Page 221 - Stock Exchange Handbook 2020 - Issue 3

P. 221

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – SEB

Att Inc 412 478 281 209 259 344 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 483 163 287 021 236 770 HEPS-C (ZARc) - 63.44 - 30.19 72.13 56.31 123.43

Fixed Ass 1 881 734 1 604 800 808 192 DPS (ZARc) - - - 55.00 43.00

Tot Curr Ass 1 728 800 1 696 630 1 061 522 NAV PS (ZARc) 558.80 663.51 831.71 730.47 624.20

Ord SH Int 2 437 274 1 814 665 1 397 666 3 Yr Beta 0.12 0.30 - 0.05 - 0.35 1.40

Minority Int 76 500 254 662 168 313 Price High 700 1 180 1 175 1 150 1 970

LT Liab 2 086 705 2 128 831 637 691 Price Low 250 252 906 900 826

Tot Curr Liab 915 774 650 126 364 849 Price Prd End 420 550 1 050 1 045 1 000

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd - 37.77 20.01 18.06 22.68 20.71

HEPS-C (ZARc) 148.50 111.50 108.00

DPS (ZARc) 50.00 40.00 31.00 Oper Pft Mgn - 52.80 38.39 17.04 15.65 17.99

NAV PS (ZARc) 879.20 705.60 582.40 D:E 0.18 0.15 0.19 0.17 0.20

1.84

1.61

1.71

1.68

Current Ratio

1.98

Price High 1 498 1 600 1 450 Div Cover - - - 2.83 3.01

Price Low 1 000 1 125 1 100

Price Prd End 1 455 1 375 1 250

Sephaku Holdings Ltd.

RATIOS

Ret on SH Fnd 15.73 14.17 17.05 SEP

ISIN: ZAE000138459 SHORT: SEPHAKU CODE: SEP

Oper Pft Mgn 15.12 15.04 15.66 REG NO: 2005/003306/06 FOUNDED: 2005 LISTED: 2009

D:E 0.95 1.11 0.43 NATURE OF BUSINESS: Sephaku Holdings Ltd. (SepHold) is a building

Current Ratio 1.89 2.61 2.91 and construction materials company with a portfolio of investments in the

Div Cover 2.99 2.82 3.84 cement and ready mix sectors in South Africa. The company’s core

investments are a 36% stake in the associate Dangote Cement South

Sebata Holdings Ltd. Africa, that manufactures the Sephaku Cement brand, and 100% in Métier

Mixed Concrete (Pty) Ltd. SepHold’s strategy is to generate income and

increase value for shareholders through the production of cement and

SEB

ISIN: ZAE000260493 SHORT: SEBATA CODE: SEB ready-mixed concrete in South Africa.

REG NO: 1998/003821/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: Sebata Holdings is an investment holding SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs

company, listed on the main board of South Africa’s JSE, with controlling NUMBER OF EMPLOYEES: 273

interest in a number of operating subsidiaries. These are primarily focused DIRECTORS: Williams B (Chair, ind ne), Janse van Rensburg M J (ind ne),

on smart city technologies and support. Ngoasheng M M (ind ne), Bulo B (ind ne), Fourie P F (ne), Mohuba Dr L

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs (CEO, ne), Crafford-Lazarus N R (FD), Capes K J

NUMBER OF EMPLOYEES: 1 253 MAJOR ORDINARY SHAREHOLDERS as at 14 May 2020

DIRECTORS: Moses K (ne), Nodwele S (ind ne), Passmore D (ld ind ne), Citiclient Nominees No 8 NY GW 10.63%

9.37%

Safika Resources

Di Siena D A (Chair, ind ne), King C A (Strategic Finance), Van Eeden Truffle Asset Management 4.73%

P (FD), Morris I G (CEO), DuvenhagePH(ne), LewinRC(ind ne),

HamillTW(ne) POSTAL ADDRESS: PO Box 7651, Centurion, 0169

MORE INFO: www.sharedata.co.za/sdo/jse/SEP

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 COMPANY SECRETARY: Acorim (Pty) Ltd.

Laird Investments (Pty) Ltd. 63.32%

Kamberg Investment Holdings 9.99% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Enigma Investment Holdings (Pty) Ltd. 3.27% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

POSTAL ADDRESS: Private Bag X9966, Sandton, 2146 AUDITORS: BDO

MORE INFO: www.sharedata.co.za/sdo/jse/SEB

CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Reegan Smith SEP Ords no par value 1 000 000 000 254 486 436

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. LIQUIDITY: Jul20 Ave 447 145 shares p.w., R256 041.0(9.1% p.a.)

SPONSOR: Merchantec Capital

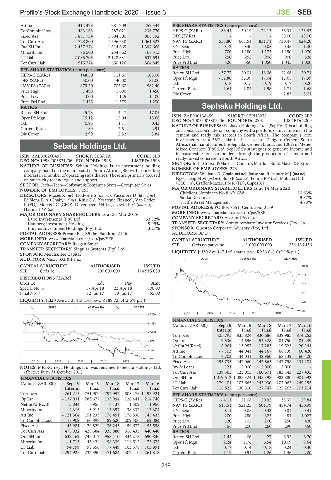

AUDITORS: Nexia SAB&T Inc. ALSH 40 Week MA SEPHAKU

1008

CAPITAL STRUCTURE AUTHORISED ISSUED

SEB Ords 1c 200 000 000 114 915 089

811

DISTRIBUTIONS [ZARc]

Ords 1c Ldt Pay Amt 615

Special No 8 17 Apr 18 23 Apr 18 300.00

Final No 7 12 Jun 17 19 Jun 17 55.00 418

LIQUIDITY: Jul20 Ave 57 374 shares p.w., R189 723.4(2.6% p.a.) 222

SUPS 40 Week MA SEBATA

25

2015 | 2016 | 2017 | 2018 | 2019 |

2260

FINANCIAL STATISTICS

1833

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

1406 Interim Final Final Final Final

Turnover 425 795 835 824 830 686 839 985 874 253

979 Op Inc 9 536 14 696 54 328 84 750 84 249

NetIntPd(Rcvd) 8 961 13 957 17 283 19 523 20 144

552

Att Inc - 7 703 44 041 44 167 68 139 60 420

TotCompIncLoss - 7 703 44 041 42 960 68 139 60 420

125

2015 | 2016 | 2017 | 2018 | 2019 | Fixed Ass 195 735 147 060 143 665 142 798 134 181

NOTES: MICROmega Holdings Ltd. was renamed to Sebata Holdings Ltd. Inv & Loans 121 2 000 2 000 2 000 -

effective from 31 October 2018 Tot Curr Ass 139 365 123 003 160 671 183 343 227 435

Ord SH Int 1 079 612 1 085 324 1 035 398 983 880 901 592

FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 LT Liab 179 401 103 665 143 930 202 063 249 155

Tot Curr Liab 116 822 130 310 127 747 125 263 103 214

Interim Final Final Final Final

Turnover 261 213 751 909 797 957 808 176 1 193 921

PER SHARE STATISTICS (cents per share)

Op Inc - 137 931 288 677 135 994 126 441 214 748 HEPS-C (ZARc) - 4.11 21.08 20.92 33.37 29.84

NetIntPd(Rcvd) 3 044 - 956 6 137 1 509 1 966 NAV PS (ZARc) 518.51 521.25 501.79 484.74 450.99

Minority Int 2 316 6 915 13 397 38 337 13 304 3 Yr Beta 0.11 0.05 0.33 0.81 0.31

Att Inc - 121 364 151 233 176 451 176 836 145 433 Price High 200 280 325 484 1 022

TotCompIncLoss - 118 902 160 898 189 620 209 506 162 084 Price Low 120 102 200 250 420

Fixed Ass 45 981 29 829 36 245 59 677 53 558 Price Prd End 156 200 260 290 450

Tot Curr Ass 475 032 428 384 935 880 516 433 440 440

RATIOS

Ord SH Int 632 162 745 017 953 110 834 278 690 836 Ret on SH Fnd - 1.43 4.06 4.27 6.93 6.70

Minority Int - 1 713 45 424 98 339 114 512 75 672 Oper Pft Mgn 2.24 1.76 6.54 10.09 9.64

LT Liab 94 799 95 556 77 449 103 378 103 991 D:E 0.17 0.14 0.18 0.24 0.30

Tot Curr Liab 294 926 232 390 471 684 302 416 261 818 Current Ratio 1.19 0.94 1.26 1.46 2.20

219