Page 205 - Stock Exchange Handbook 2020 - Issue 3

P. 205

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – REM

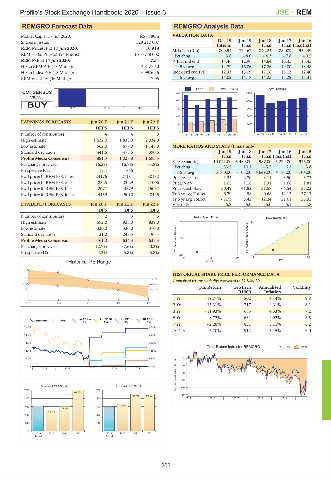

REMGRO Forecast Data REMGRO Analysis Data

Market Cap at 17 Jun 2020: R57 780m VALUATION DATA

Shares in issue: 529 217 007 Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final Final Final(rst)

MrktCap (Rm) 80 394 77 467 84 224 88 009 95 449

REM Price(c) at 17 Jun 2020: 10 918

REM Hi/Lo Price(c) (24 Mnths): 15 787/8 002 Pctchng 3.8 -8.0 -4.3 -7.8 -0.5

P/E at prd end 13.46 12.96 14.64 16.45 16.45

REM P/E at 17 Jun 2020: 7.54

Hi/Lo REM P/E (18 Mnths): 14.81/7.40 Tr 5 yr avg 14.79 16.06 17.26 19.00 18.48

Hi/Lo Index P/E (18 Mnths): 16.99/6.96 Index prd end P/E 12.33 15.09 17.16 13.13 12.40

REM Volatility (36 Mnths): 7.05 Tr 5 yr avg 14.02 14.18 14.25 13.29 13.31

HEPS DPS (ZARc) NAV (ZAR/cps)

CONSENSUS 1200 15000

VIEW:

960 12000

BUY

BUY HOLD SELL 720 9000

480 6000

240

EARNINGS FORECASTS Jun 20 F Jun 21 F Jun 22 F 3000

HEPS HEPS HEPS

Number of contributors 4 4 3 0 Jun 15 Jun 16 Jun 17 Jun 18 Jun 19 0 Jun 15 Jun 16 Jun 17 Jun 18 Jun 19

High estimate 1 632.0 1 835.0 2 034.0

Low estimate 562.0 677.0 1 148.0 MORE RATIOS AND STATS (Finals only)

Standard deviation 441.6 476.5 390.6 Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

881.3 1 028.8 1 695.3 Final Final Final Final(rst) Final

Profile Media Consensus

Sales/Share(c) 10 071.00 5 489.00 4 987.00 5 279.00 4 976.00

Pct change prev year - 16.2% 16.7% 64.8%

Pct chng 83.5 10.1 - 5.5 6.1 3.8

Prospective P/E 12.4 10.6 6.4

Tr 5 yr avg 6 160.00 5 105.00 4 649.00 4 178.00 3 704.00

Fwd price: hi REM P/E, hi est 24176 27184 30132 Price/Sales ps 1.35 2.70 3.11 3.50 3.73

Fwd price: hi REM P/E, lo est 8325 10029 17006 Price/NAV 1.05 1.18 1.31 1.66 1.81

Fwd price: lo REM P/E, hi est 12077 13579 15052 Price/CashFlow 30.49 41.82 31.58 64.54 37.22

Fwd price: lo REM P/E, lo est 4159 5010 8495 Tr 3 yr avg TotRet - 6.79 - 4.58 - 0.68 12.13 27.13

Tr 5 yr avg TotRet - 1.73 3.42 12.24 21.61 25.92

Volatility 5.2 5.0 5.0 5.1 4.8

DIVIDEND FORECASTS Jun 20 F Jun 21 F Jun 22 F

DPS DPS DPS

Number of contributors 2 3 3 Risk / Return Profile PEG inverse: 0.41

High estimate 592.0 926.0 839.0 110 30

Low estimate 330.0 330.0 370.0 PEG = 1

Standard deviation 131.0 243.5 196.4

461.0 634.3 635.3 3Yr Compound Return 45 5 Yr Average HEPS Growth

Profile Media Consensus

Pct change prev year 12.7% 37.6% 0.2%

Prospective DY 4.2% 5.8% 5.8%

-20 0

0 15 30 0 30

Historical PE Range Volatility P/E

HISTORICAL SHARE PRICE PERFORMANCE DATA

17.39 Avg High

Annualised returns with divs reinvested to 31 May 20

14.40 Average

11.78 Avg Low p.a. Return Grwth in Annualised Volatility

R1000 Inflation

1 Yr - 19.77% 802 4.14% 9.8

2016 2017 2018 2019 2020

2 Yr - 15.31% 717 4.31% 8.1

3 Yr - 11.93% 683 4.33% 7.2

5 Yr - 8.72% 634 4.92% 6.5

Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

REMGRO P/E

Est Est Est Est

7 Yr - 2.28% 851 5.11% 6.2

16.43 31000

10 Yrs 6.70% 1 912 5.15% 6.0

14.66 25600

12.9 20200

Total Return Index for REMGRO TRI Price

11.13 14800

9.36 9400 0

Percentage growthincluding dividends -20

7.6 4000 -10

| 2018 | 2019 | 2020 | 2021 | 2022 |

-30

Forecast HEPS Growth Forecast DPS Growth -40

1700 700

64.8%

-50

37.6% 0.2%

1360 560 2015 | 2016 | 2017 | 2018 | 2019 |

1020 420 12.7%

16.7%

-16.2%

680 280

340 140

0 0

2019 2020 2021 2022 2019 2020 2021 2022

Actual Actual

203