Page 123 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 123

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – EOH

indirectly investing in a diversified portfolio of unlisted private equity-type

EOH Holdings Ltd. investments managed by Ethos Private Equity (Pty) Ltd. (Ethos).

EOH SECTOR: Fins—Investment Instruments—Equities—Equities

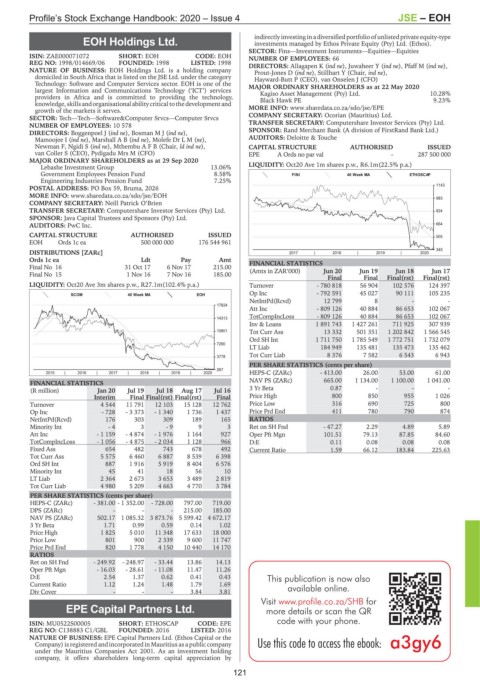

ISIN: ZAE000071072 SHORT: EOH CODE: EOH NUMBER OF EMPLOYEES: 66

REG NO: 1998/014669/06 FOUNDED: 1998 LISTED: 1998 DIRECTORS: Allagapen K (ind ne), Juwaheer Y (ind ne), Pfaff M (ind ne),

NATURE OF BUSINESS: EOH Holdings Ltd. is a holding company Prout-Jones D (ind ne), Stillhart Y (Chair, ind ne),

domiciled in South Africa that is listed on the JSE Ltd. under the category Hayward-Butt P (CEO), van Onselen J (CFO)

Technology: Software and Computer Services sector. EOH is one of the MAJOR ORDINARY SHAREHOLDERS as at 22 May 2020

largest Information and Communications Technology (‘ICT’) services Kagiso Asset Management (Pty) Ltd. 10.28%

providers in Africa and is committed to providing the technology, Black Hawk PE 9.23%

knowledge,skillsandorganisationalability critical tothe developmentand

growth of the markets it serves. MORE INFO: www.sharedata.co.za/sdo/jse/EPE

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs COMPANY SECRETARY: Ocorian (Mauritius) Ltd.

NUMBER OF EMPLOYEES: 10 578 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Boggenpoel J (ind ne), BosmanMJ(ind ne), SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Mamoojee I (ind ne), MarshallAB(ind ne), Molefe DrLM(ne), AUDITORS: Deloitte & Touche

Newman F, Ngidi S (ind ne), MthembuAFB (Chair, ld ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

van Coller S (CEO), Pydigadu Mrs M (CFO) EPE A Ords no par val - 287 500 000

MAJOR ORDINARY SHAREHOLDERS as at 29 Sep 2020

Lebashe Investment Group 13.06% LIQUIDITY: Oct20 Ave 1m shares p.w., R6.1m(22.5% p.a.)

Government Employees Pension Fund 8.58% FINI 40 Week MA ETHOSCAP

Engineering Industries Pension Fund 7.25%

1143

POSTAL ADDRESS: PO Box 59, Bruma, 2026

MORE INFO: www.sharedata.co.za/sdo/jse/EOH 983

COMPANY SECRETARY: Neill Patrick O’Brien

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 824

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

AUDITORS: PwC Inc. 664

CAPITAL STRUCTURE AUTHORISED ISSUED 505

EOH Ords 1c ea 500 000 000 176 544 961

345

DISTRIBUTIONS [ZARc] 2017 | 2018 | 2019 | 2020

Ords 1c ea Ldt Pay Amt FINANCIAL STATISTICS

Final No 16 31 Oct 17 6 Nov 17 215.00

Final No 15 1 Nov 16 7 Nov 16 185.00 (Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final(rst)

LIQUIDITY: Oct20 Ave 3m shares p.w., R27.1m(102.4% p.a.) Turnover - 780 818 56 904 102 576 124 397

SCOM 40 Week MA EOH Op Inc - 792 591 45 027 90 111 105 235

NetIntPd(Rcvd) 12 799 8 - -

17824

Att Inc - 809 126 40 884 86 653 102 067

14313 TotCompIncLoss - 809 126 40 884 86 653 102 067

Inv & Loans 1 891 743 1 427 261 711 925 307 939

10801 Tot Curr Ass 13 332 501 351 1 202 842 1 566 545

Ord SH Int 1 711 750 1 785 549 1 772 751 1 732 079

7290

LT Liab 184 949 135 481 135 473 135 462

3778 Tot Curr Liab 8 376 7 582 6 543 6 943

PER SHARE STATISTICS (cents per share)

267

2015 | 2016 | 2017 | 2018 | 2019 | 2020 HEPS-C (ZARc) - 413.00 26.00 53.00 61.00

NAV PS (ZARc) 665.00 1 134.00 1 100.00 1 041.00

FINANCIAL STATISTICS

(R million) Jan 20 Jul 19 Jul 18 Aug 17 Jul 16 3 Yr Beta 0.87 - - -

Interim Final Final(rst) Final(rst) Final Price High 800 850 955 1 026

Turnover 4 544 11 791 12 103 15 128 12 762 Price Low 316 690 725 800

Op Inc - 728 - 3 373 - 1 340 1 736 1 437 Price Prd End 411 780 790 874

NetIntPd(Rcvd) 176 303 309 189 165 RATIOS

Minority Int - 4 3 - 9 9 3 Ret on SH Fnd - 47.27 2.29 4.89 5.89

Att Inc - 1 159 - 4 874 - 1 976 1 164 927 Oper Pft Mgn 101.51 79.13 87.85 84.60

TotCompIncLoss - 1 056 - 4 875 - 2 034 1 128 966 D:E 0.11 0.08 0.08 0.08

Fixed Ass 654 482 743 678 492 Current Ratio 1.59 66.12 183.84 225.63

Tot Curr Ass 5 575 6 460 6 887 8 539 6 398

Ord SH Int 887 1 916 5 919 8 404 6 576

Minority Int 45 41 18 56 10

LT Liab 2 364 2 673 3 653 3 489 2 819

Tot Curr Liab 4 980 5 209 4 663 4 770 3 784

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 381.00 - 1 352.00 - 728.00 797.00 719.00

DPS (ZARc) - - - 215.00 185.00

NAV PS (ZARc) 502.17 1 085.32 3 873.76 5 599.42 4 672.17

3 Yr Beta 1.71 0.99 0.59 0.14 1.02

Price High 1 825 5 010 11 348 17 633 18 000

Price Low 801 900 2 339 9 600 11 747

Price Prd End 820 1 778 4 150 10 440 14 170

RATIOS

Ret on SH Fnd - 249.92 - 248.97 - 33.44 13.86 14.13

Oper Pft Mgn - 16.03 - 28.61 - 11.08 11.47 11.26

D:E 2.54 1.37 0.62 0.41 0.43 This publication is now also

Current Ratio 1.12 1.24 1.48 1.79 1.69

Div Cover - - - 3.84 3.81 available online.

Visit www.profile.co.za/SHB for

EPE Capital Partners Ltd. more details or scan the QR

EPE

ISIN: MU0522S00005 SHORT: ETHOSCAP CODE: EPE code with your phone.

REG NO: C138883 C1/GBL FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: EPE Capital Partners Ltd. (Ethos Capital or the

Company) is registered and incorporated in Mauritius as a public company Usethiscodetoaccess theebook:

under the Mauritius Companies Act 2001. As an investment holding

company, it offers shareholders long-term capital appreciation by

121