Page 109 - Stock Exchange Handbook 2020 - Issue 3

P. 109

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – CAS

MORE INFO: www.sharedata.co.za/sdo/jse/CAT

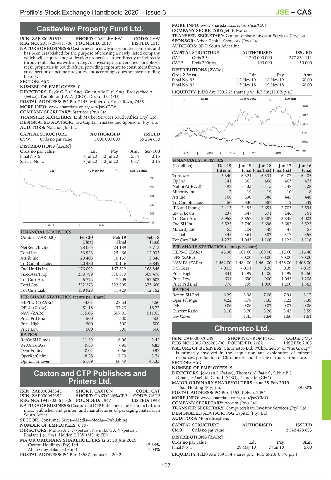

Castleview Property Fund Ltd. COMPANY SECRETARY: Jeff Edwards

CAS TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000251633 SHORT: CASTLEVIEW CODE: CVW SPONSOR: Arbor Capital Sponsors (Pty) Ltd.

REG NO: 2017/290413/06 FOUNDED: 2017 LISTED: 2017 AUDITORS: BDO South Africa Inc.

NATURE OF BUSINESS: Castleview is a newly incorporated company and

has been established for the purpose of creating a newly listed company CAPITAL STRUCTURE AUTHORISED ISSUED

which will acquire and/or develop properties either directly or indirectly CAT Ords 2.5c ea 1 200 000 000 377 861 111

through subsidiarieswithastrategyofinvestinginadiversifiedportfolioof CATP Prefs 200c ea 100 000 50 000

retail properties in South Africa, providing exposure to consumers from a

cross-section of income categories, andaccordingly does not have a trading DISTRIBUTIONS [ZARc]

history. Ords 2.5c ea Ldt Pay Amt

SECTOR: AltX Final No 93 12 Nov 19 18 Nov 19 60.00

NUMBER OF EMPLOYEES: 0 Final No 92 13 Nov 18 19 Nov 18 60.00

DIRECTORS: BaylyGC(ind ne), Green Adv D (ind ne), Padayachee A LIQUIDITY: Jul20 Ave 799 262 shares p.w., R7.3m(11.0% p.a.)

(ind ne), TempletonJWA (CEO), Dockrall C (FD)

POSTAL ADDRESS: PO Box 7145, Milnerton, Cape Town, 7435 MEDI 40 Week MA CAXTON

MORE INFO: www.sharedata.co.za/sdo/jse/CVW 3670

COMPANY SECRETARY: Statucor (Pty) Ltd.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 3017

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd.

2364

AUDITORS: Nolands Jhb Inc

1711

CAPITAL STRUCTURE AUTHORISED ISSUED

CVW Ords no par value 1 000 000 000 35 264 630

1058

DISTRIBUTIONS [ZARc]

405

2015 | 2016 | 2017 | 2018 | 2019 |

Ords no par value Ldt Pay Amt Scr/100

Final No 5 7 Jul 20 13 Jul 20 15.34 3.15

Special No 2 7 Jul 20 13 Jul 20 0.87 3.15 FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

J867 40 Week MA CASTLEVIEW Interim Final Final(rst) Final(rst) Final

Turnover 3 340 6 321 6 334 6 407 6 405

500

Op Inc 141 365 466 463 473

427 NetIntPd(Rcvd) - 98 - 133 - 115 - 148 - 128

Minority Int 7 19 19 10 8

355 Att Inc 168 330 386 445 448

TotCompIncLoss 150 330 387 472 549

282

IFA and Intang 2 413 2 495 2 651 2 703 2 594

209 Inv & Loans 237 347 371 246 161

Tot Curr Ass 3 958 3 857 3 587 3 835 4 003

137 Ord SH Int 5 525 5 740 5 696 5 682 5 523

2018 | 2019 |

Minority Int 55 104 49 47 57

LT Liab 345 361 382 377 355

FINANCIAL STATISTICS

(Amts in ZAR’000)

Tot Curr Liab 1 277 1 043 1 100 1 122 1 116

Feb 18

Feb 19

Feb 20

Final Final Final

NetRent/InvInc 28 063 24 189 7 713 PER SHARE STATISTICS (cents per share)

Total Inc 33 923 25 466 12 033 HEPS-C (ZARc) 45.30 101.60 109.00 115.60 116.40

Attrib Inc 20 405 10 157 3 846 DPS (ZARc) - 60.00 60.00 70.00 70.00

TotCompIncLoss 20 430 10 116 3 849 NAV PS (ZARc) 1 462.00 1 484.00 1 464.00 1 436.00 1 406.00

Ord UntHs Int 176 091 167 612 168 846 3 Yr Beta - 0.05 - 0.01 0.28 0.39 - 0.09

FixedAss/Prop 338 799 310 619 309 476 Price High 841 1 199 1 400 1 499 2 150

Tot Curr Ass 6 772 7 205 57 602 Price Low 634 690 900 1 045 1 208

Total Ass 352 273 322 205 373 660 Price Prd End 776 799 1 000 1 200 1 363

Tot Curr Liab 139 928 11 429 12 152 RATIOS

Ret on SH Fnd 6.29 5.98 7.06 7.94 8.17

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 4.22 5.78 7.35 7.23 7.39

HEPLU-C (ZARc) 44.01 28.63 4.50

DPLU (ZARc) 51.18 37.23 16.72 D:E 0.06 0.06 0.07 0.07 0.06

NAV (ZARc) 515.06 507.91 511.65 Current Ratio 3.10 3.70 3.26 3.42 3.59

Price Prd End 500 500 500 Div Cover - 1.45 1.64 1.60 1.61

Price High 500 500 500

Price Low 500 500 500 Chrometco Ltd.

CHR

RATIOS

RetOnSH Funds 11.59 6.06 3.42 ISIN: ZAE000070249 SHORT: CHROMETCO CODE: CMO

RetOnTotAss 9.63 7.90 4.83 REG NO: 2002/026265/06 FOUNDED: 2002 LISTED: 2005

Debt:Equity 0.01 0.66 0.97 NATURE OF BUSINESS: Chrometco Ltd. (“Chrometco” or “the Group”)

is primarily involved in the acquisition and exploration of mineral

OperRetOnInv 8.28 7.79 3.74

resources, production of Chrome ore and the sale of this Chrome ore.

OpInc:Turnover 61.69 60.49 43.33 SECTOR: AltX

NUMBER OF EMPLOYEES: 5

Caxton and CTP Publishers and DIRECTORS: Jordaan L (ind ne), Thomas N (ind ne), Sibiya B L

(Chair, ind ne), McCann L (CEO), Naude M (CFO)

Printers Ltd. MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

CAX Sail Holding (Pty) Ltd. 89.00%

ISIN: ZAE000043345 SHORT: CAXTON CODE: CAT POSTAL ADDRESS: PO Box 1553, Kelvin, 2054

ISIN: ZAE000043352 SHORT: CAXTON6%CPP CODE: CATP MORE INFO: www.sharedata.co.za/sdo/jse/CMO

REG NO: 1947/026616/06 FOUNDED: 1947 LISTED: 1948 COMPANY SECRETARY: Acorim (Pty) Ltd.

NATURE OF BUSINESS: Caxton and CTP Publishers and Printers Ltd. is a

major publisher and printer, and manufacturer of packaging material in TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

South Africa. DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

SECTOR: Consumer Srvcs—Media—Media—Publishing AUDITORS: Moore Stephens

NUMBER OF EMPLOYEES: 6 197 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: MolusiACG(ind ne), NemukulaAN(ind ne), CMO Ords no par value - 2 542 428 683

Phalane J (ind ne), HoldenTJW(MD&FD)

DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Caxton Holdings (Pty) Ltd. 42.84% Ords no par value 28 May 10 7 Jun 10 Amt

Pay

Ldt

5.00

Final No 1

Allan Gray Balanced Fund 7.03%

POSTAL ADDRESS: PO Box 43587, Industria, 2042 LIQUIDITY: Jul20 Ave 169 314 shares p.w., R15 692.6(0.3% p.a.)

107