Page 36 - Stock Exchange Handbook 2020 - Issue 3

P. 36

NSX – NHL Profile’s Stock Exchange Handbook: 2020 – Issue 3

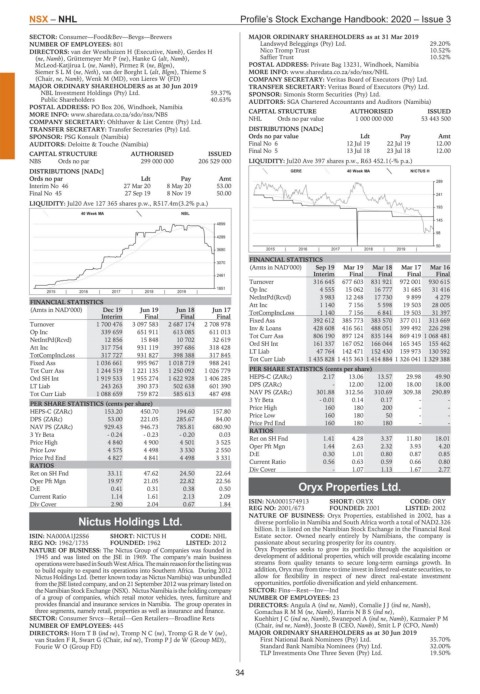

SECTOR: Consumer—Food&Bev—Bevgs—Brewers MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

NUMBER OF EMPLOYEES: 801 Landswyd Beleggings (Pty) Ltd. 29.20%

DIRECTORS: van der Westhuizen H (Executive, Namb), Gerdes H Nico Tromp Trust 10.52%

(ne, Namb), Grüttemeyer Mr P (ne), Hanke G (alt, Namb), Saffier Trust 10.52%

McLeod-Katjirua L (ne, Namb), Pirmez R (ne, Blgm), POSTAL ADDRESS: Private Bag 13231, Windhoek, Namibia

SiemerSLM(ne, Neth), van der Borght L (alt, Blgm), Thieme S MORE INFO: www.sharedata.co.za/sdo/nsx/NHL

(Chair, ne, Namb), Wenk M (MD), von Lieres W (FD) COMPANY SECRETARY: Veritas Board of Executors (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 TRANSFER SECRETARY: Veritas Board of Executors (Pty) Ltd.

NBL Investment Holdings (Pty) Ltd. 59.37% SPONSOR: Simonis Storm Securities (Pty) Ltd.

Public Shareholders 40.63% AUDITORS: SGA Chartered Accountants and Auditors (Namibia)

POSTAL ADDRESS: PO Box 206, Windhoek, Namibia

ISSUED

MORE INFO: www.sharedata.co.za/sdo/nsx/NBS CAPITAL STRUCTURE AUTHORISED 53 443 500

Ords no par value

1 000 000 000

NHL

COMPANY SECRETARY: Ohlthaver & List Centre (Pty) Ltd.

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. DISTRIBUTIONS [NADc]

SPONSOR: PSG Konsult (Namibia) Ords no par value Ldt Pay Amt

AUDITORS: Deloitte & Touche (Namibia) Final No 6 12 Jul 19 22 Jul 19 12.00

Final No 5 13 Jul 18 23 Jul 18 12.00

CAPITAL STRUCTURE AUTHORISED ISSUED

NBS Ords no par 299 000 000 206 529 000 LIQUIDITY: Jul20 Ave 397 shares p.w., R63 452.1(-% p.a.)

DISTRIBUTIONS [NADc] GERE 40 Week MA NICTUS H

Ords no par Ldt Pay Amt

289

Interim No 46 27 Mar 20 8 May 20 53.00

Final No 45 27 Sep 19 8 Nov 19 50.00 241

LIQUIDITY: Jul20 Ave 127 365 shares p.w., R517.4m(3.2% p.a.)

193

40 Week MA NBL

145

4899

98

4289

50

3680 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

3070

(Amts in NAD’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

2461 Interim Final Final Final Final

Turnover 316 645 677 603 831 921 972 001 930 615

1851 Op Inc 4 555 15 062 16 777 31 685 31 416

2015 | 2016 | 2017 | 2018 | 2019 |

NetIntPd(Rcvd) 3 983 12 248 17 730 9 899 4 279

FINANCIAL STATISTICS Att Inc 1 140 7 156 5 598 19 503 28 005

(Amts in NAD’000) Dec 19 Jun 19 Jun 18 Jun 17 TotCompIncLoss 1 140 7 156 6 841 19 503 31 397

Interim Final Final Final

313 669

Turnover 1 700 476 3 097 583 2 687 174 2 708 978 Fixed Ass 392 612 385 773 383 570 377 011 226 298

428 608

399 492

416 561

488 051

Inv & Loans

Op Inc 339 659 651 911 613 085 611 013

Tot Curr Ass 806 190 897 124 835 144 869 419 1 068 481

NetIntPd(Rcvd) 12 856 15 848 10 702 32 619 Ord SH Int 161 337 167 052 166 044 165 345 155 462

Att Inc 317 754 931 119 397 686 318 428 LT Liab 47 764 142 471 152 430 159 973 130 592

TotCompIncLoss 317 727 931 827 398 388 317 845

Fixed Ass 1 036 661 995 967 1 018 719 988 241 Tot Curr Liab 1 435 828 1 415 363 1 414 884 1 326 041 1 329 388

Tot Curr Ass 1 244 519 1 221 135 1 250 092 1 026 779 PER SHARE STATISTICS (cents per share)

Ord SH Int 1 919 533 1 955 274 1 622 928 1 406 285 HEPS-C (ZARc) 2.17 13.06 13.57 29.98 49.90

LT Liab 243 263 390 373 502 638 601 390 DPS (ZARc) - 12.00 12.00 18.00 18.00

Tot Curr Liab 1 088 659 759 872 585 613 487 498 NAV PS (ZARc) 301.88 312.56 310.69 309.38 290.89

3 Yr Beta - 0.01 0.14 0.17 - -

PER SHARE STATISTICS (cents per share) Price High 160 180 200 - -

HEPS-C (ZARc) 153.20 450.70 194.60 157.80

50

DPS (ZARc) 53.00 221.05 285.67 84.00 Price Low 160 180 180 - - - -

Price Prd End

160

180

NAV PS (ZARc) 929.43 946.73 785.81 680.90 RATIOS

3 Yr Beta - 0.24 - 0.23 - 0.20 0.03 Ret on SH Fnd 1.41 4.28 3.37 11.80 18.01

Price High 4 840 4 900 4 501 3 525 Oper Pft Mgn 1.44 2.63 2.32 3.93 4.20

Price Low 4 575 4 498 3 330 2 550

Price Prd End 4 827 4 841 4 498 3 331 D:E 0.30 1.01 0.80 0.87 0.85

0.59

0.66

0.56

0.63

Current Ratio

0.80

RATIOS Div Cover - 1.07 1.13 1.67 2.77

Ret on SH Fnd 33.11 47.62 24.50 22.64

Oper Pft Mgn 19.97 21.05 22.82 22.56

D:E 0.41 0.31 0.38 0.50 Oryx Properties Ltd.

Current Ratio 1.14 1.61 2.13 2.09 ORY

Div Cover 2.90 2.04 0.67 1.84 ISIN: NA0001574913 SHORT: ORYX CODE: ORY

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002

NATURE OF BUSINESS: Oryx Properties, established in 2002, has a

Nictus Holdings Ltd. diverse portfolio in Namibia and South Africa worth a total of NAD2.326

billion. It is listed on the Namibian Stock Exchange in the Financial Real

NHL

ISIN: NA000A1J2SS6 SHORT: NICTUS H CODE: NHL Estate sector. Owned nearly entirely by Namibians, the company is

REG NO: 1962/1735 FOUNDED: 1962 LISTED: 2012 passionate about securing prosperity for its country.

NATURE OF BUSINESS: The Nictus Group of Companies was founded in Oryx Properties seeks to grow its portfolio through the acquisition or

1945 and was listed on the JSE in 1969. The company’s main business development of additional properties, which will provide escalating income

operationswerebasedinSouthWestAfrica.Themainreasonforthelistingwas streams from quality tenants to secure long-term earnings growth. In

to build equity to expand its operations into Southern Africa. During 2012 addition, Oryx may from time to time invest in listed real-estate securities, to

Nictus Holdings Ltd. (better known today as Nictus Namibia) was unbundled allow for flexibility in respect of new direct real-estate investment

from the JSE listed company, and on 21 September 2012 was primary listed on opportunities, portfolio diversification and yield enhancement.

theNamibianStock Exchange(NSX). NictusNamibiaistheholding company SECTOR: Fins—Rest—Inv—Ind

of a group of companies, which retail motor vehicles, tyres, furniture and NUMBER OF EMPLOYEES: 23

provides financial and insurance services in Namibia. The group operates in DIRECTORS: Angula A (ind ne, Namb), ComalieJJ(ind ne, Namb),

three segments, namely retail, properties as well as insurance and finance. GomachasRMM(ne, Namb), HarrisNBS(ind ne),

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets KuehhirtJC(ind ne, Namb), Swanepoel A (ind ne, Namb), Kazmaier P M

NUMBER OF EMPLOYEES: 445 (Chair, ind ne, Namb), Jooste B (CEO, Namb), Smit L P (CFO, Namb)

DIRECTORS: HornTB(ind ne), TrompNC(ne), TrompGRdeV(ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

van Staden F R, Swart G (Chair, ind ne), TrompPJdeW (Group MD), First National Bank Nominees (Pty) Ltd. 35.70%

Fourie W O (Group FD) Standard Bank Namibia Nominees (Pty) Ltd. 32.00%

TLP Investments One Three Seven (Pty) Ltd. 19.50%

34