Page 118 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 118

JSE – DIS Profile’s Stock Exchange Handbook: 2020 – Issue 4

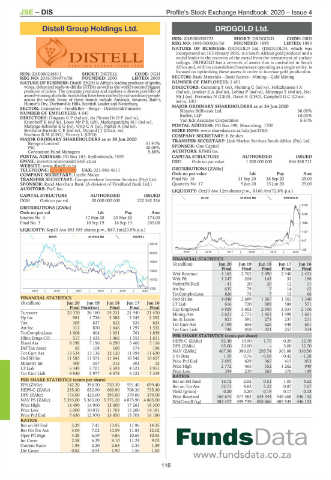

Distell Group Holdings Ltd. DRDGOLD Ltd.

DIS DRD

ISIN: ZAE000058723 SHORT: DRDGOLD CODE: DRD

REG NO: 1895/000926/06 FOUNDED: 1895 LISTED: 1895

NATURE OF BUSINESS: DRDGOLD Ltd. (DRDGOLD), which was

incorporated on 16 February 1895, is a South African gold producer and a

world leader in the recovery of the metal from the retreatment of surface

tailings. DRDGOLD has a network of assets that is unrivalled in South

Africa and, with its consolidated businesses operating as a single entity, is

focused on optimising these assets in order to increase gold production.

ISIN: ZAE000248811 SHORT: DISTELL CODE: DGH

REG NO: 2016/394974/06 FOUNDED: 2000 LISTED: 2000 SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

NATURE OF BUSINESS: Distell (DGH) is Africa’s leading producer of spirits, NUMBER OF EMPLOYEES: 2 601

wines, ciders and ready-to-drinks(RTDs)aswellasthe world’ssecondbiggest DIRECTORS: Cumming T (ne), Fleming C (ind ne), Holtzhausen J A

producer of ciders. The company produces and markets a diverse portfolio of (ind ne), JenekerEA(ind ne), Lebina P (ind ne), Mnyango T (ind ne), Nel

award-winningalcoholicbrandsthathavebeencraftedbyextraordinarypeople MrJ(ne), Pretorius N (CEO), Davel R (CFO), Campbell G C (Chair,

across the world. Some of these brands include Amarula, Savanna, Bain’s, ind ne, UK)

Hunter’s Dry, Durbanville Hills, Scottish Leader and Nederburg.

SECTOR: Consumer—Food&Bev—Bevgs—Distillers&Vintners MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2020

NUMBER OF EMPLOYEES: 4 845 Sibanye Stillwater Ltd. 38.05%

Ruffer, LLP

10.03%

DIRECTORS: DingaanGP(ind ne), du Plessis DrDP(ind ne),

Kruythoff K (ind ne), Louw MrPR(alt), MadungandabaMJ(ind ne), Van Eck Assciates Corporation 5.61%

Matenge-SebeshoEG(ne), OttoCA(ne), Parker A (ind ne), POSTAL ADDRESS: PO Box 390, Maraisburg, 1700

Sevillano-BarredoCE(ind ne), Durand J J (Chair, ne), MORE INFO: www.sharedata.co.za/sdo/jse/DRD

Rushton R M (CEO), Verwey L (CFO) COMPANY SECRETARY: E Beukes

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Remgro Limited 31.41% SPONSOR: One Capital

PIC 30.08%

Coronation Fund Managers 9.88% AUDITORS: KPMG Inc.

POSTAL ADDRESS: PO Box 184, Stellenbosch, 7599 CAPITAL STRUCTURE AUTHORISED ISSUED

EMAIL: investor.relations@distell.co.za DRD Ords no par value 1 500 000 000 864 588 711

WEBSITE: www.distell.co.za

TELEPHONE: 021-809-7000 FAX: 021-886-4611 DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Lizelle Malan Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 18 21 Sep 20 28 Sep 20 35.00

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Quarterly No 17 9 Jun 20 15 Jun 20 25.00

AUDITORS: PwC Inc. LIQUIDITY: Oct20 Ave 12m shares p.w., R166.4m(72.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

GLDX 40 Week MA DRDGOLD

DGH Ords no par val 20 000 000 000 222 382 356

2725

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

2206

Interim No 4 17 Mar 20 23 Mar 20 174.00

Final No 3 10 Sep 19 16 Sep 19 249.00 1686

LIQUIDITY: Sep20 Ave 893 595 shares p.w., R87.1m(20.9% p.a.)

1167

BEVR 40 Week MA DISTELL

647

23716

128

2015 | 2016 | 2017 | 2018 | 2019 | 2020

20325

FINANCIAL STATISTICS

16934

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final Final Final Final

13544

Wrk Revenue 4 185 2 762 2 490 2 340 2 433

10153 Wrk Pft 1 247 208 143 32 196

NetIntPd(Rcd) - 41 20 20 12 11

6762 Att Inc 635 79 7 14 62

2015 | 2016 | 2017 | 2018 | 2019 | 2020

TotCompIncLoss 826 73 7 13 66

FINANCIAL STATISTICS Ord SH Int 4 040 2 689 1 267 1 302 1 340

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 LT Liab 616 720 609 588 571

Final Final(rst) Final Final Final Cap Employed 4 929 3 602 2 040 2 031 2 106

Turnover 22 370 26 180 24 231 21 940 21 470 Mining Ass 2 621 2 775 1 453 1 498 1 601

Op Inc 981 1 726 2 388 2 345 2 352 Inv & Loans 821 591 273 237 211

Tax 305 637 632 624 624 Tot Curr Ass 2 190 656 626 548 601

Att Inc 312 870 1 646 1 297 1 532 Tot Curr Liab 746 458 321 257 314

TotCompIncLoss 1 008 804 1 931 761 1 839

Hline Erngs-CO 517 1 433 1 466 1 553 1 611 PER SHARE STATISTICS (cents per share)

Fixed Ass 8 198 7 196 6 290 5 466 5 116 HEPS-C (ZARc) 82.40 10.90 1.70 0.20 12.70

Def Tax Asset 63 108 100 174 136 DPS (ZARc) 85.00 20.00 - 5.00 12.70

Tot Curr Ass 13 534 13 136 12 120 11 994 11 630 NAV (ZARc) 467.30 386.05 293.74 301.88 310.50

Ord SH Int 11 583 11 573 11 641 10 542 10 657 3 Yr Beta 1.59 0.76 - 0.58 - 0.42 - 1.28

Minority Int 409 357 315 301 15 Price Prd End 2 695 429 365 415 853

LT Liab 6 349 5 701 5 593 4 521 1 951 Price High 2 772 465 552 1 262 949

Tot Curr Liab 6 930 5 977 4 578 5 122 7 319 Price Low 394 239 269 370 149

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH fund 15.72 2.92 0.51 1.05 4.62

EPS (ZARc) 142.20 396.50 750.30 591.40 699.40 Ret on Tot Ass 22.71 4.83 5.22 0.87 7.67

HEPS-C (ZARc) 235.30 652.90 669.90 708.30 735.30 Yield (g/ton) 0.20 0.20 0.19 0.17 0.18

DPS (ZARc) 174.00 423.00 395.00 379.00 379.00 Price Received 768 675 577 483 534 344 548 268 546 142

NAV PS (ZARc) 5 393.00 5 365.00 5 376.20 4 875.90 4 805.00 WrkCost(R/kg) 482 417 499 749 458 866 489 549 446 153

Price High 14 490 14 900 15 000 17 261 18 300

Price Low 6 000 10 013 11 703 13 200 14 181

Price Prd End 7 630 12 970 13 850 13 701 16 180

RATIOS

Ret on SH Fnd 3.29 7.41 13.95 11.96 14.35

Ret On Tot Ass 3.04 7.02 10.59 11.83 12.02

Oper Pft Mgn 4.38 6.59 9.86 10.69 10.95

Int Cover 2.58 6.39 8.10 11.24 9.05

Current Ratio 1.95 2.20 2.65 2.34 1.59

Div Cover 0.82 0.94 1.90 1.56 1.85

116