Page 116 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 116

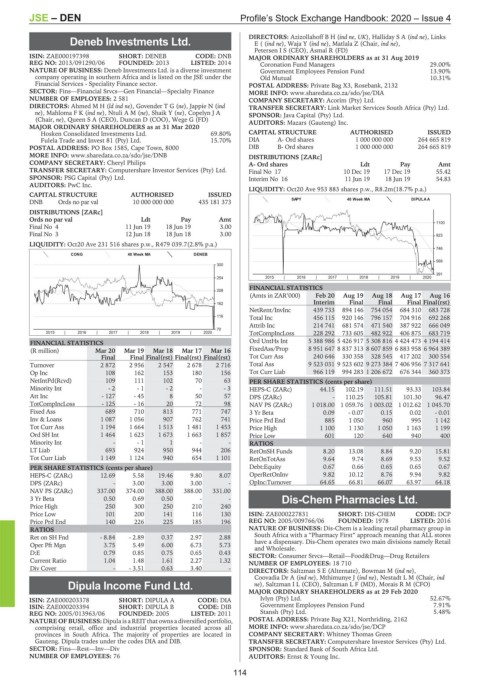

JSE – DEN Profile’s Stock Exchange Handbook: 2020 – Issue 4

DIRECTORS: AzizollahoffBH(ind ne, UK), HallidaySA(ind ne), Links

Deneb Investments Ltd. E((ind ne), Waja Y (ind ne), Matlala Z (Chair, ind ne),

Petersen I S (CEO), Asmal R (FD)

DEN

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 Coronation Fund Managers 29.00%

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment Government Employees Pension Fund 13.90%

company operating in southern Africa and is listed on the JSE under the Old Mutual 10.31%

Financial Services - Speciality Finance sector. POSTAL ADDRESS: Private Bag X3, Rosebank, 2132

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance MORE INFO: www.sharedata.co.za/sdo/jse/DIA

NUMBER OF EMPLOYEES: 2 581 COMPANY SECRETARY: Acorim (Pty) Ltd.

DIRECTORS: AhmedMH(ld ind ne), GovenderTG(ne), Jappie N (ind TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

ne), MahlomaFK(ind ne), NtuliAM(ne), Shaik Y (ne), Copelyn J A SPONSOR: Java Capital (Pty) Ltd.

(Chair, ne), Queen S A (CEO), Duncan D (COO), Wege G (FD) AUDITORS: Mazars (Gauteng) Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Hosken Consolidated Investments Ltd. 69.80% CAPITAL STRUCTURE AUTHORISED ISSUED

Fulela Trade and Invest 81 (Pty) Ltd. 15.70% DIA A- Ord shares 1 000 000 000 264 665 819

POSTAL ADDRESS: PO Box 1585, Cape Town, 8000 DIB B- Ord shares 1 000 000 000 264 665 819

MORE INFO: www.sharedata.co.za/sdo/jse/DNB DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Cheryl Philips A- Ord shares Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 17 10 Dec 19 17 Dec 19 55.42

SPONSOR: PSG Capital (Pty) Ltd. Interim No 16 11 Jun 19 18 Jun 19 54.83

AUDITORS: PwC Inc.

LIQUIDITY: Oct20 Ave 953 883 shares p.w., R8.2m(18.7% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

DNB Ords no par val 10 000 000 000 435 181 373 SAPY 40 Week MA DIPULA A

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

1100

Final No 4 11 Jun 19 18 Jun 19 3.00

Final No 3 12 Jun 18 18 Jun 18 3.00 923

LIQUIDITY: Oct20 Ave 231 516 shares p.w., R479 039.7(2.8% p.a.)

746

CONG 40 Week MA DENEB

568

300

391

254 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

208

(Amts in ZAR’000) Feb 20 Aug 19 Aug 18 Aug 17 Aug 16

162 Interim Final Final Final Final(rst)

NetRent/InvInc 439 733 894 146 754 054 684 310 683 728

116 Total Inc 456 115 920 146 796 157 704 916 692 268

Attrib Inc 214 741 681 574 471 540 387 922 666 049

70

2015 | 2016 | 2017 | 2018 | 2019 | 2020 TotCompIncLoss 228 292 733 605 482 922 406 875 683 719

FINANCIAL STATISTICS Ord UntHs Int 5 388 986 5 426 917 5 308 816 4 424 473 4 194 414

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 FixedAss/Prop 8 951 647 8 837 313 8 607 859 6 883 958 6 964 389

Final Final Final(rst) Final(rst) Final(rst) Tot Curr Ass 240 646 330 358 328 545 417 202 300 554

Turnover 2 872 2 956 2 547 2 678 2 716 Total Ass 9 523 031 9 523 602 9 273 384 7 406 956 7 317 641

Op Inc 108 162 153 180 156 Tot Curr Liab 966 119 994 283 1 206 672 676 344 360 373

NetIntPd(Rcvd) 109 111 102 70 63 PER SHARE STATISTICS (cents per share)

Minority Int - 2 - 1 - 2 - - 3 HEPS-C (ZARc) 44.15 102.19 111.51 93.33 103.84

Att Inc - 127 - 45 8 50 57 DPS (ZARc) - 110.25 105.81 101.30 96.47

TotCompIncLoss - 125 - 16 20 72 98 NAV PS (ZARc) 1 018.00 1 059.76 1 003.02 1 012.62 1 045.70

Fixed Ass 689 710 813 771 747 3 Yr Beta 0.09 - 0.07 0.15 0.02 - 0.01

Inv & Loans 1 087 1 056 907 762 741 Price Prd End 885 1 050 960 995 1 142

Tot Curr Ass 1 194 1 664 1 513 1 481 1 453 Price High 1 100 1 130 1 050 1 163 1 199

Ord SH Int 1 464 1 623 1 673 1 663 1 857 Price Low 601 120 640 940 400

Minority Int - - 1 1 - - RATIOS

LT Liab 693 924 950 944 206 RetOnSH Funds 8.20 13.08 8.84 9.20 15.81

Tot Curr Liab 1 149 1 124 940 654 1 101 RetOnTotAss 9.64 9.74 8.69 9.53 9.52

PER SHARE STATISTICS (cents per share) Debt:Equity 0.67 0.66 0.65 0.65 0.67

HEPS-C (ZARc) 12.69 5.58 19.46 9.80 8.07 OperRetOnInv 9.82 10.12 8.76 9.94 9.82

DPS (ZARc) - 3.00 3.00 3.00 - OpInc:Turnover 64.65 66.81 66.07 63.97 64.18

NAV PS (ZARc) 337.00 374.00 388.00 388.00 331.00

3 Yr Beta 0.50 0.69 0.50 - - Dis-Chem Pharmacies Ltd.

Price High 250 300 250 210 240

DIS

Price Low 101 200 141 116 130 ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP

Price Prd End 140 226 225 185 196 REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016

RATIOS NATURE OF BUSINESS: Dis-Chem is a leading retail pharmacy group in

Ret on SH Fnd - 8.84 - 2.89 0.37 2.97 2.88 South Africa with a “Pharmacy First” approach meaning that ALL stores

Oper Pft Mgn 3.75 5.49 6.00 6.73 5.73 have a dispensary. Dis-Chem operates two main divisions namely Retail

and Wholesale.

D:E 0.79 0.85 0.75 0.65 0.43 SECTOR: Consumer Srvcs—Retail—Food&Drug—Drug Retailers

Current Ratio 1.04 1.48 1.61 2.27 1.32 NUMBER OF EMPLOYEES: 18 710

Div Cover - - 3.51 0.63 3.40 -

DIRECTORS: Saltzman S E (Alternate), Bowman M (ind ne),

Coovadia Dr A (ind ne), Mthimunye J (ind ne), Nestadt L M (Chair, ind

Dipula Income Fund Ltd. ne), Saltzman I L (CEO), Saltzman L F (MD), Morais R M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

DIP

ISIN: ZAE000203378 SHORT: DIPULA A CODE: DIA Ivlyn (Pty) Ltd. 52.67%

ISIN: ZAE000203394 SHORT: DIPULA B CODE: DIB Government Employees Pension Fund 7.91%

REG NO: 2005/013963/06 FOUNDED: 2005 LISTED: 2011 Stansh (Pty) Ltd. 5.48%

NATURE OF BUSINESS: Dipula is a REIT that owns a diversified portfolio, POSTAL ADDRESS: Private Bag X21, Northriding, 2162

comprising retail, office and industrial properties located across all MORE INFO: www.sharedata.co.za/sdo/jse/DCP

provinces in South Africa. The majority of properties are located in COMPANY SECRETARY: Whitney Thomas Green

Gauteng. Dipula trades under the codes DIA and DIB. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: Fins—Rest—Inv—Div SPONSOR: Standard Bank of South Africa Ltd.

NUMBER OF EMPLOYEES: 76 AUDITORS: Ernst & Young Inc.

114