Page 241 - SHBe20.vp

P. 241

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – TON

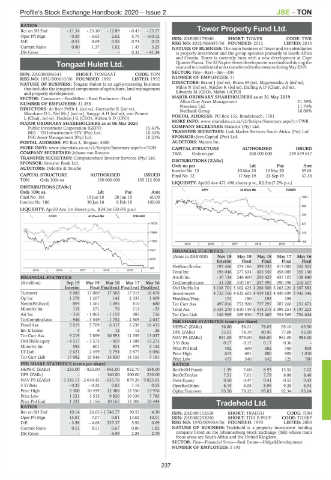

RATIOS

Ret on SH Fnd - 11.54 - 23.10 - 12.89 - 0.43 - 23.57 Tower Property Fund Ltd.

Oper Pft Mgn - 0.59 - 5.63 2.62 5.75 - 160.12 ISIN: ZAE000179040 SHORT: TOWER CODE: TWR

TOW

D:E 0.53 0.69 0.58 0.74 0.12 REG NO: 2012/066457/06 FOUNDED: 2012 LISTED: 2013

Current Ratio 0.80 1.37 1.02 1.43 3.25 NATURE OF BUSINESS: The main business of Tower and its subsidiaries

Div Cover - - - 0.32 - 41.34 is property investment and the group operates primarily in South Africa

and Croatia. Tower is currently busy with a new development at Cape

Tongaat Hulett Ltd. Quarter Piazza. The 32 Napier Street developmentwasfinalisedduring the

yearandtenresidentialunitstransferredtotheownersduringMay2019.

TON SECTOR: Fins—Rest—Inv—Div

ISIN: ZAE000096541 SHORT: TONGAAT CODE: TON

REG NO: 1892/000610/06 FOUNDED: 1892 LISTED: 1952 NUMBER OF EMPLOYEES: 11

NATURE OF BUSINESS: Tongaat Hulett is an agri-processing business DIRECTORS: Bester J (ind ne), Evans M (ne), Magwentshu A (ind ne),

that includes the integrated components of agriculture, land management Milne N (ind ne), Naidoo R (ind ne), Dalling A D (Chair, ind ne),

and property development. Edwards M (CEO), Mabin J (CFO)

SECTOR: Consumer—Food&Bev—Food Producers—Food MAJOR ORDINARY SHAREHOLDERS as at 31 May 2019

NUMBER OF EMPLOYEES: 31 355 Allan Gray Asset Management 21.59%

Prescient Ltd.

11.74%

DIRECTORS: de Beer PrfDr L (ind ne), Goetzsche R (ind ne), Nedbank Group 10.00%

Marokane D L, Nel Mr J (ind ne), SangquAH(ind ne), von Zeuner

L (Chair, ind ne), Hudson J G (CEO), Aitken R D (CFO) POSTAL ADDRESS: PO Box 155, Rondebosch, 7701

MAJOR ORDINARY SHAREHOLDERS as at 06 Mar 2020 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TWR

Public Investment Corporation (GEPF) 15.61% COMPANY SECRETARY: Statucor (Pty) Ltd.

BEE - TH Infrastructure SPV (Pty) Ltd. 10.32% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

PSG Asset Management (Pty) Ltd. 10.23% SPONSOR: Java Capital (Pty) Ltd.

POSTAL ADDRESS: PO Box 3, Tongaat, 4400 AUDITORS: Mazars Inc.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TON CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Johann van Rooyen TWR Ords no par 500 000 000 339 549 647

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Investec Bank Ltd. Ords no par Ldt Pay Amt

AUDITORS: Deloitte & Touche

Interim No 13 10 Mar 20 16 Mar 20 35.01

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 12 17 Sep 19 23 Sep 19 37.36

TON Ords 100c ea 150 000 000 135 112 506

LIQUIDITY: Apr20 Ave 471 496 shares p.w., R2.5m(7.2% p.a.)

DISTRIBUTIONS [ZARc]

SAPY 40 Week MA TOWER

Ords 100c ea Ldt Pay Amt

Final No 181 19 Jun 18 28 Jun 18 60.00 1064

Interim No 180 30 Jan 18 8 Feb 18 100.00

885

LIQUIDITY: Apr20 Ave 1m shares p.w., R24.3m(50.6% p.a.)

706

FOOD 40 Week MA TONGAAT

19528 527

15664 348

11800 169

2015 | 2016 | 2017 | 2018 | 2019 |

7937 FINANCIAL STATISTICS

(Amts in ZAR’000) Nov 19 May 19 May 18 May 17 May 16

4073

Interim Final Final Final Final

NetRent/InvInc 193 468 374 186 399 035 413 082 352 505

209

2015 | 2016 | 2017 | 2018 | 2019 |

Total Inc 196 046 377 534 403 349 458 089 355 140

FINANCIAL STATISTICS Attrib Inc - 35 124 246 400 293 429 437 103 158 840

(R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 TotCompIncLoss 31 328 310 187 297 495 390 398 210 527

Interim Final Final(rst) Final(rst) Final(rst) Ord UntHs Int 3 138 701 3 302 425 3 288 508 3 263 220 2 367 583

Turnover 8 085 17 069 17 505 17 915 16 676 Investments 4 722 766 4 632 602 4 439 102 4 449 699 3 942 346

Op Inc 1 278 1 207 142 2 333 1 669 FixedAss/Prop 174 150 193 198 -

NetIntPd(Rcvd) 894 1 361 1 095 810 680 Tot Curr Ass 497 016 753 920 737 297 707 260 251 673

Minority Int 119 271 76 112 - 53 Total Ass 5 339 270 5 610 149 5 414 218 5 398 251 4 197 203

Att Inc - 318 - 1 063 - 1 159 983 716 Tot Curr Liab 146 969 269 830 713 465 354 569 754 644

TotCompIncLoss - 946 - 3 549 - 1 752 - 2 505 2 047 PER SHARE STATISTICS (cents per share)

Fixed Ass 5 619 5 709 6 317 6 239 16 415 HEPS-C (ZARc) 36.80 58.21 78.03 95.10 69.50

Inv & Loans 4 6 12 12 26 DPS (ZARc) 35.01 74.19 80.96 77.08 92.00

Tot Curr Ass 9 219 7 899 10 593 11 359 13 037 NAV PS (ZARc) 931.00 979.00 968.00 961.00 985.00

Ord ShHs equty - 4 517 - 3 573 - 859 1 188 13 273 3 Yr Beta 0.17 0.12 0.17 0.36 -

Minority Int 592 601 921 979 2 152 Price Prd End 492 600 682 760 808

LT Liab 2 621 2 459 2 794 2 875 8 086 Price High 615 691 800 900 1 010

Tot Curr Liab 17 982 15 546 15 830 14 153 7 181

Price Low 475 540 642 725 780

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 233.00 - 823.00 - 861.00 852.70 588.00 RetOnSH Funds - 1.39 7.60 8.93 13.52 7.02

DPS (ZARc) - - 160.00 300.00 230.00 RetOnTotAss 7.51 7.01 7.79 8.88 8.46

NAV PS (ZARc) - 3 343.13 - 2 644.45 - 635.76 879.26 9 823.63 Debt:Equity 0.50 0.47 0.41 0.53 0.43

3 Yr Beta - 0.25 - 0.32 0.85 1.18 0.55 OperRetOnInv 8.19 8.08 8.99 9.28 8.94

Price High 2 400 10 499 12 488 13 550 13 976 OpInc:Turnover 93.50 79.32 95.83 92.34 93.64

Price Low 1 321 1 515 9 820 10 030 7 785

Price Prd End 1 321 2 156 10 165 12 306 10 444 Tradehold Ltd.

RATIOS

TRA

Ret on SH Fnd 10.14 26.65 - 1 746.77 50.53 4.30 ISIN: ZAE000152658 SHORT: TRADEH CODE: TDH

Oper Pft Mgn 15.81 7.07 0.81 13.02 10.01 ISIN: ZAE000253050 SHORT: TDH B PREF CODE: TDHBP

D:E - 3.98 - 4.68 227.37 5.92 0.69 REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

Current Ratio 0.51 0.51 0.67 0.80 1.82 NATURE OF BUSINESS: Tradehold is a property investment holding

Div Cover - - - 6.59 2.85 2.70 company listed on the Johannesburg Stock Exchange (JSE) whose main

focus areas are South Africa and the United Kingdom.

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

NUMBER OF EMPLOYEES: 5 195

237