Page 200 - Stock Exchange Handbook 2020 - Issue 3

P. 200

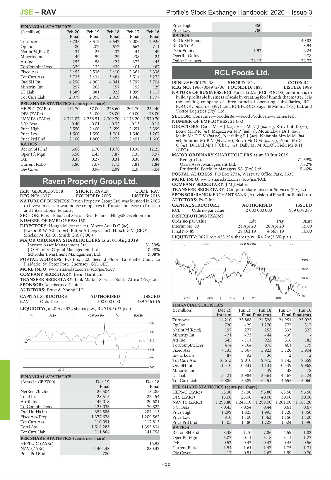

JSE – RAV Profile’s Stock Exchange Handbook: 2020 – Issue 3

Price High 850 -

FINANCIAL STATISTICS Price Low 780 -

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

RATIOS

Final Final Final Final Final

Turnover 8 735 8 519 8 542 9 006 7 926 RetOnSH Funds - - 40.82

Op Inc 480 207 672 662 711 RetOnTotAss - 8.94

NetIntPd(Rcvd) 34 25 32 44 49 Debt:Equity 1.92 2.24

Minority Int 49 59 29 38 24 OperRetOnInv - 9.78

Att Inc 252 58 424 372 445 OpInc:Turnover 72.13 72.73

TotCompIncLoss 329 132 439 401 467

Fixed Ass 2 452 2 536 2 410 2 364 2 336 RCL Foods Ltd.

Tot Curr Ass 3 733 3 434 3 484 3 514 3 272

RCL

Ord SH Int 4 256 4 065 4 041 3 797 3 704 ISIN: ZAE000179438 SHORT: RCL CODE: RCL

Minority Int 257 262 157 152 129 REG NO: 1966/004972/06 FOUNDED: 1891 LISTED: 1989

LT Liab 1 389 881 923 1 099 1 117 NATURE OF BUSINESS: RCL Foods Ltd.’s (RCL FOODS) ambition is to

Tot Curr Liab 2 079 2 058 2 019 1 945 1 777 build a profitable business of scale by creating food brands that matter. It is

the holding company of three principal operating subsidiaries, RCL

PER SHARE STATISTICS (cents per share) FOODS Consumer (Pty) Ltd., RCL FOODS Sugar & Milling (Pty) Ltd. and

HEPS-C (ZARc) 161.70 57.00 228.60 201.70 234.40 Vector Logistics (Pty) Ltd.

DPS (ZARc) - 34.00 78.00 90.00 78.00 SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

NAV PS (ZARc) 2 341.87 2 236.51 2 309.70 2 173.20 1 970.70 NUMBER OF EMPLOYEES: 21 000

3 Yr Beta 0.40 - 0.01 - 0.32 - 0.15 0.14

Price High 2 550 2 400 2 659 2 651 2 399 DIRECTORS: Carse MrHJ(ne), Hess MsCJ(ind ne), Kruythoff K (ne),

Louw MrPR(ne), Mageza MrNP(ind ne), Moumakwa Dr P (ne),

Price Low 1 500 1 550 1 701 1 540 1 267 Msibi MrDTV(ind ne), NeethlingPJ(alt), Nhlanhla MrsMM(ind

Price Prd End 2 100 1 860 2 272 2 451 1 600 ne), Smither MrRV(ld ind ne), Steyn MrGM(ind ne), Zondi Mr G

C(ne), Durand Mr J J (Chair, ne), Dally Mr M (CEO), Field Mr R H

RATIOS

Ret on SH Fnd 6.68 2.70 10.78 10.38 12.25 (CFO)

Oper Pft Mgn 5.50 2.43 7.87 7.35 8.97

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

D:E 0.38 0.27 0.31 0.38 0.40 Remgro Ltd. 71.69%

Current Ratio 1.80 1.67 1.73 1.81 1.84 Oasis Asset Management Ltd. 7.72%

Div Cover - 0.94 2.99 2.26 3.04 Prudential Portfolio Managers SA (Pty) Ltd. 5.46%

POSTAL ADDRESS: PO Box 2734, Westway Office Park, 3635

Raven Property Group Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/RCL

COMPANY SECRETARY: J M J Maher

RAV

ISIN: GB00B0D5V538 SHORT: RAVEN CODE: RAV TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 43371 FOUNDED: 2005 LISTED: 2018 SPONSOR:RANDMERCHANTBANK(AdivisionofFirstRandBankLtd.)

NATURE OF BUSINESS: Raven Property Group Ltd. was founded in 2005 AUDITORS: PwC Inc.

to invest in class A warehouse complexes in Russia and lease to Russian CAPITAL STRUCTURE AUTHORISED ISSUED

and International tenants. RCL Ords no par value 2 000 000 000 959 004 383

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

DISTRIBUTIONS [ZARc]

NUMBER OF EMPLOYEES: 150 Ords no par value Ldt Pay Amt

DIRECTORS: Hough M (snr ind ne), Moore AdvDC(ne), Interim No 90 21 Apr 20 28 Apr 20 15.00

Jewson R W (Chair, ne), Bilton A (Dep Chair), Hirsch G V (CEO), Final No 89 29 Oct 19 4 Nov 19 10.00

Sinclair M (CFO), Smith C A (COO)

LIQUIDITY: Jul20 Ave 425 294 shares p.w., R4.7m(2.3% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 01 Aug 2019

Invesco Asset Management Ltd. 31.39% FOOD 40 Week MA RCL

J O Hambro Capital Management Ltd. 10.98%

Schroder Investment Management Ltd. 9.08%

POSTAL ADDRESS: PO Box 522, Second Floor, La Vieille Cour, La 1919

Plaiderie, St. Peter Port, Guernsey, GY1 6EH

MORE INFO: www.sharedata.co.za/sdo/jse/RAV 1652

COMPANY SECRETARY: Benn Garnham

1385

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSOR: Renaissance Capital

1117

AUDITORS: Ernst & Young LLP

850

2015 | 2016 | 2017 | 2018 | 2019 |

CAPITAL STRUCTURE AUTHORISED ISSUED

RAV Ords 1p ea 1 500 000 000 489 746 016

FINANCIAL STATISTICS

LIQUIDITY: Jul20 Ave 322 shares p.w., R2 713.5(-% p.a.)

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

ALSH 40 Week MA RAVEN Interim Final Final(rst) Final Final(rst)

Turnover 14 210 25 888 24 528 24 951 25 025

950

Op Inc 720 - 29 1 270 777 317

NetIntPd(Rcvd) 197 277 252 333 327

881

Minority Int - 71 - 73 - 44 - 39 -

812 Att Inc 545 - 111 922 516 182

TotCompIncLoss 474 - 164 876 461 179

743 Fixed Ass 7 135 5 567 5 923 5 720 5 904

Inv & Loans 87 92 36 2 2

674

Tot Curr Ass 10 613 9 010 9 475 8 145 8 659

Ord SH Int 11 310 10 831 11 131 10 349 9 968

605

2019 | Minority Int - 3 49 38 78

LT Liab 5 421 3 984 3 361 4 467 5 124

FINANCIAL STATISTICS

(Amts in GBP’000) Dec 19 Dec 18 Tot Curr Liab 6 886 5 589 6 451 4 655 5 060

Final Final PER SHARE STATISTICS (cents per share)

NetRent/InvInc 126 504 118 285 HEPS-C (ZARc) 53.30 37.90 96.80 63.50 96.50

Total Inc 128 515 123 154 DPS (ZARc) 15.00 25.00 40.00 30.00 30.00

Attrib Inc 46 018 - 120 681 NAV PS (ZARc) 1 299.80 1 245.10 1 289.00 1 201.00 1 163.20

TotCompIncLoss 123 036 - 70 827 3 Yr Beta - 0.45 - 0.54 0.44 0.61 0.67

Ord UntHs Int 354 586 284 415 Price High 1 299 1 825 1 995 1 720 1 850

FixedAss/Prop 1 377 678 1 209 562 Price Low 810 1 100 1 363 1 150 1 100

Tot Curr Ass 110 091 117 813 Price Prd End 1 105 1 180 1 728 1 524 1 390

Total Ass 1 518 283 1 395 834

RATIOS

Tot Curr Liab 111 864 141 758 Ret on SH Fnd 8.38 - 1.70 7.86 4.59 1.82

Oper Pft Mgn 5.07 - 0.11 5.18 3.11 1.27

PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) - - 16.93 D:E 0.52 0.43 0.42 0.45 0.56

NAV (ZARc) 1 404.48 880.32 Current Ratio 1.54 1.61 1.47 1.75 1.71

Price Prd End 780 - Div Cover 4.17 - 0.51 2.67 1.99 0.70

198