Low 650 305 500 800 890

Price Prd End 650 730 669 850 925

RATIOS

Ret on SH Fnd 11.40 21.15 19.07 16.00 26.15

Oper Pft Mgn 14.71 22.81 20.29 18.98 23.64

D:E 0.10 0.10 0.12 0.12 0.14

Current Ratio 6.25 5.76 10.65 17.97 8.18

Div Cover - 3.27 2.91 2.46 2.97

Indluplace Properties Ltd.

This publication is now also

IND

ISIN: ZAE000201125 SHORT: INDLU CODE: ILU available online.

REG NO: 2013/226082/06 FOUNDED: 2013 LISTED: 2015

NATURE OF BUSINESS: The primary business of Indluplace is focused on Visit www.profile.co.za/SHB for

owning a substantial residential property portfolio from which it pays more details or scan the QR

increasingdividendstoitsshareholders.Thecompanyownsaportfolioof167

residential properties which comprise 9 917 residential units and 20 538 m 2 code with your phone.

GLA of associated retail space together valued at R4.2 billion located in

Gauteng, Free State, Mpumalanga and KwaZulu-Natal in South Africa.

SECTOR: Fins—Rest—Inv—Res Usethiscodetoaccess theebook:

NUMBER OF EMPLOYEES: 0

146