Page 30 - Stock Exchange Handbook 2020 - Issue 3

P. 30

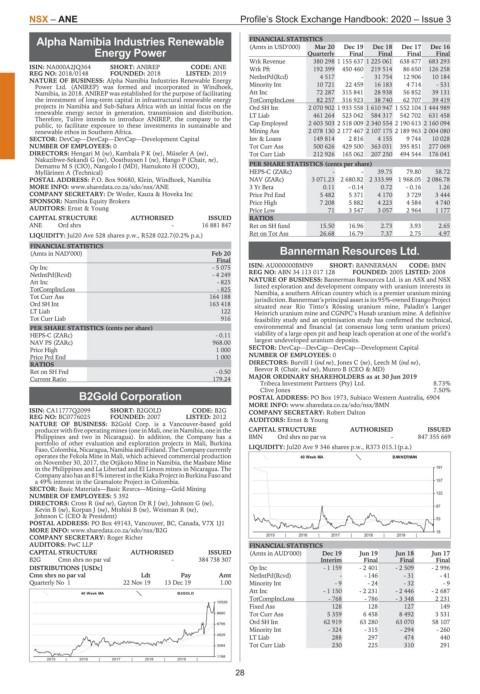

NSX – ANE Profile’s Stock Exchange Handbook: 2020 – Issue 3

Alpha Namibia Industries Renewable FINANCIAL STATISTICS Dec 19 Dec 18 Dec 17 Dec 16

(Amts in USD’000)

Mar 20

Energy Power Quarterly Final Final Final Final

Wrk Revenue 380 298 1 155 637 1 225 061 638 677 683 293

ANE

ISIN: NA000A2JQ364 SHORT: ANIREP CODE: ANE Wrk Pft 192 399 450 460 219 514 86 650 126 258

REG NO: 2018/0148 FOUNDED: 2018 LISTED: 2019 NetIntPd(Rcd) 4 517 - 31 754 12 906 10 184

NATURE OF BUSINESS: Alpha Namibia Industries Renewable Energy

Power Ltd. (ANIREP) was formed and incorporated in Windhoek, Minority Int 10 721 22 459 16 183 4 714 - 531

Namibia, in 2018. ANIREP was established for the purpose of facilitating Att Inc 72 287 315 841 28 938 56 852 39 131

the investment of long-term capital in infrastructural renewable energy TotCompIncLoss 82 257 316 923 38 740 62 707 39 419

projects in Namibia and Sub-Sahara Africa with an initial focus on the Ord SH Int 2 070 902 1 933 558 1 610 947 1 552 104 1 444 989

renewable energy sector in generation, transmission and distribution. LT Liab 461 264 523 042 584 317 542 702 631 458

Therefore, Tulive intends to introduce ANIREP, the company to the

public, to facilitate exposure to these investments in sustainable and Cap Employed 2 603 503 2 518 009 2 340 554 2 190 613 2 160 094

renewable ethos in Southern Africa. Mining Ass 2 078 130 2 177 467 2 107 175 2 189 963 2 004 080

SECTOR: DevCap—DevCap—DevCap—Development Capital Inv & Loans 149 814 2 816 4 155 9 744 10 028

NUMBER OF EMPLOYEES: 0 Tot Curr Ass 500 626 429 500 363 031 395 851 277 069

DIRECTORS: Hengari M (ne), KambalaPK(ne), Müseler A (ne), Tot Curr Liab 212 926 165 062 207 250 494 544 176 041

Nakazibwe-Sekandi G (ne), Oosthuysen I (ne), Hango P (Chair, ne),

Demamu M S (CIO), Nangolo I (MD), Hamukoto H (COO), PER SHARE STATISTICS (cents per share)

Myllärinen A (Technical) HEPS-C (ZARc) - - 39.75 79.80 58.72

POSTAL ADDRESS: P.O. Box 90680, Klein, Windhoek, Namibia NAV (ZARc) 3 071.23 2 680.82 2 333.99 1 968.05 2 086.78

MORE INFO: www.sharedata.co.za/sdo/nsx/ANE 3 Yr Beta 0.11 - 0.14 0.72 - 0.16 1.26

COMPANY SECRETARY: Dr Weder, Kauta & Hoveka Inc Price Prd End 5 482 5 371 4 170 3 729 3 444

SPONSOR: Namibia Equity Brokers Price High 7 208 5 882 4 223 4 584 4 740

AUDITORS: Ernst & Young Price Low 71 3 547 3 057 2 964 1 177

CAPITAL STRUCTURE AUTHORISED ISSUED RATIOS

ANE Ord shrs - 16 881 847 Ret on SH fund 15.50 16.96 2.73 3.93 2.65

LIQUIDITY: Jul20 Ave 528 shares p.w., R528 022.7(0.2% p.a.) Ret on Tot Ass 26.68 16.79 7.37 2.75 4.97

FINANCIAL STATISTICS

(Amts in NAD’000) Feb 20 Bannerman Resources Ltd.

Final BMN

Op Inc - 5 075 ISIN: AU000000BMN9 SHORT: BANNERMAN CODE: BMN

NetIntPd(Rcvd) - 4 249 REG NO: ABN 34 113 017 128 FOUNDED: 2005 LISTED: 2008

AttInc -825 NATURE OF BUSINESS: Bannerman Resources Ltd. is an ASX and NSX

TotCompIncLoss - 825 listed exploration and development company with uranium interests in

Tot Curr Ass 164 188 Namibia, a southern African country which is a premier uranium mining

jurisdiction. Bannerman’s principal asset is its 95%-owned Etango Project

Ord SH Int 163 418 situated near Rio Tinto’s Rössing uranium mine, Paladin’s Langer

LT Liab 122 Heinrich uranium mine and CGNPC’s Husab uranium mine. A definitive

Tot Curr Liab 916 feasibility study and an optimisation study has confirmed the technical,

PER SHARE STATISTICS (cents per share) environmental and financial (at consensus long term uranium prices)

HEPS-C (ZARc) - 0.11 viability of a large open pit and heap leach operation at one of the world’s

NAV PS (ZARc) 968.00 largest undeveloped uranium deposits.

Price High 1 000 SECTOR: DevCap—DevCap—DevCap—Development Capital

Price Prd End 1 000 NUMBER OF EMPLOYEES: 0

RATIOS DIRECTORS: Burvill I (ind ne), Jones C (ne), Leech M (ind ne),

RetonSHFnd -0.50 Beevor R (Chair, ind ne), Munro B (CEO & MD)

Current Ratio 179.24 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Tribeca Investment Partners (Pty) Ltd. 8.73%

Clive Jones 7.50%

B2Gold Corporation POSTAL ADDRESS: PO Box 1973, Subiaco Western Australia, 6904

MORE INFO: www.sharedata.co.za/sdo/nsx/BMN

B2G

ISIN: CA11777Q2099 SHORT: B2GOLD CODE: B2G COMPANY SECRETARY: Robert Dalton

REG NO: BC0776025 FOUNDED: 2007 LISTED: 2012 AUDITORS: Ernst & Young

NATURE OF BUSINESS: B2Gold Corp. is a Vancouver-based gold

producerwithfiveoperatingmines(oneinMali,oneinNamibia, oneinthe CAPITAL STRUCTURE AUTHORISED ISSUED

Philippines and two in Nicaragua). In addition, the Company has a BMN Ord shrs no par va - 847 355 669

portfolio of other evaluation and exploration projects in Mali, Burkina

Faso, Colombia, Nicaragua, Namibia and Finland. The Company currently LIQUIDITY: Jul20 Ave 9 346 shares p.w., R373 015.1(p.a.)

operates the Fekola Mine in Mali, which achieved commercial production 40 Week MA BANNERMAN

on November 30, 2017, the Otjikoto Mine in Namibia, the Masbate Mine

in the Philippines and La Libertad and El Limon mines in Nicaragua. The 191

Company also has an 81% interest in the Kiaka Project in Burkina Faso and

a 49% interest in the Gramalote Project in Colombia. 157

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

122

NUMBER OF EMPLOYEES: 5 392

DIRECTORS: Cross R (ind ne), Gayton DrRJ(ne), Johnson G (ne),

Kevin B (ne), Korpan J (ne), Mtshisi B (ne), Weisman R (ne), 87

Johnson C (CEO & President)

POSTAL ADDRESS: PO Box 49143, Vancouver, BC, Canada, V7X 1J1 53

MORE INFO: www.sharedata.co.za/sdo/nsx/B2G 18

2015 | 2016 | 2017 | 2018 | 2019 |

COMPANY SECRETARY: Roger Richer

AUDITORS: PwC LLP FINANCIAL STATISTICS

CAPITAL STRUCTURE AUTHORISED ISSUED (Amts in AUD’000) Dec 19 Jun 19 Jun 18 Jun 17

B2G Cmn shrs no par val - 384 738 307 Interim Final Final Final

DISTRIBUTIONS [USDc] Op Inc - 1 159 - 2 401 - 2 509 - 2 996

Cmn shrs no par val Ldt Pay Amt NetIntPd(Rcvd) - - 146 - 31 - 41

Quarterly No 1 22 Nov 19 13 Dec 19 1.00 Minority Int - 9 - 24 - 32 - 9

Att Inc - 1 150 - 2 231 - 2 446 - 2 687

40 Week MA B2GOLD

TotCompIncLoss - 768 - 786 - 3 348 2 231

10526

Fixed Ass 128 128 127 149

8660 Tot Curr Ass 5 359 6 458 8 492 3 531

Ord SH Int 62 919 63 280 63 070 58 107

6795

Minority Int - 324 - 315 - 294 - 260

4929

LT Liab 288 297 474 440

Tot Curr Liab 230 225 310 291

3064

1198

2015 | 2016 | 2017 | 2018 | 2019 |

28