Page 25 - Stock Exchange Handbook 2020 - Issue 3

P. 25

Profile’s Stock Exchange Handbook: 2020 – Issue 3

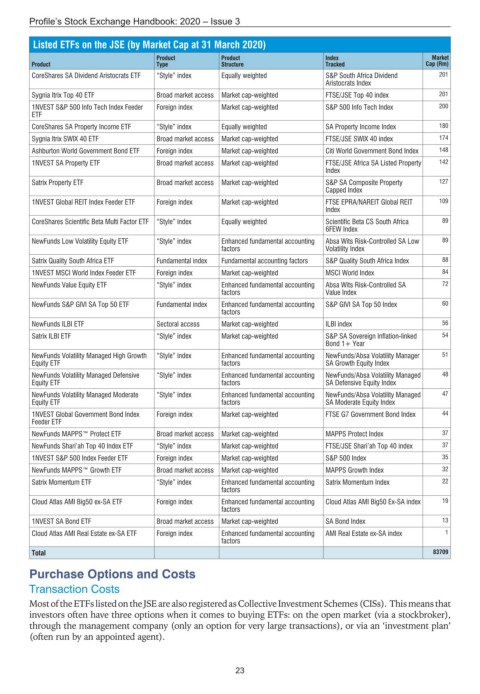

Listed ETFs on the JSE (by Market Cap at 31 March 2020)

Product Product Index Market

Product Type Structure Tracked Cap (Rm)

CoreShares SA Dividend Aristocrats ETF “Style” index Equally weighted S&P South Africa Dividend 201

Aristocrats Index

Sygnia Itrix Top 40 ETF Broad market access Market cap-weighted FTSE/JSE Top 40 index 201

1NVEST S&P 500 Info Tech Index Feeder Foreign index Market cap-weighted S&P 500 Info Tech Index 200

ETF

CoreShares SA Property Income ETF “Style” index Equally weighted SA Property Income Index 180

Sygnia Itrix SWIX 40 ETF Broad market access Market cap-weighted FTSE/JSE SWIX 40 index 174

Ashburton World Government Bond ETF Foreign index Market cap-weighted Citi World Government Bond Index 148

1NVEST SA Property ETF Broad market access Market cap-weighted FTSE/JSE Africa SA Listed Property 142

Index

Satrix Property ETF Broad market access Market cap-weighted S&P SA Composite Property 127

Capped Index

1NVEST Global REIT Index Feeder ETF Foreign index Market cap-weighted FTSE EPRA/NAREIT Global REIT 109

Index

CoreShares Scientific Beta Multi Factor ETF “Style” index Equally weighted Scientific Beta CS South Africa 89

6FEW Index

NewFunds Low Volatility Equity ETF “Style” index Enhanced fundamental accounting Absa Wits Risk-Controlled SA Low 89

factors Volatility Index

Satrix Quality South Africa ETF Fundamental index Fundamental accounting factors S&P Quality South Africa Index 88

1NVEST MSCI World Index Feeder ETF Foreign index Market cap-weighted MSCI World Index 84

NewFunds Value Equity ETF “Style” index Enhanced fundamental accounting Absa Wits Risk-Controlled SA 72

factors Value Index

NewFunds S&P GIVI SA Top 50 ETF Fundamental index Enhanced fundamental accounting S&P GIVI SA Top 50 Index 60

factors

NewFunds ILBI ETF Sectoral access Market cap-weighted ILBI index 56

Satrix ILBI ETF “Style” index Market cap-weighted S&P SA Sovereign Inflation-linked 54

Bond 1+ Year

NewFunds Volatility Managed High Growth “Style” index Enhanced fundamental accounting NewFunds/Absa Volatility Manager 51

Equity ETF factors SA Growth Equity Index

NewFunds Volatility Managed Defensive “Style” index Enhanced fundamental accounting NewFunds/Absa Volatility Managed 48

Equity ETF factors SA Defensive Equity Index

NewFunds Volatility Managed Moderate “Style” index Enhanced fundamental accounting NewFunds/Absa Volatility Managed 47

Equity ETF factors SA Moderate Equity Index

1NVEST Global Government Bond Index Foreign index Market cap-weighted FTSE G7 Government Bond Index 44

Feeder ETF

NewFunds MAPPS™ Protect ETF Broad market access Market cap-weighted MAPPS Protect Index 37

NewFunds Shari’ah Top 40 Index ETF “Style” index Market cap-weighted FTSE/JSE Shari’ah Top 40 index 37

1NVEST S&P 500 Index Feeder ETF Foreign index Market cap-weighted S&P 500 Index 35

NewFunds MAPPS™ Growth ETF Broad market access Market cap-weighted MAPPS Growth Index 32

Satrix Momentum ETF “Style” index Enhanced fundamental accounting Satrix Momentum Index 22

factors

Cloud Atlas AMI Big50 ex-SA ETF Foreign index Enhanced fundamental accounting Cloud Atlas AMI Big50 Ex-SA index 19

factors

1NVEST SA Bond ETF Broad market access Market cap-weighted SA Bond Index 13

Cloud Atlas AMI Real Estate ex-SA ETF Foreign index Enhanced fundamental accounting AMI Real Estate ex-SA index 1

factors

Total 83709

Purchase Options and Costs

Transaction Costs

MostoftheETFslistedontheJSEarealsoregisteredasCollectiveInvestmentSchemes(CISs). Thismeansthat

investors often have three options when it comes to buying ETFs: on the open market (via a stockbroker),

through the management company (only an option for very large transactions), or via an ‘investment plan’

(often run by an appointed agent).

23