Page 209 - Stock Exchange Handbook 2020 - Issue 3

P. 209

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – REX

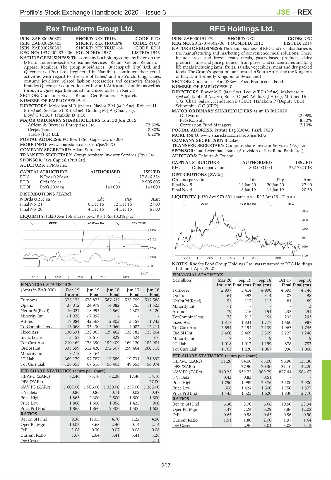

Rex Trueform Group Ltd. RFG Holdings Ltd.

REX RFG

ISIN: ZAE000250387 SHORT: REX TRUE CODE: RTO ISIN: ZAE000191979 SHORT: RFG CODE: RFG

ISIN: ZAE000250403 SHORT: REX TRUE6% CODE: RTOP REG NO: 2012/074392/06 FOUNDED: 2012 LISTED: 2014

ISIN: ZAE000250395 SHORT: REX TRUE -N- CODE: RTN NATURE OF BUSINESS: The main business of RFG and its subsidiaries is

REG NO: 1937/009839/06 FOUNDED: 1937 LISTED: 1945 the manufacturing and marketing of convenience meal solutions. These

NATURE OF BUSINESS: The company is a holding company listed on the include fresh and frozen ready meals, pastry-based products, dairy

JSE Ltd. under the sector: Consumer Services – Retail – General Retailers – products, juice and juice products, fruit purees and concentrates and long

Apparel Retailers. The group subsidiaries, Queenspark (Pty) Ltd. and life meals including jams, fruits, salads, vegetables, meat and dry packed

Queenspark (Pty) Ltd. (registered in Namibia), continued their retail foods.The Group’soperationsare locatedinSouth Africa andthe Kingdom

activities with regard to the sale of ladies’ and men’s clothing, shoes, of Eswatini (formerly Kingdom of Swaziland).

costume jewellery, related fashion accessories and cosmetics through SECTOR: Consumer—Food&Bev—Food Producers—Food

brandedQueensparkoutletslocatedinSouth Africa andNamibia aswellas NUMBER OF EMPLOYEES: 0

through a Queenspark-branded franchised outlet in Kenya. DIRECTORS: BowerMR(ld ind ne), LeeuwTP(ind ne), Makenete A

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels (ind ne), Njobe B (ind ne), Smart C (ne), WillisGJH(ne), Muthien Dr

NUMBER OF EMPLOYEES: 594 Y G (Chair, ind ne), Henderson B (CEO), Hanekom P (Deputy CEO),

DIRECTORS: MolosiwaMR(ind ne), NaylorPM(ld ind ne), Roberts H Schoombie C C (CFO)

B(ind ne), SebataneLK(ind ne), GoldingMJA (Chair, ne),

MAJOR ORDINARY SHAREHOLDERS as at 13 Jul 2020

Lloyd C (CEO), Franklin D (FD) Old Mutual 22.05%

PSG Konsult 8.80%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

African & Overseas Enterprises Ltd. 72.60% Coronation Fund Managers 7.10%

Ceejay Trust 8.80% POSTAL ADDRESS: Private Bag X3040, Paarl, 7620

Traclo (Pty) Ltd. 6.20% MORE INFO: www.sharedata.co.za/sdo/jse/RFG

POSTAL ADDRESS: PO Box 1856, Cape Town, 8000 COMPANY SECRETARY: B Lakey

MORE INFO: www.sharedata.co.za/sdo/jse/RTO TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Adam Snitcher SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Deloitte & Touche

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: KPMG Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

RFG Ords no par value 1 800 000 000 262 762 018

CAPITAL STRUCTURE AUTHORISED ISSUED

RTN NOrds 0.25c ea - 17 846 354 DISTRIBUTIONS [ZARc]

RTO Ords 50c ea - 2 905 805 Ords no par value Ldt Pay Amt

RTOP Prefs 200c ea 140 000 140 000 Final No 5 14 Jan 20 20 Jan 20 27.90

Final No 4 8 Jan 19 14 Jan 19 20.30

LIQUIDITY: Jul20 Ave 979 801 shares p.w., R15.3m(19.4% p.a.)

DISTRIBUTIONS [ZARc]

NOrds 0.25c ea Ldt Pay Amt

Final No 21 6 Dec 16 12 Dec 16 27.00 ALSH 40 Week MA RFG

Final No 20 4 Dec 15 14 Dec 15 61.00

2954

LIQUIDITY: Jul20 Ave 166 shares p.w., R3 156.6(0.3% p.a.)

2603

GERE 40 Week MA REX TRUE

2252

2500

1901

2102

1550

1704

1199

1306 2015 | 2016 | 2017 | 2018 | 2019 |

NOTES: Rhodes Food Group Holdings Ltd. was renamed to RFG Holdings

908

Ltd. on 1 April 2020.

510 FINANCIAL STATISTICS

2015 | 2016 | 2017 | 2018 | 2019 |

(R million) Mar 20 Sep 19 Sep 18 Oct 17 Sep 16

FINANCIAL STATISTICS

Interim Final(rst) Final(rst) Final Final(rst)

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Turnover 2 937 5 414 4 990 4 593 4 146

Op Inc 161 392 314 407 498

Interim Final Final Final Final

Turnover 378 175 678 873 587 632 528 759 537 588 NetIntPd(Rcvd) 54 117 113 84 89

Op Inc 38 012 24 979 14 082 755 11 523 Minority Int - 1 - - - 3

NetIntPd(Rcvd) 10 027 - 8 995 - 4 569 - 4 307 - 5 120 Att Inc 79 216 154 235 291

Minority Int - 1 026 - 7 098 - - - TotCompIncLoss 78 215 154 235 293

Att Inc 17 084 42 568 12 803 3 158 11 743 Fixed Ass 1 817 1 831 1 777 1 460 987

TotCompIncLoss 16 068 35 430 13 060 4 087 12 211 Tot Curr Ass 2 654 2 194 2 139 1 965 1 745

Fixed Ass 130 331 128 065 129 462 128 182 125 204 Ord SH Int 2 460 2 469 2 309 2 227 1 248

Inv & Loans 3 157 2 616 829 524 576 Minority Int 7 8 9 9 9

Tot Curr Ass 210 469 178 390 192 409 169 120 182 984 LT Liab 1 018 1 017 1 199 878 787

Ord SH Int 333 399 312 420 272 507 259 464 260 718 Tot Curr Liab 1 763 1 220 1 067 996 1 066

Minority Int 9 718 8 464 - - -

LT Liab 369 179 97 787 19 589 19 731 21 897 PER SHARE STATISTICS (cents per share) 63.00 96.90 133.30

HEPS-C (ZARc)

84.00

31.20

Tot Curr Liab 126 353 67 616 56 403 49 553 56 074

DPS (ZARc) - 27.90 20.30 31.10 42.20

NAV PS (ZARc) 940.22 939.72 909.79 877.44 564.67

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 82.40 73.10 62.20 17.40 54.10 3 Yr Beta 0.43 0.83 0.51 - -

DPS (ZARc) - - - - 27.00 Price High 1 750 1 999 2 376 3 100 2 900

NAV PS (ZARc) 1 607.00 1 506.00 1 320.00 1 257.00 1 265.00 Price Low 606 1 424 1 500 1 750 1 877

3 Yr Beta 0.86 0.86 0.71 - 0.02 - 0.47 Price Prd End 1 445 1 523 1 620 1 830 2 770

Price High 1 865 2 300 2 500 1 600 1 600

RATIOS

Price Low 1 860 1 600 1 056 1 425 900 Ret on SH Fnd 6.30 8.70 6.66 10.50 23.34

Price Prd End 1 865 1 860 2 300 1 500 1 600 Oper Pft Mgn 5.47 7.24 6.29 8.86 12.02

D:E 0.65 0.58 0.65 0.56 0.90

RATIOS

Ret on SH Fnd 9.36 11.05 4.70 1.22 4.50 Current Ratio 1.51 1.80 2.00 1.97 1.64

Oper Pft Mgn 10.05 3.68 2.40 0.14 2.14 Div Cover - 2.96 3.01 3.08 3.13

D:E 1.08 0.30 0.07 0.08 0.08

Current Ratio 1.67 2.64 3.41 3.41 3.26

Div Cover - - - - 2.11

207