Page 222 - Stock Exchange Handbook 2020 - Issue 3

P. 222

JSE – SHO Profile’s Stock Exchange Handbook: 2020 – Issue 3

NUMBER OF EMPLOYEES: 69 450

Shoprite Holdings Ltd. DIRECTORS: Cumming T (ind ne), Danson S (ind ne), Dorward-King E (ind ne),

SHO Kenyon-Slaney H (ind ne), Menell R P (ld ind ne), Nika N G (ind ne),

ISIN: ZAE000012084 SHORT: SHOPRIT CODE: SHP Rayner K A (ind ne), van der Merwe S (ind ne), Vilakazi J S (ind ne),

REG NO: 1936/007721/06 FOUNDED: 1936 LISTED: 1936 Maphai Dr V (Chair, ind ne), Froneman N (CEO), Keyter C (CFO)

NATURE OF BUSINESS: Shoprite is an investment holding company

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

listed on the Johannesburg Stock Exchange Ltd. in the “food retailers & Gold One International Ltd. 16.81%

wholesalers” sector. Secondary listings are also maintained on the Public Investment Corporation SOC Ltd. 9.17%

Namibian and Zambian Stock Exchanges. Exor Investments (UK) LLP 6.60%

SECTOR: Consumer Srvcs—Retail—Food&Drug—Food POSTAL ADDRESS: Private Bag X5, Westonaria, 1780

NUMBER OF EMPLOYEES: 147 268 MORE INFO: www.sharedata.co.za/sdo/jse/SSW

DIRECTORS: BassonJF(ind ne), Harisunker B, le RouxAM(ind ne), COMPANY SECRETARY: Lerato Matlosa

Mokgokong DrATM(ld ind ne), RockJA(ind ne), Wiese AdvJD(alt), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Wiese Dr C H (Chair, ne), Engelbrecht P C (CEO), de Bruyn A (CFO)

SPONSOR: JP Morgan Equities South Africa Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2020 AUDITORS: Ernst & Young

Government Employees Pension Fund 15.01%

Wiese C H 10.70% CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Asset Management (Pty) Ltd. 10.10% SSW Ords no par 10 000 000 000 2 676 001 886

POSTAL ADDRESS: PO Box 215, Brackenfell, 7561

DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/SHP

Amt

COMPANY SECRETARY: P G du Preez Ords no par value 4 Apr 17 10 Apr 17 60.00

Pay

Ldt

Final No 8

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 7 20 Sep 16 26 Sep 16 85.00

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: PwC Inc. LIQUIDITY: Jul20 Ave 96m shares p.w., R2 645.6m(186.9% p.a.)

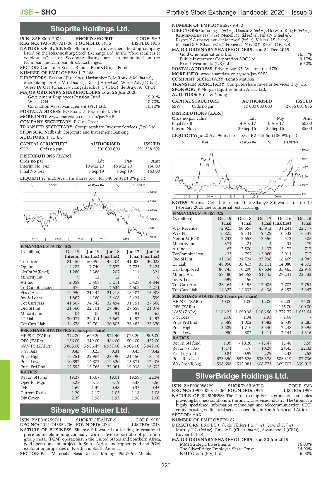

PLAT 40 Week MA SIBANYE-S

CAPITAL STRUCTURE AUTHORISED ISSUED

SHP Ords no par 1 300 000 000 591 338 502 6912

DISTRIBUTIONS [ZARc]

5674

Ords no par Ldt Pay Amt

Interim No 142 10 Mar 20 16 Mar 20 156.00

4437

Final No 141 3 Sep 19 9 Sep 19 163.00

LIQUIDITY: Jul20 Ave 11m shares p.w., R1 540.3m(101.0% p.a.) 3199

FOOR 40 Week MA SHOPRIT 1962

26681

724

2015 | 2016 | 2017 | 2018 | 2019 |

23364 NOTES: Sibanye Gold Ltd. renamed to Sibanye Stillwater Ltd. on 19

February 2020 due to internal restructuring.

20047

FINANCIAL STATISTICS

16730 (R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

Final Final Final Final(rst) Final

13413 Wrk Revenue 72 925 50 656 45 912 31 241 22 717

Wrk Pft 16 825 9 141 9 429 10 532 6 337

10096 NetIntPd(Rcd) 2 742 2 653 2 556 572 305

2015 | 2016 | 2017 | 2018 | 2019 |

Minority Int 371 - 21 4 - 431 - 179

Att Inc 62 - 2 500 - 4 437 3 473 717

FINANCIAL STATISTICS

(R million)

TotCompIncLoss - 33 - 757 - 5 060 2 911 717

Jun 17

Jun 16

Jun 19

Jun 18

Dec 19

Interim Final(rst) Final(rst) Final Final(rst) Ord SH Int 31 138 24 724 23 998 16 469 14 985

Turnover 81 150 150 395 145 104 141 000 130 028

4 372

Op Inc 4 287 7 740 7 527 7 725 7 224 LT Liab 48 950 35 413 35 111 14 080 22 918

86 745

67 634

70 290

Cap Employed

35 465

NetIntPd(Rcvd) 1 280 2 386 207 114 324 Mining Ass 57 480 54 558 51 445 27 241 22 132

Minority Int 9 12 12 7 6 Inv & Loans 599 156 - - -

Att Inc 2 059 3 468 5 211 5 428 4 844 Tot Curr Ass 26 164 15 195 12 005 7 703 2 751

TotCompIncLoss 376 827 4 534 4 502 4 271 Tot Curr Liab 14 327 14 633 8 438 6 257 5 347

Fixed Ass 19 950 21 444 21 218 18 407 16 908

Inv & Loans 1 867 4 180 3 408 2 421 599 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 41 507 34 742 32 494 31 151 27 368 HEPS-C (ZARc) - 40.00 - 1.00 - 12.00 162.00 74.00

Ord SH Int 21 360 22 101 27 386 27 658 21 074 DPS (ZARc) - - - 145.00 100.00

Minority Int 104 106 91 91 65 NAV (ZARc) 1 166.22 1 090.98 1 106.56 1 772.77 1 635.64

LT Liab 30 077 29 011 3 567 1 492 1 492 3 Yr Beta 2.00 1.34 2.93 2.68 -

Tot Curr Liab 34 678 29 764 30 803 26 482 25 370 Price Prd End 3 589 1 002 1 582 2 539 2 285

Price High 3 589 1 716 3 540 7 248 3 395

Price Low 950 682 1 414 2 144 1 316

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 372.80 699.20 971.40 1 023.20 905.00

DPS (ZARc) 156.00 319.00 484.00 504.00 452.00 RATIOS 1.39 - 10.20 - 18.47 18.48 3.59

Ret on SH fund

NAV PS (ZARc) 3 865.00 3 986.49 4 937.00 4 905.00 3 942.00 Ret on Tot Ass 15.71 8.76 10.28 24.45 22.33

3 Yr Beta 0.43 0.23 0.31 0.45 0.42 Yield (g/ton) 0.84 0.99 2.29 2.33 2.52

Price High 16 751 22 964 28 190 21 450 18 174 Price Received 676 350 552 526 536 378 586 319 487 736

Price Low 10 892 14 883 19 320 15 871 12 406 WrkCost(R/kg) 538 696 532 081 408 773 369 707 339 017

Price Prd End 12 592 15 766 22 061 19 938 16 632

RATIOS

Ret on SH Fnd 19.27 15.67 19.01 19.59 22.94 SilverBridge Holdings Ltd.

Oper Pft Mgn 5.28 5.15 5.19 5.48 5.56 SIL

D:E 1.69 1.49 0.48 0.35 0.45 ISIN: ZAE000086229 SHORT: SILVERB CODE: SVB

Current Ratio 1.20 1.17 1.05 1.18 1.08 REG NO: 1995/006315/06 FOUNDED: 1995 LISTED: 1999

NATURE OF BUSINESS: The Group comprises a group of companies

Div Cover 2.39 1.96 1.93 1.98 2.00

providing business solutions to the financial services industry. The Group is a

highly specialised information technology and telecommunication (ITC)

Sibanye Stillwater Ltd. entity focusing on financial services operating in South Africa and Africa.

SECTOR: AltX

SIB

ISIN: ZAE000259701 SHORT: SIBANYE-S CODE: SSW NUMBER OF EMPLOYEES: 82

REG NO: 2014/243852/06 FOUNDED: 2002 LISTED: 2013 DIRECTORS: BooiLS(ne), de Villiers J (ind ne), Govind H (ne),

NATURE OF BUSINESS: Sibanye Stillwater is a leading international MurrayTC(ind ne), Emslie R (Chair, ind ne), Swanepoel J (CEO),

precious metals mining company, with a diverse portfolio of platinum Kuyper L (FD)

group metal (PGM) operations in the United States and Southern Africa,

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

gold operations and projects in South Africa, and copper, gold and PGM MMI Strategic Investments 16.00%

exploration properties in North and South America. The SilverBridge Employee Share Trust 14.00%

SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals NMT Group (Pty) Ltd. 6.00%

220