Page 237 - SHBe20.vp

P. 237

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – TAS

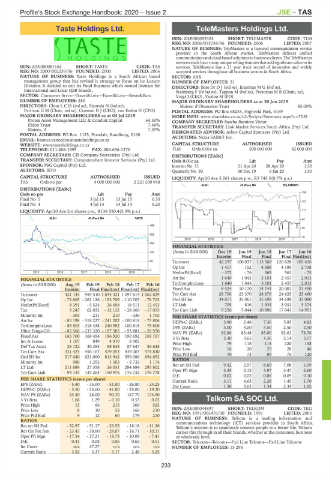

Taste Holdings Ltd. TeleMasters Holdings Ltd.

TAS TEL

ISIN: ZAE000093324 SHORT: TELEMASTR CODE: TLM

REG NO: 2006/015734/06 FOUNDED: 2006 LISTED: 2007

NATURE OF BUSINESS: TeleMasters is a licenced communication service

provider in the South African market. TeleMasters delivers unified

communicationandcloudbasedsolutionstobusinessclients.TheTeleMasters

servicesstackhavemanyuniquesellingfeaturesthataddsignificantvaluetoits

ISIN: ZAE000081162 SHORT: TASTE CODE: TAS services. TeleMasters has a 21 year track record of innovative and widely

REG NO: 2000/002239/06 FOUNDED: 2000 LISTED: 2006 accepted services throughout all business sectors in South Africa.

NATURE OF BUSINESS: Taste Holdings is a South African based SECTOR: AltX

management group that has revised it strategy to focus on its Luxury NUMBER OF EMPLOYEES: 31

Division. It decided to exit its Food Business which owned licenses for DIRECTORS: Bate DrDJ(ind ne), ErasmusMG(ind ne),

International and Local QSR brands. Steinberg F (ld ind ne), Tappan M (ind ne), Pretorius M B (Chair, ne),

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Rests&Bars Voigt J (CEO), Vosloo M (FD)

NUMBER OF EMPLOYEES: 280 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

DIRECTORS: ChouLCH(ind ne), Siyotula N (ind ne), Maison d’Obsession Trust 85.00%

Pattison G M (Chair, ind ne), Crosson D J (CEO), van Eeden H (CFO) POSTAL ADDRESS: PO Box 68255, Highveld Park, 0169

MAJOR ORDINARY SHAREHOLDERS as at 03 Jul 2019 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TLM

Protea Asset Management LLC & Conduit Capital 64.50% COMPANY SECRETARY: Sascha Ramirez-Victor

Eldon Trust 7.46% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Maizey, A 7.29%

POSTAL ADDRESS: PO Box 1125, Ferndale, Randburg, 2160 DESIGNATED ADVISOR: Arbor Capital Sponsors (Pty) Ltd.

AUDITORS: Nexia SAB&T Inc.

EMAIL: hannes.vaneeden@tasteholdings.co.za

WEBSITE: www.tasteholdings.co.za CAPITAL STRUCTURE AUTHORISED ISSUED

TELEPHONE: 011-608-1999 FAX: 086-696-1270 TLM Ords 0.01c ea 500 000 000 42 000 000

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 0.01c ea Ldt Pay Amt

SPONSOR: PSG Capital (Pty) Ltd. Interim No 51 21 Apr 20 28 Apr 20 1.50

AUDITORS: BDO Quarterly No 50 30 Dec 19 6 Jan 20 1.50

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Apr20 Ave 5 261 shares p.w., R3 745.5(0.7% p.a.)

TAS Ords no par 4 000 000 000 2 221 500 948

ALSH 40 Week MA TELEMASTR

DISTRIBUTIONS [ZARc]

185

Ords no par Ldt Pay Amt

Final No 5 3 Jul 15 13 Jul 15 6.50

151

Final No 4 4 Jul 14 14 Jul 14 6.20

LIQUIDITY: Apr20 Ave 2m shares p.w., R138 550.4(5.3% p.a.) 117

ALSH 40 Week MA TASTE 84

489

50

392

16

2015 | 2016 | 2017 | 2018 | 2019 |

294

FINANCIAL STATISTICS

197 (Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final Final Final(rst)

99 Turnover 42 297 100 037 113 568 120 628 105 426

Op Inc 1 417 152 4 508 4 189 2 738

2

2015 | 2016 | 2017 | 2018 | 2019 | NetIntPd(Rcvd) - 372 - 76 369 563 - 75

Att Inc 1 640 1 043 3 101 2 457 2 013

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 TotCompIncLoss 1 640 1 043 3 101 2 457 2 013

Interim Final Final(rst) Final(rst) Final(rst) Fixed Ass 8 524 10 170 14 741 20 081 21 450

Turnover 421 145 959 510 1 034 321 1 097 614 1 062 829 Tot Curr Ass 28 756 23 370 24 879 24 625 25 460

Op Inc - 73 865 - 261 126 - 193 709 - 110 703 - 78 703 Ord SH Int 34 811 35 061 35 698 34 698 33 080

NetIntPd(Rcvd) 8 391 - 5 524 26 698 18 511 12 453 LT Liab 705 816 1 934 3 031 3 374

Tax 3 247 62 032 - 12 122 - 28 060 - 17 055 Tot Curr Liab 9 256 5 044 10 896 17 041 14 951

Minority Int - 305 - 211 210 - 336 1 705 PER SHARE STATISTICS (cents per share)

Att Inc - 85 198 - 318 227 - 241 202 - 100 818 - 75 806 HEPS-C (ZARc) 3.90 2.48 7.36 5.85 4.82

TotCompIncLoss - 85 503 - 318 438 - 240 992 - 100 818 - 75 806 DPS (ZARc) 3.00 4.00 5.50 2.50 2.50

Hline Erngs-CO - 85 566 - 233 320 - 197 585 - 93 881 - 59 970 NAV PS (ZARc) 82.88 83.48 85.00 82.61 78.76

Fixed Ass 165 700 168 454 186 920 190 692 159 767 3 Yr Beta 3.30 3.65 4.36 2.14 3.57

Inv & Loans 1 107 849 4 919 8 905 - Price High 79 115 115 120 138

Def Tax Asset 28 122 30 294 88 848 87 647 56 648 Price Low 16 20 25 28 46

Tot Curr Ass 331 425 456 167 479 053 439 003 574 830

Ord SH Int 517 640 621 000 813 942 559 086 654 652 Price Prd End 70 73 89 75 120

RATIOS

Minority Int 988 1 292 1 503 - 2 732 1 174

LT Liab 211 889 27 358 26 031 284 884 295 802 Ret on SH Fnd 9.42 2.97 8.69 7.08 6.09

Tot Curr Liab 94 133 135 264 150 976 176 732 176 778 Oper Pft Mgn 3.35 0.15 3.97 3.47 2.60

D:E 0.02 0.02 0.06 0.09 0.10

PER SHARE STATISTICS (cents per share) Current Ratio 3.11 4.63 2.28 1.45 1.70

EPS (ZARc) - 5.40 - 35.00 - 51.00 - 26.80 - 24.25 Div Cover 1.30 0.62 1.34 2.34 1.92

HEPS-C (ZARc) - 5.50 - 25.60 - 41.80 - 25.00 - 19.20

NAV PS (ZARc) 23.30 28.00 90.70 147.70 174.90

3 Yr Beta 1.66 1.29 - 0.10 0.53 0.02 Telkom SA SOC Ltd.

Price High 15 66 215 300 525 TEL

Price Low 8 10 52 160 210 ISIN: ZAE000044897 SHORT: TELKOM CODE: TKG

Price Prd End 9 12 60 179 210 REG NO: 1991/005476/30 FOUNDED: 1991 LISTED: 2003

NATURE OF BUSINESS: Telkom is a leading information and

RATIOS communications technology (ICT) services provider in South Africa.

Ret on SH Fnd - 32.97 - 51.17 - 29.55 - 18.18 - 11.30 Telkom’s mission is to seamlessly connect people to a better life. Telkom

Ret On Tot Ass - 23.43 - 38.60 - 28.07 - 16.71 - 10.31 carries this through in all their brands, whether at the consumer, business

Oper Pft Mgn - 17.54 - 27.21 - 18.73 - 10.09 - 7.41 or wholesale level.

D:E 0.41 0.08 0.06 0.62 0.51 SECTOR: Telcoms—Telcoms—Fxd Line Telcoms—Fxd Line Telcoms

Int Cover n/a 47.27 n/a n/a n/a NUMBER OF EMPLOYEES: 15 296

Current Ratio 3.52 3.37 3.17 2.48 3.25

233