Page 245 - SHBe20.vp

P. 245

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – TRE

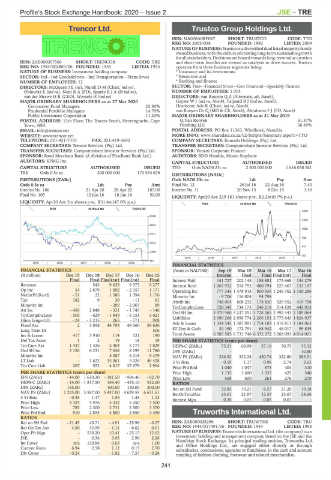

Trencor Ltd. Trustco Group Holdings Ltd.

TRE TRU

ISIN: NA000A0RF067 SHORT: TRUSTCO CODE: TTO

REG NO: 2003/058 FOUNDED: 1992 LISTED: 2009

NATURE OF BUSINESS:Trustco is a diversified dual listed majority family

ownedbusiness, with the culture of creating long-term sustainable growth

for all stakeholders. Decisions are biased towards long-term value creation

ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE and short-term hurdles are viewed as catalysts to drive success. Trustco

REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955 operates from three business segments being:

NATURE OF BUSINESS: Investment holding company. * Insurance and its investments

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs * Resources and

NUMBER OF EMPLOYEES: 12 * Banking and finance

DIRECTORS: McQueenJE(ne), Nurek D M (Chair, ind ne), SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

Oblowitz E (ind ne), Sieni R A (FD), SparksRJA(ld ind ne), NUMBER OF EMPLOYEES: 1 015

van der Merwe H R (CEO), Wessels H (ind ne) DIRECTORS: van Rooyen Q Z (Alternate, alt, Namb),

MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020 GeyserWJ(ind ne, Namb), TaljaardRJ(ind ne, Namb),

Coronation Fund Managers 25.90% Heathcote Adv R (Chair, ind ne, Namb),

Prudential Portfolio Managers 14.70% van Rooyen Dr Q (MD & CE, Namb), Abrahams F J (FD, Namb)

Public Investment Corporation 11.20% MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

POSTAL ADDRESS: 13th Floor, The Towers South, Heerengracht, Cape Q.Van Rooyen 51.37%

Town, 8001 Pershing LLC 36.49%

EMAIL: info@trencor.net POSTAL ADDRESS: PO Box 11363, Windhoek, Namibia

WEBSITE: www.trencor.net MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TTO

TELEPHONE: 021-421-7310 FAX: 021-419-3692 COMPANY SECRETARY: Komada Holdings (Pty) Ltd.

COMPANY SECRETARY: Trencor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Vunani Corporate Finance

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) AUDITORS: BDO Nambia, Moore Stephens

AUDITORS: KPMG Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED TTO Ords NAD0.23c ea 2 500 000 000 1 616 038 581

TRE Ords 0.5c ea 200 000 000 173 534 676 DISTRIBUTIONS [NADc]

DISTRIBUTIONS [ZARc] Ords NAD0.23c ea Ldt Pay Amt

Ords 0.5c ea Ldt Pay Amt Final No 12 26 Jul 16 22 Aug 16 7.40

Interim No 106 21 Apr 20 28 Apr 20 185.00 Interim No 11 20 Nov 15 8 Dec 15 3.40

Final No 105 12 Jun 18 18 Jun 18 50.00

LIQUIDITY: Apr20 Ave 229 181 shares p.w., R2.2m(0.7% p.a.)

LIQUIDITY: Apr20 Ave 2m shares p.w., R31.4m(47.0% p.a.)

FINA 40 Week MA TRUSTCO

INDT 40 Week MA TRENCOR

1599

8328

1309

6823

1020

5317

730

3812

441

2306

151

2015 | 2016 | 2017 | 2018 | 2019 |

801

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in NAD’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Interim Final Final Final(rst) Final

Final Final Final(rst) Final(rst) Final Interest Paid 141 727 202 144 188 881 173 668 134 279

Revenue - 543 9 625 9 373 9 277 Interest Rcvd 1 067 952 554 792 480 794 225 467 153 167

Op Inc 54 2 879 1 002 - 2 357 1 171 Operating Inc 777 344 1 478 918 800 939 1 246 762 1 150 286

NetIntPd(Rcvd) - 51 22 1 586 1 394 1 176 Minority Int - 9 706 116 804 94 798 - -

Tax 182 9 30 - 11 61 Attrib Inc 748 004 608 232 178 830 529 952 419 798

Minority Int - - - 289 - 2 003 89 TotCompIncLoss 720 345 734 173 246 218 514 828 443 913

Att Inc - 456 2 848 - 321 - 1 743 - 146

TotCompIncLoss - 505 - 629 - 1 849 - 6 151 5 621 Ord SH Int 3 970 960 3 237 251 3 728 265 2 492 443 2 189 064

Hline Erngs-CO - 24 - 3 215 265 - 771 908 Liabilities 2 090 266 2 956 774 2 206 151 2 775 643 1 824 937

Fixed Ass 2 3 058 44 793 49 060 59 636 Adv & Loans 1 334 545 1 387 091 1 754 103 1 818 811 1 184 063

Long Term Dr - - - - 506 ST Dep & Cash 30 190 172 791 68 942 46 017 99 835

Inv & Loans 417 3 910 114 121 190 Total Assets 6 585 585 6 731 748 6 372 372 5 268 093 4 014 001

Def Tax Asset 1 2 19 18 19 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 437 1 426 5 404 5 773 7 829 HEPS-C (ZARc) 75.21 69.99 27.19 70.75 55.32

Ord SH Int 2 126 6 231 7 048 8 199 11 780 DPS (ZARc) - - - - 10.80

Minority Int - - 5 387 6 218 9 479 NAV PS (ZARc) 326.92 332.28 450.74 322.80 283.51

LT Liab - 1 622 35 061 5 026 46 428 3 Yr Beta 0.59 1.17 0.98 2.74 2.63

Tot Curr Liab 207 552 4 817 37 679 2 904

Price Prd End 1 040 1 047 875 404 310

PER SHARE STATISTICS (cents per share) Price High 1 135 1 600 1 035 425 540

EPS (ZARc) - 44.00 1 610.20 - 181.50 - 984.40 - 82.70 Price Low 568 600 261 276 270

HEPS-C (ZARc) - 14.00 - 1 817.50 149.40 - 435.10 512.60 RATIOS

DPS (ZARc) 185.00 - 100.00 130.00 300.00 Ret on SH Fund 32.85 19.21 6.57 21.26 19.18

NAV PS (ZARc) 1 225.00 3 587.00 5 437.00 4 629.59 6 651.61 RetOnTotalAss 23.61 21.97 12.57 23.67 28.66

3 Yr Beta - 0.35 1.17 1.55 1.43 1.13 Interest Mgn 0.28 0.05 0.05 0.01 -

Price High 3 324 4 976 5 332 5 250 7 500

Price Low 785 2 300 2 731 2 500 3 370

Price Prd End 910 2 855 4 800 2 850 4 450 Truworths International Ltd.

RATIOS TRU

Ret on SH Fnd - 21.45 45.71 - 4.91 - 25.98 - 0.27 ISIN: ZAE000028296 SHORT: TRUWTHS CODE: TRU

Ret On Tot Ass 4.50 33.99 - 1.11 - 6.62 0.01 REG NO: 1944/017491/06 FOUNDED: 1944 LISTED: 1998

Oper Pft Mgn - 530.20 10.41 - 25.15 12.62 NATUREOF BUSINESS:TruworthsInternationalLtd.(the company) is an

D:E - 0.34 3.03 2.90 2.26 investment holding and management company listed on the JSE and the

Int Cover n/a 130.86 0.63 n/a 1.00 Namibian Stock Exchange. Its principal trading entities, Truworths Ltd.

and Office Holdings Ltd., are engaged either directly or through

Current Ratio 6.94 2.58 1.12 0.15 2.70 subsidiaries, concessions, agencies or franchises, in the cash and account

Div Cover - 0.24 - - 1.82 - 7.57 - 0.28

retailing of fashion clothing, footwear and related merchandise.

241