Page 35 - Stock Exchange Handbook 2020 - Issue 3

P. 35

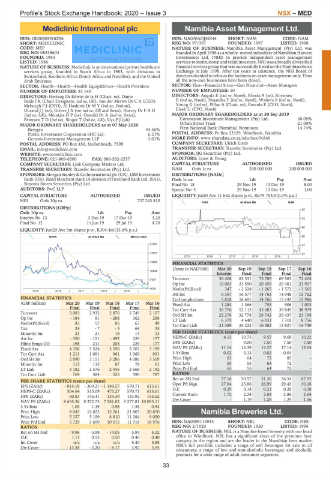

Profile’s Stock Exchange Handbook: 2020 – Issue 3 NSX – MED

Mediclinic International plc Namibia Asset Management Ltd.

MED NAM

ISIN: GB00B8HX8Z88 ISIN: NA000AOJMZ44 SHORT: NAM CODE: NAM

SHORT: MEDICLINIC REG NO: 97/397 FOUNDED: 1997 LISTED: 1998

CODE: MEP NATURE OF BUSINESS: Namibia Asset Management (Pty) Ltd. was

REG NO: 08338604 founded in April 1996 as a wholly- owned subsidiary of Namibian Harvest

FOUNDED: 1983 Investments Ltd. (NHI) to provide independent asset management

LISTED: 1986 services to institutional and retail investors. NHI was a broadly diversified

NATURE OF BUSINESS: Mediclinic is an international private healthcare financial services group that was successfully listed on the Namibian Stock

services group, founded in South Africa in 1983, with divisions in Exchange in July 1998. After ten years in existence, the NHI Board of

Switzerland, Southern Africa (South Africa and Namibia), and the United directors decided to refocus the business on asset management only. Thus

Arab Emirates. all the non-core businesses have been closed.

SECTOR: Health—Health—Health Equip&Srvcs—Health Providers SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

NUMBER OF EMPLOYEES: 33 140 NUMBER OF EMPLOYEES: 10

DIRECTORS: Hertzog Dr Edwin de la H (Chair, ne), Dame DIRECTORS: Angula E (ind ne, Namb), Rhoda A (ne), Rossouw

Beale I K (Chair Designate, ind ne, UK), van der Merwe Dr C A (CEO), B(ind ne, Namb), Shaanika T (ind ne, Namb), Walters S (ind ne, Namb),

Myburgh P J (CFO), Al Hashimi DrMY(ind ne, Emirati), Young G (ind ne), Pillay A (Chair, ne), Emvula E (CEO, Namb),

DurandJJ(ne), GrieveJA(snr ind ne, UK and Swiss), Harvey DrFAH Eiseb U (CFO, Namb)

(ind ne, UK), MeintjesDP(ne), Oswald Dr A (ind ne, Swiss), MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

PetersenTD(ind ne), Singer T (ind ne, UK), UysPJ(alt) Coronation Investment Management (Pty) Ltd. 40.05%

MAJOR ORDINARY SHAREHOLDERS as at 07 May 2020 Orban Street Trust 21.00%

Remgro 44.56% First National Bank (Namibia) Nominees 14.74%

Public Investment Corporation SOC Ltd. 6.21% POSTAL ADDRESS: Po Box 23329, Windhoek, Namibia

Genesis Investment Management LLP 5.01% MORE INFO: www.sharedata.co.za/sdo/nsx/NAM

POSTAL ADDRESS: PO Box 456, Stellenbosch, 7599 COMPANY SECRETARY: Ulrich Eiseb

EMAIL: info@mediclinic.com TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

WEBSITE: www.mediclinic.com SPONSOR: IJG Securities (Pty) Ltd.

TELEPHONE: 021-809-6500 FAX: 086-532-2557 AUDITORS: Ernst & Young

COMPANY SECRETARY: Link Company Matters Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. NAM Ords 1c ea 200 000 000 200 000 000

SPONSORS: Morgan Stanley & Co International plc (UK), UBS Investment DISTRIBUTIONS [NADc]

Bank (UK), Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA)), Ords 1c ea Ldt Pay Amt

Simonis Storm Securities (Pty) Ltd. Final No 18 29 Nov 19 13 Dec 19 8.00

AUDITORS: PwC LLP Special No 4 29 Nov 19 13 Dec 19 1.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul20 Ave 11 662 shares p.w., R679 704.9(0.3% p.a.)

MEI Ords 10p ea - 737 243 810

FINA 40 Week MA NAM

DISTRIBUTIONS [GBPp]

85

Ords 10p ea Ldt Pay Amt

Interim No 13 3 Dec 19 17 Dec 19 3.20 75

Final No 12 11 Jun 19 29 Jul 19 4.70

66

LIQUIDITY: Jun20 Ave 5m shares p.w., R304.4m(33.6% p.a.)

HEES 40 Week MA MEDICLINIC 56

21091

47

17677 37

2015 | 2016 | 2017 | 2018 | 2019 |

14262

FINANCIAL STATISTICS

(Amts in NAD’000) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

10848

Interim Final Final Final Final

Turnover 36 408 83 331 75 789 69 583 72 404

7434

Op Inc 10 063 21 550 20 455 20 481 21 907

4019 NetIntPd(Rcvd) 347 - 2 528 - 1 265 - 1 572 - 1 565

2015 | 2016 | 2017 | 2018 | 2019 |

Att Inc 6 367 16 577 14 763 14 948 15 762

FINANCIAL STATISTICS TotCompIncLoss 5 818 16 691 14 766 15 143 15 986

(GBP million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 Fixed Ass 1 284 1 366 755 906 1 003

Final Final Final Final Final Tot Curr Ass 36 776 52 113 43 083 39 849 38 979

Turnover 3 083 2 932 2 876 2 749 2 107 Ord SH Int 22 276 32 778 28 742 26 437 23 198

Op Inc - 184 81 - 288 362 288 LT Liab 6 379 4 640 6 031 7 318 8 756

NetIntPd(Rcvd) 83 57 85 67 49 Tot Curr Liab 21 389 23 222 16 382 13 927 14 749

Tax 24 - 7 - 5 64 55

Minority Int 21 21 18 14 13 PER SHARE STATISTICS (cents per share)

Att Inc - 320 - 151 - 492 229 177 HEPS-C (ZARc) 4.13 10.75 9.57 9.69 10.22

Hline Erngs-CO 198 211 203 229 177 DPS (ZARc) - 9.00 7.50 7.50 7.50

Fixed Ass 4 358 3 524 3 590 3 703 3 199 NAV PS (ZARc) 11.14 16.39 14.37 17.14 15.04

Tot Curr Ass 1 213 1 091 961 1 069 931 3 Yr Beta 0.02 0.13 0.02 - 0.04 -

Ord SH Int 2 890 3 151 3 286 4 086 3 509 Price High 65 64 72 85 -

Minority Int 113 115 87 78 61 Price Low 55 55 64 72 -

LT Liab 3 182 2 576 2 445 2 668 2 192 Price Prd End 65 55 64 72 -

Tot Curr Liab 769 584 525 590 787 RATIOS

Ret on SH Fnd 57.16 50.57 51.36 56.54 67.95

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 814.18 - 369.21 - 1 148.57 570.71 613.61 Oper Pft Mgn 27.64 25.86 26.99 29.43 30.26

HEPS-C (ZARc) 504.64 515.09 475.27 570.71 613.61 D:E 0.29 0.14 0.21 0.28 0.38

DPS (ZARc) 60.83 145.41 139.39 133.92 155.52 Current Ratio 1.72 2.24 2.63 2.86 2.64

NAV PS (ZARc) 8 655.36 8 372.73 7 581.02 9 277.81 10 095.11 Div Cover - 1.19 1.28 1.29 1.36

3 Yr Beta 1.05 1.19 0.98 1.38 0.94

Price High 8 043 12 023 15 261 21 803 20 870 Namibia Breweries Ltd.

Price Low 5 157 5 199 8 810 11 384 9 050 NBS

Price Prd End 5 729 5 699 10 015 11 918 18 976 ISIN: NA0009114944 SHORT: NBL CODE: NBS

RATIOS REG NO: 2/1920 FOUNDED: 1920 LISTED: 1996

Ret on SH Fnd - 9.96 - 3.98 - 14.05 5.84 5.32 NATURE OF BUSINESS: NBL is a Namibia-based brewery with our head

D:E 1.11 0.53 0.50 0.40 0.40 office in Windhoek. NBL has a significant share of the premium beer

Int Cover n/a n/a n/a 5.40 5.88 category in the region and are the leader in the Namibian beer market.

Div Cover - 13.38 - 2.20 - 8.17 3.92 3.95 NBL’s full portfolio includes: a range of soft beverages for sale to all

consumers; a range of low and non-alcoholic beverages; and alcoholic

products for a wide range of adult consumer segments.

33