Page 244 - SHBe20.vp

P. 244

JSE – TRE Profile’s Stock Exchange Handbook: 2020 – Issue 2

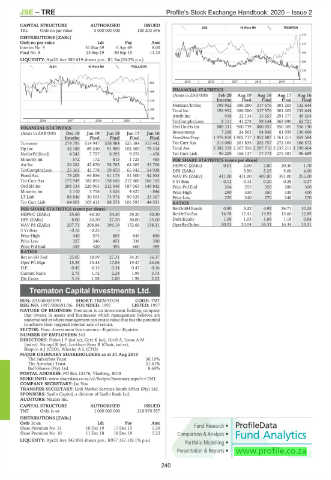

CAPITAL STRUCTURE AUTHORISED ISSUED

TRL Ords no par value 5 000 000 000 100 203 596 EQII 40 Week MA TREMATON

470

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 410

Interim No 9 31 Mar 69 6 Apr 69 8.00

Final No 8 23 Sep 19 30 Sep 19 11.10 350

LIQUIDITY: Apr20 Ave 389 619 shares p.w., R1.5m(20.2% p.a.)

290

ALSH 40 Week MA TRELLIDOR

230

170

2015 | 2016 | 2017 | 2018 | 2019 |

560

FINANCIAL STATISTICS

469

(Amts in ZAR’000) Feb 20 Aug 19 Aug 18 Aug 17 Aug 16

378 Interim Final Final Final Final

NetRent/InvInc 198 952 386 280 317 576 301 203 132 644

286

Total Inc 198 952 386 280 317 576 301 203 132 644

Attrib Inc 918 22 134 35 657 291 777 49 504

195

| 2016 | 2017 | 2018 | 2019 | TotCompIncLoss 8 111 41 278 59 144 363 990 62 721

FINANCIAL STATISTICS Ord UntHs Int 888 331 900 739 880 057 850 305 556 190

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Investments 7 268 24 563 94 848 81 959 136 660

Interim Final Final Final Final FixedAss/Prop 1 978 818 1 902 717 1 852 807 1 761 211 859 584

Turnover 274 795 514 947 538 984 525 384 313 442 Tot Curr Ass 214 060 261 835 202 757 272 104 166 572

Op Inc 42 180 69 240 91 900 102 300 75 418 Total Ass 2 382 319 2 367 556 2 297 710 2 237 211 1 190 664

NetIntPd(Rcvd) 4 543 7 797 8 293 9 076 - 458 Tot Curr Liab 96 209 166 137 77 774 275 387 96 689

Minority Int 572 172 815 1 725 485 PER SHARE STATISTICS (cents per share)

Att Inc 26 261 42 870 58 763 64 265 53 706 HEPS-C (ZARc) 0.01 2.00 2.80 20.30 1.70

TotCompIncLoss 25 361 42 778 59 470 65 942 54 938 DPS (ZARc) - 5.50 5.25 5.00 4.00

Fixed Ass 78 205 64 856 61 175 51 500 42 553 NAV PS (ZARc) 411.00 411.00 407.00 391.00 255.00

Tot Curr Ass 175 949 182 055 198 646 212 400 166 165 3 Yr Beta - 0.12 0.14 0.20 0.28 0.27

Ord SH Int 208 134 220 903 212 548 187 063 149 842 Price Prd End 264 255 320 280 300

Minority Int 6 110 5 758 5 626 4 827 - 846 Price High 290 330 350 330 400

LT Liab 88 846 30 555 73 974 90 529 23 367 Price Low 225 240 270 248 270

Tot Curr Liab 64 001 105 613 88 573 106 597 44 531 RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds 0.80 3.32 4.92 36.71 10.25

HEPS-C (ZARc) 25.60 40.10 54.30 59.20 50.30 RetOnTotAss 16.78 17.41 14.93 15.60 12.89

DPS (ZARc) 8.00 20.20 27.20 30.00 25.00 Debt:Equity 1.08 1.05 1.09 1.18 0.84

NAV PS (ZARc) 207.71 208.86 196.19 172.66 138.31 OperRetOnInv 20.03 20.04 16.31 16.34 13.31

3 Yr Beta - 0.16 - 0.25 - - -

Price High 440 573 605 649 650

Price Low 327 346 451 338 390

Price Prd End 359 420 495 600 489

RATIOS

Ret on SH Fnd 25.05 18.99 27.31 34.39 36.37

Oper Pft Mgn 15.35 13.45 17.05 19.47 24.06

D:E 0.45 0.15 0.34 0.47 0.16

Current Ratio 2.75 1.72 2.24 1.99 3.73

Div Cover 3.14 1.98 2.00 1.98 2.03

Trematon Capital Investments Ltd.

TRE

ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT

REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997

NATURE OF BUSINESS: Trematon is an investment holding company

that invests in assets and businesses which management believes are

undervalued or where management can create value that has the potential

to achieve their targeted internal rate of return.

SECTOR: Fins—Investment Instruments—Equities—Equities

NUMBER OF EMPLOYEES: 342

DIRECTORS: FisherJP(ind ne), Getz K (ne), Groll A, Louw A M

(ind ne), Stumpf R (ne), Lockhart-Ross R (Chair, ind ne),

Shapiro A J (CEO), Winkler A L (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

The Suikerbos Trust 30.19%

The Armchair Trust 21.61%

Buff-Shares (Pty) Ltd. 8.69%

POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TMT

COMPANY SECRETARY: Jac Vos

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

AUDITORS: Mazars Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

TMT Ords 1c ea 1 000 000 000 218 970 557

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Share Premium No 11 10 Dec 19 17 Dec 19 5.50

Share Premium No 10 11 Dec 18 18 Dec 18 5.25

LIQUIDITY: Apr20 Ave 342 083 shares p.w., R957 357.1(8.1% p.a.)

240