Page 219 - Stock Exchange Handbook 2020 - Issue 3

P. 219

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – SAS

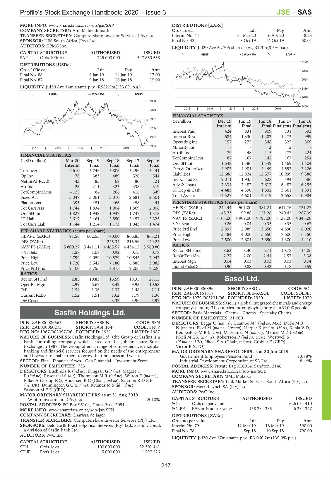

MORE INFO: www.sharedata.co.za/sdo/jse/SAP DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Ami Mahendranath Ords 1c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 44 31 Mar 20 6 Apr 20 48.73

SPONSOR: UBS South Africa (Pty) Ltd. Final No 43 8 Oct 19 14 Oct 19 50.01

AUDITORS: KPMG Inc. LIQUIDITY: Jul20 Ave 52 705 shares p.w., R1.3m(8.5% p.a.)

GENF 40 Week MA SASFIN

CAPITAL STRUCTURE AUTHORISED ISSUED

SAP Ords 100c ea 725 000 000 547 860 538

7490

DISTRIBUTIONS [USDc]

Ords 100c ea Ldt Pay Amt 6272

Final No 88 8 Jan 19 14 Jan 19 17.00

Final No 87 9 Jan 18 16 Jan 18 15.00 5054

LIQUIDITY: Jul20 Ave 14m shares p.w., R582.5m(133.0% p.a.)

3836

FORE 40 Week MA SAPPI

2618

10300

1400

2015 | 2016 | 2017 | 2018 | 2019 |

8629

FINANCIAL STATISTICS

6957

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

5286 Interim Final Final Final(rst) Final(rst)

Interest Paid 424 831 809 731 593

3614 Interest Rcvd 684 1 330 1 282 1 173 999

Operating Inc 157 272 348 327 369

1943 Minority Int - - 2 2 -

2015 | 2016 | 2017 | 2018 | 2019 |

Attrib Inc 79 148 115 177 224

TotCompIncLoss 87 167 142 167 254

FINANCIAL STATISTICS

(USD million)

Ord SH Int 1 648 1 586 1 549 1 469 1 404

Sep 17

Sep 16

Sep 19

Mar 20

Sep 18

Interim Final Final Final Final Dep & OtherAcc 4 983 4 981 4 449 4 552 3 226

Turnover 2 610 5 746 5 806 5 296 5 141

Op Inc 78 383 489 526 544 Liabilities 12 686 12 824 12 577 10 999 9 388

NetIntPd(Rcvd) 43 85 68 80 121 Inv & Trad Sec 2 011 1 935 628 494 586

Att Inc 26 211 323 338 319 Adv & Loans 7 334 7 487 7 617 6 487 6 255

TotCompIncLoss - 125 84 266 416 349 ST Dep & Cash 4 483 4 390 1 892 3 561 1 891

Fixed Ass 3 047 3 061 3 010 2 681 2 501 Total Assets 14 527 14 601 14 319 12 658 10 984

Plantations 395 451 466 458 441 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 744 1 834 1 904 1 869 2 006 HEPS-C (ZARc) 244.44 501.00 381.21 611.76 731.27

Ord SH Int 1 827 1 948 1 947 1 747 1 378 DPS (ZARc) 48.73 99.88 151.26 240.42 287.39

LT Liab 2 617 2 461 2 550 2 457 2 325 NAV PS (ZARc) 5 103.00 4 909.00 4 797.00 5 137.00 4 346.00

Tot Curr Liab 1 144 1 214 1 173 1 043 1 474 3 Yr Beta - 0.26 - 0.04 0.35 0.35 0.67

Price Prd End 2 897 2 989 3 650 4 890 6 020

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 91.56 602.55 770.00 866.85 863.21 Price High 3 484 4 000 5 650 7 600 6 150

DPS (ZARc) - - 245.34 215.56 149.24 Price Low 2 500 2 601 3 650 4 300 4 410

NAV PS (ZARc) 5 800.27 5 441.11 4 465.57 4 434.12 3 560.80 RATIOS

3 Yr Beta 1.58 1.08 0.92 0.75 0.78 Ret on SH Fund 8.63 8.30 6.71 10.78 14.06

Price High 4 799 9 059 10 579 10 543 7 942 RetOnTotalAss 2.27 2.00 2.44 2.57 3.38

Price Low 1 720 3 542 7 180 6 888 3 982 Interest Mgn 0.04 0.03 0.03 0.03 0.04

Price Prd End 2 100 3 755 8 875 9 206 7 226 LiquidFnds:Dep 0.90 0.88 0.43 0.78 0.59

RATIOS

Ret on SH Fnd 2.85 10.83 16.59 19.35 23.15 Sasol Ltd.

Oper Pft Mgn 2.99 6.67 8.42 9.93 10.58 SAS

D:E 1.54 1.36 1.37 1.48 2.11 ISIN: ZAE000006896 SHORT: SASOL CODE: SOL

Current Ratio 1.52 1.51 1.62 1.79 1.36 ISIN: ZAE000151817 SHORT: BEE-SASOL CODE: SOLBE1

Div Cover - - 3.33 3.96 5.97 REG NO: 1979/003231/06 FOUNDED: 1950 LISTED: 1979

NATURE OF BUSINESS: Sasol is a global integrated chemicals and energy

companyspanning31countriesandemployingmorethan31000 people.

Sasfin Holdings Ltd. SECTOR: Basic Materials—Chems—Chems—Specialty Chems

NUMBER OF EMPLOYEES: 31 000

SAS

ISIN: ZAE000006565 SHORT: SASFIN CODE: SFN DIRECTORS: Beggs C (ind ne), CuambeMJ(ind ne, Moz), Dube M B

ISIN: ZAE000060273 SHORT: SASFIN-P CODE: SFNP N(ind ne), Flöel M (ind ne, German), Harper K (ind ne, USA), Kahla V D,

REG NO: 1987/002097/06 FOUNDED: 1951 LISTED: 1987 KennealyGMB(ind ne), Matyumza N (ind ne), MkhizeMZ(ind ne),

NATURE OF BUSINESS: Sasfin Holdings Ltd. (the Group or Sasfin) is a NkeliMEK(ind ne), Robertson P (ind ne, USA), Westwell S

bank controlling company which listed on the Johannesburg Stock (ld ind ne, UK), Nkosi S A (Chair, ind ne), Grobler F (CEO),

Exchange in 1987. The Group offers a range of comprehensive, modular Victor P (CFO)

banking and financial services focused on the needs of the entrepreneur MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

and investor to enable them to grow their business and wealth. Government Employees Pension Fund 13.78%

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs Industrial Development Corporation of SA Ltd. 8.44%

NUMBER OF EMPLOYEES: 733 POSTAL ADDRESS: Private Bag X10014, Sandton, 2146

DIRECTORS: Buchholz R (ind ne), DingaanGP(ne), Magare T MORE INFO: www.sharedata.co.za/sdo/jse/SOL

E(ind ne), Rosenthal S (alt), ThompsonMR(ind ne), Wilton E (ind ne), COMPANY SECRETARY: MML Mokoka

Pillay A (Group FD), Andersen R C (Chair, ind ne), SassoonRDEB TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

(ne, UK), DunningtonGC(ind ne), RylandsMS(ld ind ne), SPONSOR: Merrill Lynch SA (Pty) Ltd.

SassoonMEE (CEO)

AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

Wipfin Investments (Pty) Ltd. 25.10% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 95104, Grant Park, 2051 SOL Ords no par value - 626 034 410

MORE INFO: www.sharedata.co.za/sdo/jse/SFN SOLBE1 BEE ords no par value 158 331 335 6 331 347

COMPANY SECRETARY: Charissa de Jager

DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSORS: Deloitte & Touche Sponsor Services (Pty) Ltd., Sasfin Capital, Interim No 79 12 Mar 19 18 Mar 19 590.00

a division of Sasfin Bank Ltd. Final No 78 4 Sep 18 10 Sep 18 790.00

AUDITORS: PwC Inc.

LIQUIDITY: Jul20 Ave 17m shares p.w., R3 060.2m(139.0% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

SFN Ords 1c ea 100 000 000 32 301 441

SFNP Prefs 1c ea 5 000 000 1 797 226

217