Page 120 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 120

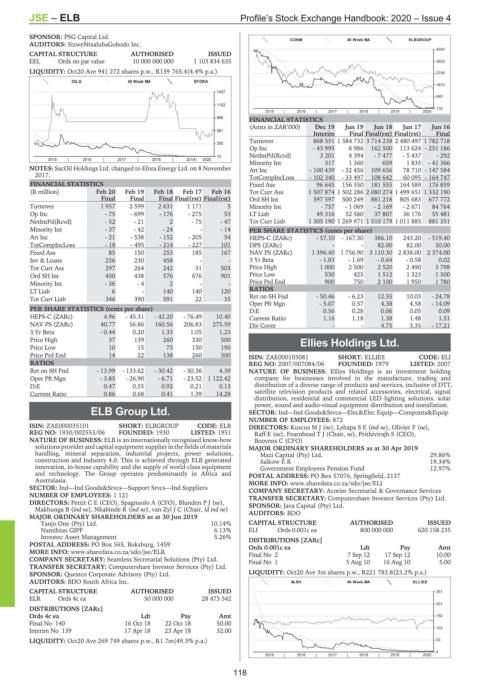

JSE – ELB Profile’s Stock Exchange Handbook: 2020 – Issue 4

SPONSOR: PSG Capital Ltd.

CONM 40 Week MA ELBGROUP

AUDITORS: SizweNtsalubaGobodo Inc.

4500

CAPITAL STRUCTURE AUTHORISED ISSUED

EEL Ords no par value 10 000 000 000 1 103 834 635 3623

LIQUIDITY: Oct20 Ave 941 272 shares p.w., R139 765.4(4.4% p.a.) 2746

OILG 40 Week MA EFORA

1870

1437

993

1152

116

2015 | 2016 | 2017 | 2018 | 2019 | 2020

866

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

581

Interim Final Final(rst) Final(rst) Final

Turnover 868 551 1 584 732 3 714 238 2 480 497 1 782 718

295

Op Inc - 43 995 8 986 162 500 113 624 - 251 186

10 NetIntPd(Rcvd) 3 201 4 394 - 7 477 - 5 437 - 292

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Minority Int 317 1 360 659 1 835 - 41 366

NOTES: SacOil Holdings Ltd. changed to Efora Energy Ltd. on 8 November Att Inc - 100 439 - 32 456 109 656 78 710 - 147 584

2017.

TotCompIncLoss - 102 340 - 33 497 108 642 60 095 - 164 747

FINANCIAL STATISTICS Fixed Ass 96 645 156 350 181 555 164 589 176 859

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 Tot Curr Ass 1 507 874 1 502 286 2 080 274 1 499 651 1 332 190

Final Final Final Final(rst) Final(rst) Ord SH Int 397 597 500 249 881 218 805 683 677 772

Turnover 1 957 2 599 2 631 1 171 5 Minority Int - 757 - 1 069 - 2 169 - 2 671 84 764

Op Inc - 75 - 699 - 176 - 275 53 LT Liab 49 316 32 560 37 807 36 176 55 481

NetIntPd(Rcvd) - 52 - 21 2 - 75 - 47 Tot Curr Liab 1 305 190 1 269 971 1 510 179 1 011 885 881 351

Minority Int - 37 - 42 - 24 - - 14 PER SHARE STATISTICS (cents per share)

Att Inc - 21 - 538 - 152 - 205 54 HEPS-C (ZARc) - 57.10 - 167.30 386.10 243.20 - 519.40

TotCompIncLoss - 18 - 495 - 214 - 227 101 DPS (ZARc) - - 82.00 82.00 30.00

Fixed Ass 85 150 253 185 167 NAV PS (ZARc) 1 396.40 1 756.90 3 110.30 2 838.00 2 374.00

Inv & Loans 256 230 458 - - 3 Yr Beta - 1.83 - 1.69 - 0.64 - 0.58 0.02

Tot Curr Ass 297 264 242 31 503 Price High 1 000 2 500 2 520 2 490 3 798

Ord SH Int 450 438 576 676 901 Price Low 530 425 1 512 1 323 1 500

Minority Int - 36 - 4 2 - - Price Prd End 900 750 2 100 1 950 1 780

LT Liab 6 - 140 140 120 RATIOS

Tot Curr Liab 346 390 591 22 35 Ret on SH Fnd - 50.46 - 6.23 12.55 10.03 - 24.78

Oper Pft Mgn - 5.07 0.57 4.38 4.58 - 14.09

PER SHARE STATISTICS (cents per share) D:E 0.56 0.28 0.06 0.05 0.09

HEPS-C (ZARc) 4.96 - 45.31 - 42.20 - 76.49 10.40 Current Ratio 1.16 1.18 1.38 1.48 1.51

NAV PS (ZARc) 40.77 56.86 160.56 206.83 275.59 Div Cover - - 4.75 3.35 - 17.21

3 Yr Beta - 0.44 0.20 1.33 1.05 1.23

Price High 37 139 260 330 500 Ellies Holdings Ltd.

Price Low 10 15 75 150 190

ELL

Price Prd End 14 22 138 260 300 ISIN: ZAE000103081 SHORT: ELLIES CODE: ELI

RATIOS REG NO: 2007/007084/06 FOUNDED: 1979 LISTED: 2007

Ret on SH Fnd - 13.99 - 133.62 - 30.42 - 30.36 4.39 NATURE OF BUSINESS: Ellies Holdings is an investment holding

Oper Pft Mgn - 3.85 - 26.90 - 6.71 - 23.52 1 122.42 company for businesses involved in the manufacture, trading and

D:E 0.47 0.55 0.92 0.21 0.13 distribution of a diverse range of products and services, inclusive of DTT,

Current Ratio 0.86 0.68 0.41 1.39 14.29 satellite television products and related accessories, electrical, signal

distribution, residential and commercial LED lighting solutions, solar

power, sound and audio-visual equipment distribution and installation.

ELB Group Ltd. SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip

NUMBER OF EMPLOYEES: 872

ELB

ISIN: ZAE000035101 SHORT: ELBGROUP CODE: ELR DIRECTORS: KuscusMJ(ne), LehapaSE(ind ne), Olivier F (ne),

REG NO: 1930/002553/06 FOUNDED: 1930 LISTED: 1951 Raff E (ne), Fearnhead T J (Chair, ne), Prithivirajh S (CEO),

NATURE OF BUSINESS: ELB is an internationally recognised know-how Booyens C (CFO)

solutions provider and capital equipment supplier in the fields of materials MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2019

handling, mineral separation, industrial projects, power solutions, Mazi Capital (Pty) Ltd. 29.86%

construction and Industry 4.0. This is achieved through ELB generated Salkow E R 19.34%

innovation, in-house capability and the supply of world-class equipment Government Employees Pension Fund 12.97%

and technology. The Group operates predominantly in Africa and POSTAL ADDRESS: PO Box 57076, Springfield, 2137

Australasia. MORE INFO: www.sharedata.co.za/sdo/jse/ELI

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Ind Suppliers COMPANY SECRETARY: Acorim Secretarial & Governance Services

NUMBER OF EMPLOYEES: 1 121 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Pettit C E (CEO), Spagnuolo A (CFO), BlundenPJ(ne), SPONSOR: Java Capital (Pty) Ltd.

Makhunga B (ind ne), Nkabinde R (ind ne), van Zyl J C (Chair, ld ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 AUDITORS: BDO

Tanjo One (Pty) Ltd. 10.14% CAPITAL STRUCTURE AUTHORISED ISSUED

Namibian GIPF 6.13% ELI Ords 0.001c ea 800 000 000 620 158 235

Investec Asset Management 5.26% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 565, Boksburg, 1459 Ords 0.001c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/ELR Final No 2 7 Sep 12 17 Sep 12 10.00

COMPANY SECRETARY: Seamless Secretarial Solutions (Pty) Ltd. Final No 1 5 Aug 10 16 Aug 10 5.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. LIQUIDITY: Oct20 Ave 3m shares p.w., R221 783.8(23.2% p.a.)

AUDITORS: BDO South Africa Inc. ALSH 40 Week MA ELLIES

CAPITAL STRUCTURE AUTHORISED ISSUED 251

ELR Ords 4c ea 50 000 000 28 473 542

201

DISTRIBUTIONS [ZARc]

Ords 4c ea Ldt Pay Amt 152

Final No 140 16 Oct 18 22 Oct 18 50.00

103

Interim No 139 17 Apr 18 23 Apr 18 32.00

LIQUIDITY: Oct20 Ave 269 749 shares p.w., R1.7m(49.3% p.a.) 53

4

2015 | 2016 | 2017 | 2018 | 2019 | 2020

118