Page 111 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 111

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – COM

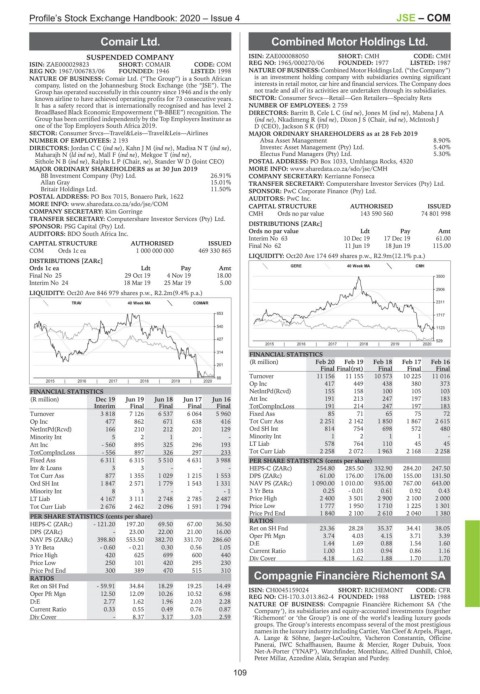

Comair Ltd. Combined Motor Holdings Ltd.

COM COM

SUSPENDED COMPANY ISIN: ZAE000088050 SHORT: CMH CODE: CMH

ISIN: ZAE000029823 SHORT: COMAIR CODE: COM REG NO: 1965/000270/06 FOUNDED: 1977 LISTED: 1987

REG NO: 1967/006783/06 FOUNDED: 1946 LISTED: 1998 NATURE OF BUSINESS: Combined Motor Holdings Ltd. (“the Company”)

NATURE OF BUSINESS: Comair Ltd. (“The Group”) is a South African is an investment holding company with subsidiaries owning significant

company, listed on the Johannesburg Stock Exchange (the “JSE”). The interests in retail motor, car hire and financial services. The Company does

Group has operated successfully in this country since 1946 and is the only not trade and all of its activities are undertaken through its subsidiaries.

known airline to have achieved operating profits for 73 consecutive years. SECTOR: Consumer Srvcs—Retail—Gen Retailers—Specialty Rets

It has a safety record that is internationally recognised and has level 2 NUMBER OF EMPLOYEES: 2 759

BroadBased Black Economic Empowerment (“B-BBEE”) recognition. The DIRECTORS: Barritt B, CeleLC(ind ne), Jones M (ind ne), Mabena J A

Group has been certified independently by the Top Employers Institute as (ind ne), Nkadimeng R (ind ne), Dixon J S (Chair, ind ne), McIntosh J

one of the Top Employers South Africa 2019. D (CEO), Jackson S K (FD)

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Airlines MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

NUMBER OF EMPLOYEES: 2 193 Absa Asset Management 8.90%

DIRECTORS: JordanCC(ind ne), KahnJM(ind ne), MadisaNT(ind ne), Investec Asset Management (Pty) Ltd. 5.40%

Maharajh N (ld ind ne), Mall F (ind ne), Mekgoe T (ind ne), Electus Fund Managers (Pty) Ltd. 5.30%

SitholeNB(ind ne), Ralphs L P (Chair, ne), Stander W D (Joint CEO) POSTAL ADDRESS: PO Box 1033, Umhlanga Rocks, 4320

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 MORE INFO: www.sharedata.co.za/sdo/jse/CMH

BB Investment Company (Pty) Ltd. 26.91% COMPANY SECRETARY: Kerrianne Fonseca

Allan Gray 15.01% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Britair Holdings Ltd. 11.50% SPONSOR: PwC Corporate Finance (Pty) Ltd.

POSTAL ADDRESS: PO Box 7015, Bonaero Park, 1622 AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/COM CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Kim Gorringe CMH Ords no par value 143 590 560 74 801 998

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: BDO South Africa Inc. Ords no par value Ldt Pay Amt

Interim No 63 10 Dec 19 17 Dec 19 61.00

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 62 11 Jun 19 18 Jun 19 115.00

COM Ords 1c ea 1 000 000 000 469 330 865

LIQUIDITY: Oct20 Ave 174 649 shares p.w., R2.9m(12.1% p.a.)

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt GERE 40 Week MA CMH

Final No 25 29 Oct 19 4 Nov 19 18.00 3500

Interim No 24 18 Mar 19 25 Mar 19 5.00

2906

LIQUIDITY: Oct20 Ave 846 979 shares p.w., R2.2m(9.4% p.a.)

TRAV 40 Week MA COMAIR 2311

653

1717

540

1123

427 529

2015 | 2016 | 2017 | 2018 | 2019 | 2020

314 FINANCIAL STATISTICS

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

201

Final Final(rst) Final Final Final

Turnover 11 156 11 155 10 573 10 225 11 016

88

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Op Inc 417 449 438 380 373

FINANCIAL STATISTICS NetIntPd(Rcvd) 155 158 100 105 103

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Att Inc 191 213 247 197 183

Interim Final Final Final Final TotCompIncLoss 191 214 247 197 183

Turnover 3 818 7 126 6 537 6 064 5 960 Fixed Ass 85 71 65 75 72

Op Inc 477 862 671 638 416 Tot Curr Ass 2 251 2 142 1 850 1 867 2 615

NetIntPd(Rcvd) 166 210 212 201 129 Ord SH Int 814 754 698 572 480

Minority Int 5 2 1 - - Minority Int 1 2 1 1 -

Att Inc - 560 895 325 296 193 LT Liab 578 764 110 45 45

TotCompIncLoss - 556 897 326 297 233 Tot Curr Liab 2 258 2 072 1 963 2 168 2 258

Fixed Ass 6 311 6 315 5 510 4 631 3 988 PER SHARE STATISTICS (cents per share)

Inv & Loans 3 3 - - - HEPS-C (ZARc) 254.80 285.50 332.90 284.20 247.50

Tot Curr Ass 877 1 355 1 029 1 215 1 553 DPS (ZARc) 61.00 176.00 176.00 155.00 131.50

Ord SH Int 1 847 2 571 1 779 1 543 1 331 NAV PS (ZARc) 1 090.00 1 010.00 935.00 767.00 643.00

Minority Int 8 3 - - - 1 3 Yr Beta 0.25 - 0.01 0.61 0.92 0.43

LT Liab 4 167 3 111 2 748 2 785 2 487 Price High 2 400 3 501 2 900 2 100 2 000

Tot Curr Liab 2 676 2 462 2 096 1 591 1 794 Price Low 1 777 1 950 1 710 1 225 1 301

Price Prd End 1 840 2 100 2 610 2 040 1 380

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 121.20 197.20 69.50 67.00 36.50 RATIOS

DPS (ZARc) - 23.00 22.00 21.00 16.00 Ret on SH Fnd 23.36 28.28 35.37 34.41 38.05

3.71

4.15

Oper Pft Mgn

3.39

4.03

3.74

NAV PS (ZARc) 398.80 553.50 382.70 331.70 286.60 D:E 1.44 1.69 0.88 1.54 1.60

3 Yr Beta - 0.60 - 0.21 0.30 0.56 1.05 Current Ratio 1.00 1.03 0.94 0.86 1.16

Price High 420 625 699 600 440 Div Cover 4.18 1.62 1.88 1.70 1.70

Price Low 250 101 420 295 230

Price Prd End 300 389 470 515 310

RATIOS Compagnie Financière Richemont SA

Ret on SH Fnd - 59.91 34.84 18.29 19.25 14.49 ISIN: CH0045159024 SHORT: RICHEMONT CODE: CFR

COM

Oper Pft Mgn 12.50 12.09 10.26 10.52 6.98 REG NO: CH-170.3.013.862-4 FOUNDED: 1988 LISTED: 1988

D:E 2.77 1.62 1.96 2.03 2.28 NATURE OF BUSINESS: Compagnie Financière Richemont SA (‘the

Current Ratio 0.33 0.55 0.49 0.76 0.87 Company’), its subsidiaries and equity-accounted investments (together

Div Cover - 8.37 3.17 3.03 2.59 ‘Richemont’ or ‘the Group’) is one of the world’s leading luxury goods

groups. The Group’s interests encompass several of the most prestigious

names in the luxury industry including Cartier, Van Cleef & Arpels, Piaget,

A. Lange & Söhne, Jaeger-LeCoultre, Vacheron Constantin, Officine

Panerai, IWC Schaffhausen, Baume & Mercier, Roger Dubuis, Yoox

Net-A-Porter (‘YNAP’), Watchfinder, Montblanc, Alfred Dunhill, Chloé,

Peter Millar, Azzedine Alaïa, Serapian and Purdey.

109