Page 251 - SHBe20.vp

P. 251

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – WES

Price High 170 220 249 270 224 NUMBER OF EMPLOYEES: 3 616

Price Low 106 140 155 130 71 DIRECTORS: Bester C (ind ne), Forbay K (ind ne), Gardiner R (ld ind ne),

Maziya S (ind ne), Ntene H (ind ne), Nel E L (Chair), Neff W (CEO),

Price Prd End 134 144 167 228 153 Henwood C (CFO)

RATIOS MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Ret on SH Fnd - 10.42 8.09 19.29 4.41 13.44 Government Employees Pension Fund 14.48%

Oper Pft Mgn 0.71 5.65 9.76 5.80 6.35 Allan Gray 8.98%

D:E 1.91 1.36 1.31 0.81 0.83 Old Mutual 6.53%

Current Ratio 1.26 0.98 0.92 1.23 0.71 POSTAL ADDRESS: PO Box 531, Bergvlei, 2012

Div Cover - - 4.42 1.69 6.23 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=WBO

COMPANY SECRETARY: Shereen Vally-Kara

Wesizwe Platinum Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

WES

ISIN: ZAE000075859 SHORT: WESIZWE CODE: WEZ AUDITORS: BDO South Africa Inc.

REG NO: 2003/020161/06 FOUNDED: 2003 LISTED: 2005 CAPITAL STRUCTURE AUTHORISED ISSUED

NATURE OF BUSINESS: Wesizwe is a public company incorporated in the WBO Ords 1c ea 100 000 000 59 890 514

Republic of South Africa and its shares are listed onthe JSE. The group’s DISTRIBUTIONS [ZARc]

main strategic project is to build and operate South Africa’s next platinum Ords 1c ea Ldt Pay Amt

group metals (“PGM”) mine at its Bakubung Platinum Mine (“BPM”),

which is owned by Bakubung Minerals (Pty) Ltd., firmly positioning the Interim 14 Apr 20 20 Apr 20 0.00

group as a significant mid-tier precious metals producer. Final 8 Oct 19 14 Oct 19 190.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals LIQUIDITY: Apr20 Ave 411 344 shares p.w., R49.6m(35.7% p.a.)

NUMBER OF EMPLOYEES: 247

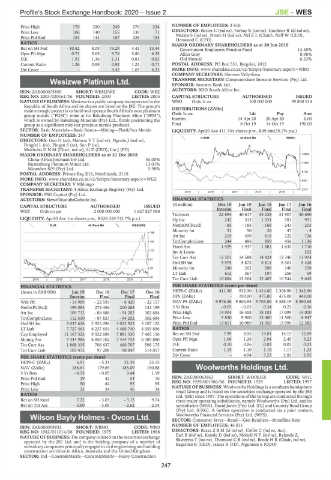

DIRECTORS: GuoH(ne), MabuzaVT(ind ne), Ngculu J (ind ne), CONM 40 Week MA WBHO

Pengfei L (ne), Pingan S (ne), Sun P (ne),

MokhoboDNM (Chair, ind ne), Li Z (CEO), Liu J (FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 14605

China-Africa Jinchuan Inv Ltd. 45.00%

Rustenburg Platinum Mines Ltd. 13.01% 11891

Micawber 809 (Pty) Ltd. 5.98%

9176

POSTAL ADDRESS: Private Bag X16, Northlands, 2116

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=WEZ 6461

COMPANY SECRETARY: V Mhlongo

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. 3747

2015 | 2016 | 2017 | 2018 | 2019 |

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: SizweNtsalubaGobodo Inc. FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

CAPITAL STRUCTURE AUTHORISED ISSUED

WEZ Ords no par 2 000 000 000 1 627 827 058 Interim Final Final Final Final

Turnover 22 894 40 617 35 028 31 907 30 650

LIQUIDITY: Apr20 Ave 1m shares p.w., R528 259.7(3.7% p.a.) Op Inc 242 513 1 031 781 991

PLAT 40 Week MA WESIZWE NetIntPd(Rcvd) - 85 - 183 - 168 - 241 - 203

Minority Int 31 50 28 47 - 4

186

Att Inc 219 499 816 722 726

154 TotCompIncLoss 244 496 859 456 1 136

Fixed Ass 1 929 1 937 1 883 1 635 1 710

123

Inv & Loans - - - - 202

Tot Curr Ass 12 501 14 588 14 424 12 346 11 904

91

Ord SH Int 5 975 5 872 5 812 5 301 5 428

Minority Int 280 262 208 140 258

59

LT Liab 612 367 197 250 59

28

2015 | 2016 | 2017 | 2018 | 2019 | Tot Curr Liab 10 884 13 264 12 407 10 544 9 645

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in ZAR’000) Jun 19 Dec 18 Dec 17 Dec 16 HEPS-C (ZARc) 411.30 932.30 1 414.60 1 308.90 1 342.90

Interim Final Final Final DPS (ZARc) - 190.00 475.00 475.00 448.00

Wrk Pft - 14 989 - 22 593 - 8 420 - 22 157 NAV PS (ZARc) 9 976.26 9 804.95 9 703.86 8 388.19 8 590.65

NetIntPd(Rcd) 199 083 274 456 200 268 132 199 3 Yr Beta - 0.05 - 0.05 0.34 0.21 0.36

Att Inc 109 712 - 88 688 - 94 202 302 684 Price High 14 904 16 458 18 101 17 099 14 000

TotCompIncLoss 112 530 - 87 827 - 94 202 302 684 Price Low 9 830 9 900 13 400 11 500 8 947

Ord SH Int 3 037 626 2 925 096 3 012 923 3 107 125 Price Prd End 13 811 10 989 14 950 13 999 12 582

LT Liab 7 727 463 6 237 654 4 488 740 4 055 896 RATIOS

Cap Employed 11 167 523 9 522 689 7 881 530 7 465 156 Ret on SH Fnd 7.99 8.95 14.01 14.15 12.69

Mining Ass 9 344 986 8 858 102 7 454 753 6 389 880 Oper Pft Mgn 1.06 1.26 2.94 2.45 3.23

Tot Curr Ass 1 868 335 706 637 466 707 596 175 D:E 0.10 0.06 0.03 0.05 0.03

Tot Curr Liab 103 475 97 208 98 047 114 057 Current Ratio 1.15 1.10 1.16 1.17 1.23

Div Cover - 4.94 3.23 2.83 2.95

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 6.91 - 5.31 21.39 25.15

NAV (ZARc) 186.61 179.69 185.09 190.88 Woolworths Holdings Ltd.

3 Yr Beta - 0.33 - 0.05 0.44 1.19 WOO

Price Prd End 39 42 54 76 ISIN: ZAE000063863 SHORT: WOOLIES CODE: WHL

REG NO: 1929/001986/06 FOUNDED: 1929 LISTED: 1997

Price High 50 64 95 95

Price Low 33 34 46 34 NATURE OF BUSINESS: Woolworths Holdings is a southern hemisphere

retail Group and is listed on the securities exchange operated by the JSE

RATIOS Ltd. (JSE) since 1997. The operations of the Group are conducted through

Ret on SH fund 7.22 - 3.03 - 3.13 9.74 three major operating subsidiaries, namely Woolworths (Pty) Ltd. and its

Ret on Tot Ass - 3.80 - 3.09 - 2.62 - 2.04 subsidiaries (WSA), David Jones (Pty) Ltd. (DJ) and Country Road Group

(Pty) Ltd. (CRG). A further operation is conducted via a joint venture,

Woolworths Financial Services (Pty) Ltd. (WFS).

Wilson Bayly Holmes - Ovcon Ltd. SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets

WIL NUMBER OF EMPLOYEES: 46 831

ISIN: ZAE000009932 SHORT: WBHO CODE: WBO

REG NO: 1982/011014/06 FOUNDED: 1975 LISTED: 1988 DIRECTORS: BassaZBM(ld ind ne), Colfer C (ind ne, Aus),

NATURE OF BUSINESS: The company is listed on the securities exchange Earl B (ind ne), Kneale D (ind ne), MoholiNT(ind ne), Rylands Z,

operated by the JSE Ltd. and is the holding company of a number of Skweyiya T (ind ne), ThomsonCB(ind ne), Brody H R (Chair, ind ne),

Bagattini R (CEO), Isaacs R (FD), Ngumeni S (COO)

subsidiary companies principally engaged in civil engineering andbuilding

construction activities in Africa, Australia and the United Kingdom.

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction

247