Page 248 - SHBe20.vp

P. 248

JSE – VAL Profile’s Stock Exchange Handbook: 2020 – Issue 2

DIRECTORS: Birrell A (UK), Chan F (ne, Mau), DunnAJ(ne), LIQUIDITY: Apr20 Ave 82 338 shares p.w., R487 490.1(2.5% p.a.)

Gain P (ind ne), Moothoosamy K (ne, Mau), Ooms M (ind ne),

Page N (ind ne), Nestadt L (Chair, ne), Joubert P (CEO), INDT 40 Week MA VALUE

Vinokur D (CFO) 667

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Blackstone 13.82% 566

Cassycode Trust 10.98%

Investec Bank Ltd. 8.26% 466

POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene,

Mauritius, 72201 365

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=UPL

265

COMPANY SECRETARY: Intercontinental Trust Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 164

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd. 2015 | 2016 | 2017 | 2018 | 2019 |

AUDITORS: Grant Thornton FINANCIAL STATISTICS

CAPITAL STRUCTURE AUTHORISED ISSUED (Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

UPL Ords no par - 72 350 131 Interim Final(rst) Final Final(rst) Final(rst)

Turnover 1 404 037 2 779 675 2 513 241 2 468 923 2 043 994

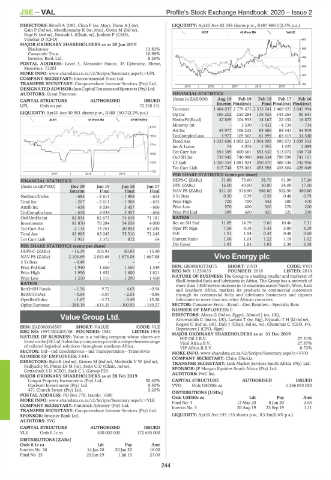

LIQUIDITY: Apr20 Ave 30 951 shares p.w., R488 150.7(2.2% p.a.) Op Inc 106 202 255 284 136 435 143 264 85 641

ALSH 40 Week MA UPARTNERS NetIntPd(Rcvd) 47 869 104 933 14 167 22 452 16 872

Minority Int - 3 330 - 1 432 - 4 734 - 734

2114

Att Inc 43 977 106 232 83 406 88 341 54 919

1914 TotCompIncLoss 4 977 109 562 81 899 83 415 54 540

Fixed Ass 1 035 636 1 003 231 1 004 903 990 573 1 039 515

1714

Inv & Loans 74 3 078 1 955 1 925 2 089

Tot Curr Ass 654 389 600 361 553 630 513 072 438 718

1515

Ord SH Int 739 945 740 980 848 634 799 598 741 161

1315 LT Liab 1 050 354 1 081 924 290 670 308 336 342 956

Tot Curr Liab 615 748 575 003 453 398 433 604 429 049

1115

2017 | 2018 | 2019 | PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS HEPS-C (ZARc) 31.80 75.60 58.70 61.90 37.20

(Amts in GBP’000) Dec 19 Jun 19 Jun 18 Jun 17 DPS (ZARc) 16.00 40.00 30.00 24.00 17.00

Interim Final Final Final NAV PS (ZARc) 521.10 516.90 566.80 522.50 480.80

NetRent/InvInc - 683 - 2 611 - 1 908 - 615 3 Yr Beta 0.20 0.39 0.58 0.48 0.79

Total Inc - 267 - 2 611 - 1 908 - 615 Price High 700 700 442 380 470

Attrib Inc - 638 8 034 3 457 - 666 Price Low 570 400 320 270 200

TotCompIncLoss - 638 8 034 3 457 - 666 Price Prd End 589 600 425 325 290

Ord UntHs Int 82 034 82 673 74 638 71 181 RATIOS

Investments 81 870 70 284 54 658 4 000 Ret on SH Fnd 11.89 14.79 9.66 10.46 7.31

Tot Curr Ass 2 115 14 761 20 852 67 245 Oper Pft Mgn 7.56 9.18 5.43 5.80 4.19

Total Ass 83 985 85 045 75 510 71 245 D:E 1.51 1.54 0.42 0.48 0.60

Tot Curr Liab 1 951 2 372 872 64 Current Ratio 1.06 1.04 1.22 1.18 1.02

PER SHARE STATISTICS (cents per share) Div Cover 1.93 1.83 1.83 2.38 2.08

HEPS-C (ZARc) - 16.29 203.91 80.83 - 15.90

NAV PS (ZARc) 2 103.69 2 043.68 1 873.08 1 667.88 Vivo Energy plc

3 Yr Beta - 0.49 - - - VIV

Price Prd End 1 940 1 650 1 550 1 549 ISIN: GB00BDGT2M75 SHORT: VIVO CODE: VVO

Price High 1 950 1 651 1 600 1 811 REG NO: 11250655 FOUNDED: 2018 LISTED: 2018

Price Low 1 250 1 115 1 290 1 450 NATURE OF BUSINESS: The Group is a leading retailer and marketer of

Shell-branded fuels and lubricants in Africa. The Group has a network of

RATIOS more than 1 800 service stations in 15 countries across North, West, East

RetOnSH Funds - 1.56 9.72 4.63 - 0.94 and Southern Africa, markets its products to commercial customers

RetOnTotAss - 0.64 - 3.07 - 2.53 - 0.86 through its commercial fuels and lubricants businesses and exports

OperRetOnInv - 1.67 - 3.71 - 3.49 - 15.38 lubricants to more than ten other African countries.

OpInc:Turnover - 288.19 - 614.35 - 300.95 - 149.27 SECTOR: Consumer Srvcs—Retail—Gen Retailers—Specialty Rets

NUMBER OF EMPLOYEES: 0

Value Group Ltd. DIRECTORS: Abaza G (ind ne, Egypt), Ahmed J (ne, UK),

Arrowsmith C (ind ne, UK), Lawani T (ne, Nig), NyasuluTH(ld ind ne),

VAL Rogers C (ind ne, UK), Daly J (Chair, ind ne, Ire), Chammas C (CEO, Fr),

ISIN: ZAE000016507 SHORT: VALUE CODE: VLE Depraetere J (CFO, Blgm)

REG NO: 1997/002203/06 FOUNDED: 1981 LISTED: 1998 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

NATURE OF BUSINESS: Value is a holding company whose shares are HIP Oil 2 B.V. 27.51%

listedonthe JSELtd.Subsidiary companiesprovideacomprehensive range Vitol Africa B.V. 27.37%

of tailored logistical solutions throughout southern Africa. VIP Africa II B.V. 8.73%

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=VVO

NUMBER OF EMPLOYEES: 2 843 COMPANY SECRETARY: Claire Dhokia

DIRECTORS: Bulo B (ind ne), Groves M (ind ne), McobothiVW(ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Padiyachy M, Phosa Dr M (ne), Stein C D (Chair, ind ne), SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

Gottschalk S D (CEO), Sack C L (Group FD)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 AUDITORS: PwC Inc.

Lougot Property Investments (Pty) Ltd. 50.40% CAPITAL STRUCTURE AUTHORISED ISSUED

Opsiweb Investments (Pty) Ltd. 8.50% VVO Ords USD50c ea - 1 266 073 050

471 Church Street (Pty) Ltd. 5.20%

POSTAL ADDRESS: PO Box 778, Isando, 1600 DISTRIBUTIONS [USDc] Ldt Pay Amt

Ords USD50c ea

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=VLE Final No 4 12 May 20 8 Jun 20 2.65

COMPANY SECRETARY: Fluidrock Advisory (Pty) Ltd. Interim No 3 20 Aug 19 23 Sep 19 1.11

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. LIQUIDITY: Apr20 Ave 145 143 shares p.w., R3.4m(0.6% p.a.)

AUDITORS: SVG

CAPITAL STRUCTURE AUTHORISED ISSUED

VLE Ords 0.1c ea 500 000 000 172 635 000

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt

Interim No 26 14 Jan 20 20 Jan 20 16.00

Final No 25 25 Jun 19 1 Jul 19 27.00

244