Page 32 - Stock Exchange Handbook 2020 - Issue 3

P. 32

NSX – DYL Profile’s Stock Exchange Handbook: 2020 – Issue 3

NUMBER OF EMPLOYEES: 0

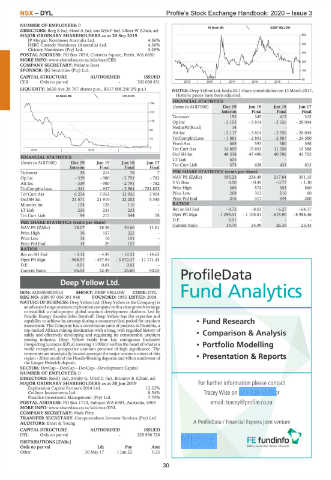

40 Week MA DEEP YELLOW

DIRECTORS: Borg B (ne), HoodA(ne), van Wyk P (ne), Oliver W (Chair, ne)

MAJOR ORDINARY SHAREHOLDERS as at 20 Sep 2019 560

JP Morgan Nominees Australia Ltd. 4.56%

HSBC Custody Nominees (Australia) Ltd. 4.36% 460

Citicorp Nominees (Pty) Ltd. 3.29%

360

POSTAL ADDRESS: PO Box 7054, Cloisters Square, Perth, WA 6850

MORE INFO: www.sharedata.co.za/sdo/nsx/CER

260

COMPANY SECRETARY: Melanie Ross

SPONSOR: IJG Securities (Pty) Ltd. 160

CAPITAL STRUCTURE AUTHORISED ISSUED

CER Ords no par val - 702 050 851 2015 | 2016 | 2017 | 2018 | 2019 | 60

LIQUIDITY: Jul20 Ave 28 767 shares p.w., R517 808.2(0.2% p.a.) NOTES: Deep Yellow Ltd. had a 20:1 share consolidation on 13 March 2017.

40 Week MA CELSIUS Historic prices have been adjusted.

FINANCIAL STATISTICS

194

(Amts in AUD’000) Dec 19 Jun 19 Jun 18 Jun 17

157 Interim Final Final Final

Turnover 192 345 415 312

119 Op Inc - 2 103 - 3 814 - 2 556 - 28 044

NetIntPd(Rcvd) 14 - - -

82

Att Inc - 2 117 - 3 814 - 2 556 - 28 044

44 TotCompIncLoss - 1 881 - 2 893 - 2 887 - 24 580

Fixed Ass 668 593 580 548

7 Tot Curr Ass 14 809 15 693 11 358 15 588

2018 | 2019 |

Ord SH Int 48 538 47 490 40 786 43 705

FINANCIAL STATISTICS LT Liab 605 - - -

(Amts in AUD’000) Dec 19 Jun 19 Jun 18 Jun 17 Tot Curr Liab 373 628 431 613

Interim Final Final Final

Turnover 35 214 76 7 PER SHARE STATISTICS (cents per share)

Op Inc - 339 - 980 - 2 791 - 782 NAV PS (ZARc) 195.23 234.49 217.84 351.15

Att Inc - 339 - 980 - 2 791 - 782 3 Yr Beta 0.50 - 0.45 - 0.77 - 1.30

TotCompIncLoss - 341 - 657 - 2 964 - 781 822 Price High 366 572 353 560

Tot Curr Ass 6 254 7 051 13 926 3 904 Price Low 268 313 210 60

Ord SH Int 21 571 21 910 22 202 5 345 Price Prd End 276 317 344 280

Minority Int 124 126 116 - RATIOS

LT Liab 233 233 233 - Ret on SH Fnd - 8.72 - 8.03 - 6.27 - 64.17

Tot Curr Liab 94 217 544 78 Oper Pft Mgn - 1 095.31 - 1 105.51 - 615.90 - 8 988.46

D:E 0.01 - - -

PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 28.07 28.58 39.66 11.61 Current Ratio 39.70 24.99 26.35 25.43

Price High 36 157 222 -

Price Low 13 16 151 -

Price Prd End 14 29 157 -

RATIOS

Ret on SH Fnd - 3.13 - 4.45 - 12.51 - 14.63

Oper Pft Mgn - 968.57 - 457.94 - 3 672.37 - 11 171.43

D:E 0.01 0.01 0.01 -

Current Ratio 66.53 32.49 25.60 50.05

Deep Yellow Ltd.

DYL

ISIN: AU000000DYL4 SHORT: DEEP YELLOW CODE: DYL

REG NO: ABN 97 006 391 948 FOUNDED: 1985 LISTED: 2008

NATURE OF BUSINESS: Deep Yellow Ltd. (Deep Yellow or the Company) is

an advanced stage uranium exploration company with a clear growth strategy

to establish a multi-project global uranium development platform. Led by

Paladin Energy founder John Borshoff, Deep Yellow has the expertise and

capability to achieve its strategy during a countercyclical period for uranium Fund Research

investment. The Company has a cornerstone suite of projects in Namibia, a

top-ranked African mining destination with a long, well regarded history of Comparison & Analysis

safely and effectively developing and regulating its considerable uranium

mining industry. Deep Yellow holds four key contiguous Exclusive

Prospecting Licences (EPLs) covering 1 590km 2 within the heart of what is a Portfolio Modelling

world recognised, prospective uranium province of high significance. The

tenements are strategically located amongst the major uranium mines of this Presentation & Reports

region - 20km south of the Husab/Rössing deposits and 40km southwest of

the Langer Heinrich deposit.

SECTOR: DevCap—DevCap—DevCap—Development Capital

NUMBER OF EMPLOYEES: 0

DIRECTORS: Reid J (ne), Swaby G, Urtel C (ne), Brunovs R (Chair, ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 For further information please contact

Exploration Capital Partners 2014 Ltd. 12.22%

Collines Investments Ltd. 8.54% Tracey Wise on 011-728-5510 or

Paradice Investment Management (Pty) Ltd. 7.70%

POSTAL ADDRESS: PO Box 1770, Subiaco WA 6904, Australia, 6904 email: tracey@profile.co.za

MORE INFO: www.sharedata.co.za/sdo/nsx/DYL

COMPANY SECRETARY: Mark Pitts

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young A ProfileData / Financial Express joint venture

CAPITAL STRUCTURE AUTHORISED ISSUED

DYL Ords no par val - 229 938 728

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Other 30 May 17 1 Jun 22 0.25

30