Page 201 - Stock Exchange Handbook 2020 - Issue 3

P. 201

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – RDI

EMAIL: info@rdireit.com

RDI REIT P.L.C. WEBSITE: www.rdireit.com

RDI TELEPHONE: 0044207-811-0100

FAX: 0044207-811-0101

COMPANY SECRETARY: Lisa Hibberd

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors

(Pty) Ltd.

Scan the QR code to AUDITORS: KPMG UK

visit our website

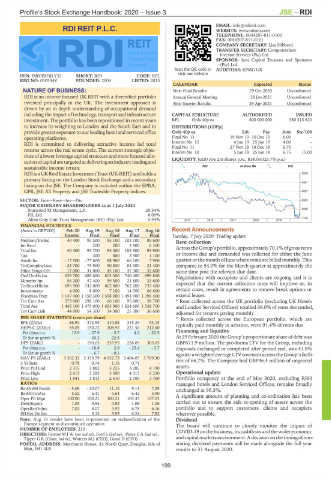

ISIN: IM00BH3JLY32 SHORT: RDI CODE: RPL

REG NO: 010534V FOUNDED: 2004 LISTED: 2013

CALENDAR Expected Status

NATURE OF BUSINESS: Next Final Results 29 Oct 2020 Unconfirmed

RDI is an income focused UK REIT with a diversified portfolio Annual General Meeting 28 Jan 2021 Unconfirmed

invested principally in the UK. The investment approach is Next Interim Results 29 Apr 2021 Unconfirmed

driven by an in depth understanding of occupational demand

including the impact of technology, transport and infrastructure CAPITAL STRUCTURE AUTHORISED ISSUED

investment. The portfolio has been repositioned in recent years RPL Ords 40p ea 600 000 000 380 315 623

to increase its weighting to London and the South East and to

DISTRIBUTIONS [GBPp]

provide greater exposure to our leading hotel and serviced office Ords 40p ea Ldt Pay Amt Scr/100

operating platforms. Final No 13 19 Nov 19 10 Dec 19 6.00 -

RDI is committed to delivering attractive income led total Interim No 12 4 Jun 19 25 Jun 19 4.00 -

Final No 11 27 Nov 18 18 Dec 18 6.75 -

returns across the real estate cycle. The current strategic objec- Interim No 10 5 Jun 18 25 Jun 18 6.75 15.00

tives of a lower leverage capital structure and more focused allo-

cationofcapitalaretargetedatdeliveringanindustryleadingand LIQUIDITY: Jul20 Ave 2m shares p.w., R38.0m(23.7% p.a.)

sustainable income return. J867 40 Week MA RDI

RDIisaUKRealEstateInvestmentTrust(UK-REIT)andholdsa 5955

primary listing on the London Stock Exchange and a secondary

4991

listing on the JSE. The Company is included within the EPRA,

GPR, JSE All Property and JSE Tradeable Property indices. 4027

SECTOR: Fins—Rest—Inv—Div 3063

MAJOR ORDINARY SHAREHOLDERS as at 1 July 2020

Starwood XI Management, L.P. 29.54% 2099

FIL Ltd. 6.09%

1135

Allan Gray Unit Trust Management (RF) (Pty) Ltd. 5.94% 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

(Amts in GBP’000) Feb 20 Aug 19 Aug 18 Aug 17 Aug 16 Recent Announcements

Tuesday, 7 July 2020: Trading update

Interim Final Final Final Final

NetRent/InvInc 40 400 93 500 95 100 102 100 89 600

Int Recd - 200 200 3 400 6 300 Rent collection

Total Inc 40 400 93 700 95 300 105 500 95 900 Across the Group’s portfolio, approximately 70.1% of gross rents

Tax - 300 800 3 900 1 100 or income due and demanded was collected for either the June

Attrib Inc - 17 500 - 77 600 88 900 66 100 7 900 quarter or the month of June where rents are billed monthly. This

TotCompIncLoss - 23 700 - 73 900 90 800 82 300 21 400 compares to 54.0% for the March quarter at approximately the

Hline Erngs-CO 17 000 31 000 45 100 47 300 32 600 same time post the relevant due date.

Ord UntHs Int 639 700 685 600 803 300 740 400 699 800 Negotiations with occupiers and clients are ongoing and it is

Minority Int 56 200 57 400 59 500 21 800 33 600 expected that the current collection rates will improve or, in

TotStockHldInt 695 900 743 000 862 800 762 200 733 400

Investments 4 000 8 000 7 100 14 700 66 600 certain cases, result in agreements to remove break options or

FixedAss/Prop 1 147 400 1 150 300 1 598 000 1 494 900 1 396 400 extend leases.

Tot Curr Ass 273 600 298 100 66 100 95 600 58 700 * Rent collected across the UK portfolio (excluding UK Hotels

Total Ass 1 445 100 1 475 000 1 693 900 1 624 600 1 538 700 and London Serviced Offices) totalled 68.0% of rents demanded,

Tot Curr Liab 44 900 54 300 34 300 25 300 36 600

adjusted for tenants paying monthly

PER SHARE STATISTICS (cents per share) * Rents collected across the European portfolio, which are

EPS (ZARc) - 86.94 - 374.95 410.88 315.25 53.15 typically paid monthly in advance, were 91.4% of rents due

HEPS-C (ZARc) 85.05 150.72 208.92 221.50 212.60

Pct chng p.a. 12.9 - 27.9 - 5.7 4.2 - 22.5 Financing and liquidity

Tr 5yr av grwth % - - 20.2 22.5 - - At 29 February 2020 the Group’s proportionate share of debt was

DPS (ZARc) - 190.05 233.95 228.05 305.65 GBP671.9 million. The pro-forma LTV for the Group, including

Pct chng p.a. - - 18.8 2.6 - 25.4 - 3.7 disposals exchanged or completed after period end, was 41.8%

Tr 5yr av grwth % - - 6.7 - 0.1 - - againstaweightedaverageLTVcovenantacrosstheGroup’sfacili-

NAV PS (ZARc) 3 362.32 3 333.79 4 052.73 3 404.05 3 709.30 ties of 66.7%. The Company had GBP46.4 million of ungeared

3 Yr Beta 0.78 0.74 1.16 0.71 -

Price Prd End 2 315 1 882 3 235 3 285 4 190 assets.

Price High 2 615 3 295 3 590 4 315 6 250 Operational update

Price Low 1 841 1 813 2 610 2 700 3 760 Portfolio occupancy at the end of May 2020, excluding RBH

managed hotels and London Serviced Offices, remains broadly

RATIOS

RetOnSH Funds - 5.06 - 10.07 11.16 9.13 7.29 unchanged at 96.3%.

RetOnTotAss 5.52 6.41 5.64 6.42 5.90

Oper Pft Mgn 100.00 100.21 100.21 103.33 107.03 A significant amount of planning and co-ordination has been

Debt:Equity 1.03 0.94 0.92 1.08 1.06 carried out to ensure the safe re-opening of assets across the

OperRetOnInv 7.02 8.07 5.92 6.78 6.16 portfolio and to support customers, clients and occupiers

SH Ret On Inv - 5.12 5.95 6.24 7.83 wherever possible.

Note: Aug 18 results have been re-presented on reclassification of the

Dividend

Europe segment as discontinued operation The board will continue to closely monitor the impact of

NUMBER OF EMPLOYEES: 230 COVID-19onthebusiness,itscashflowsandthewidereconomic

DIRECTORS: Farrow M J W (snr ind ne), Ford S (ind ne), Peace E A (ind ne),

Tipper G R (Chair, ind ne), Watters M J (CEO), Grant D (CFO) andcapitalmarketsenvironment.Adecisiononthetimingofrein-

POSTAL ADDRESS: Merchants House, 24 North Quay, Douglas, Isle of stating dividend payments will be made alongside the full year

Man, IM1 4LE results to 31 August 2020.

199