Page 146 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 146

JSE – IMP Profile’s Stock Exchange Handbook: 2020 – Issue 4

POSTAL ADDRESS:POBox3013, Edenvale,1610

Imperial Logistics Ltd. EMAIL: Esha.Mansingh@imperiallogistics.com

WEBSITE: www.imperiallogistics.com

IMP

TELEPHONE: 011-372-6500

COMPANY SECRETARY: R A Venter

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: Deloitte & Touche

Scan the QR code to BANKERS: First National Bank, Nedbank,

visit our website

Standard Bank

CALENDAR Expected Status

Annual General Meeting 9 Nov 2020 Confirmed

Next Interim Results 23 Feb 2021 Confirmed

Next Final Results 24 Aug 2021 Confirmed

ISIN: ZAE000067211 SHORT: IMPERIAL CODE: IPL

REG NO: 1946/021048/06 FOUNDED: 1946 LISTED: 1987

CAPITAL STRUCTURE AUTHORISED ISSUED

NATURE OF BUSINESS: IPL Ords 4c ea 394 999 000 202 074 388

Imperial is an African and European focused provider of DISTRIBUTIONS [ZARc]

logistics and market access solutions. Ranked among the top Ords 4c ea Ldt Pay Amt

30 global logistics providers, the group is listed on the Johan- Interim No 60 17 Mar 20 23 Mar 20 167.00

nesburg Stock Exchange and employs over 25 000 people. Final No 59 23 Sep 19 30 Sep 19 109.00

Operating in more than 26 countries, we play a critical role in Interim No 58 18 Mar 19 25 Mar 19 135.00

the lives of our clients, countries and communities by Final No 57 25 Sep 18 1 Oct 18 387.00

providing accesstoqualityproducts andservices. With afocus LIQUIDITY: Sep20 Ave 5m shares p.w., R231.3m(127.1% p.a.)

on five key industries - automotive, chemicals, consumer,

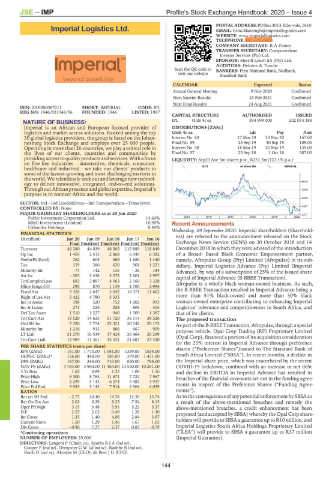

healthcare and industrial - we take our clients’ products to INDT 40 Week MA IMPERIAL

some of the fastest-growing and most challenging markets in

the world. We relentlessly seek out and leverage new technol-

ogy to deliver innovative, integrated, end-to-end solutions. 9635

Through our African presence and globalexpertise, Imperial’s 7846

purpose is to connect Africa and the world.

6056

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

4267

CONTROLLED BY: None

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 2477

Public Investment Corporation Ltd. 14.60% 2015 | 2016 | 2017 | 2018 | 2019 | 2020

M&G Investments (London) 10.90% Recent Announcements

Ukhamba Holdings 8.40%

Wednesday, 09 September 2020: Imperial shareholders (Sharehold-

FINANCIAL STATISTICS ers) are referred to the announcement released on the Stock

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final(rst) Final(rst) Final(rst) Exchange News Service (SENS) on 30 October 2018 and 14

Turnover 46 380 44 039 48 565 115 889 118 849 December 2018 in which they were advised of the introduction

Op Inc 1 459 2 413 2 868 6 049 6 382 of a Broad- Based Black Economic Empowerment partner,

NetIntPd(Rcvd) 762 605 569 1 680 1 440 namely, Afropulse Group (Pty) Limited (Afropulse) in its sub-

Tax 159 386 620 901 1 221 sidiary, Imperial Logistics Advance (Pty) Limited (Imperial

Minority Int 77 142 135 - 36 184 Advance), by way of a subscription of 25% of the issued share

Att Inc - 303 3 438 3 273 2 601 2 997 capital of Imperial Advance (B-BBEE Transaction).

TotCompIncLoss 683 3 887 4 063 2 160 3 328 Afropulse is a wholly black woman-owned business. As such,

Hline Erngs-CO 295 870 1 139 2 700 2 994

Fixed Ass 3 326 2 647 3 042 10 371 11 602 the B-BBEE Transaction resulted in Imperial Advance being a

more than 51% black-owned and more than 30% black

Right of use Ass 5 422 4 780 5 335 - -

Inv in Assoc 198 520 752 1 002 993 woman-owned enterprise contributing to enhancing Imperial

Inv & Loans 271 225 258 805 404 Logistics’ relevance and competitiveness in South Africa, and

Def Tax Asset 1 510 1 227 940 1 509 1 387 that of its clients.

Tot Curr Ass 19 529 14 633 51 720 36 114 38 526 The proposed transaction

Ord SH Int 7 320 7 774 22 321 20 742 20 173 As part of the B-BBEE Transaction, Afropulse, through a special

Minority Int 1 218 913 886 667 909 purpose vehicle, Opal Corp Trading (RF) Proprietary Limited

LT Liab 21 270 16 539 17 428 26 464 26 299 (Opal Corp), financed a portion of its acquisition consideration

Tot Curr Liab 12 984 11 361 35 331 21 687 23 320

for the 25% interest in Imperial Advance through preference

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 161.00 1 773.00 1 681.00 1339.00 1554.00 shares (“Preference Shares”)issued to The Standard Bank of

HEPS-C (ZARc)* 156.00 448.00 585.00 379.00 1 451.00 South Africa Limited (“SBSA”). In recent months, a decline in

DPS (ZARc) 167.00 244.00 710.00 650.00 795.00 the Imperial share price, which was exacerbated by the recent

NAV PS (ZARc) 3 783.00 3 960.00 11 464.00 10 550.00 10 261.00 COVID-19 lockdown, combined with an increase in net debt

3 Yr Beta 1.62 0.89 1.25 1.06 1.16 and decline in EBITDA in Imperial Advance has resulted in

Price High 6 300 8 764 11 671 7 724 7 567 breaches of the financial covenants set out in the funding agree-

Price Low 2 299 5 143 6 374 5 482 3 937 ments in respect of the Preference Shares (“Funding Agree-

Price Prd End 3 933 5 143 7 914 6 504 6 039

RATIOS ments”).

Ret on SH Fnd - 2.73 10.40 14.76 12.39 15.74 As to the consequencesof any potential enforcementby SBSA as

Ret On Tot Ass 2.03 6.29 8.25 7.54 8.15 a result of the above-mentioned breaches and remedy the

Oper Pft Mgn 3.15 5.48 5.91 5.22 5.37 above-mentioned breaches, a credit enhancement has been

D:E 2.57 2.03 0.49 1.28 1.30 proposed (and accepted by SBSA) whereby the Opal Corp share-

Int Cover 1.33 1.40 4.06 2.84 3.67

Current Ratio 1.50 1.29 1.46 1.67 1.65 holders will provide to SBSA a guarantee up to R10 million, and

Div Cover - 0.96 7.27 2.37 0.83 0.79 Imperial Logistics South Africa Holdings Proprietary Limited

*Continuing operations (“ÏLSA”) will provide to SBSA a guarantee up to R37 million

NUMBER OF EMPLOYEES: 25 000 (Imperial Guarantee).

DIRECTORS: Langeni P (Chair, ne), SparksRJA(ind ne),

Cooper P (ind ne), DempsterGW(ld ind ne), Radebe B (ind ne),

Reich D (ind ne), Akoojee M (CEO), de Beer J G (CFO)

144