Page 233 - SHBe20.vp

P. 233

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – STE

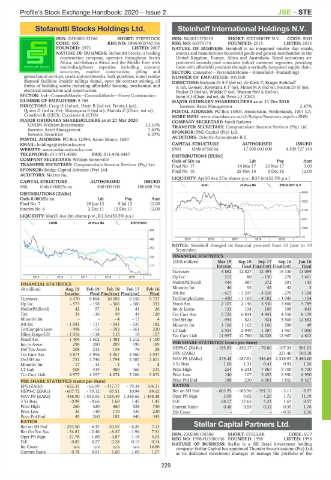

Stefanutti Stocks Holdings Ltd. Steinhoff International Holdings N.V.

STE STE

ISIN: ZAE000123766 SHORT: STEFSTOCK ISIN: NL0011375019 SHORT: STEINHOFF N.V. CODE: SNH

CODE: SSK REG NO: 1996/003767/06 REG NO: 63570173 FOUNDED: 2015 LISTED: 2015

FOUNDED: 1971 LISTED: 2007 NATURE OF BUSINESS: Steinhoff is an integrated retailer that retails,

NATURE OF BUSINESS: Stefanutti Stocks, a leading sources and manufactures household goods and general merchandise in the

construction company, operates throughout South United Kingdom, Europe, Africa and Australasia. Retail operations are

Africa, sub-Saharan Africa and the Middle East with positioned towards price conscious (value) consumer segments, providing

multi-disciplinary expertise including concrete them with affordable products through a vertically integrated supply chain.

structures, marine construction, piling and SECTOR: Consumer—Personal&House—Household—Furnishings

geotechnical services, roads and earthworks, bulk pipelines, mine residue NUMBER OF EMPLOYEES: 105 000

disposal facilities (mainly tailings dams), open pit contract mining, all DIRECTORS: Booysen Dr S F (ind ne), de Klerk T, Kruger-Steinhoff

forms of building works including affordable housing, mechanical and A(alt, German), KweyamaKT(ne), Moses M A (ind ne), Nelson Dr H (ne),

electrical installation and construction. Pauker D (ind ne), Wakkie P (ne), Watson Prof A (ind ne),

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction Sonn H J (Chair, ind ne), du PreezLJ(CEO)

NUMBER OF EMPLOYEES: 9 768 MAJOR ORDINARY SHAREHOLDERS as at 11 Oct 2018

DIRECTORS: Craig H (ind ne), Harie B (ind ne), Poluta J (alt), Investec Asset Management 2.87%

Quinn D (ind ne, Ire), Silwanyana B (ind ne), Matlala Z (Chair, ind ne), POSTAL ADDRESS: PO Box 15803, Amsterdam, Netherlands, 1001 CA

Crawford R (CEO), Cocciante A (CFO) MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SNH

MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020 COMPANY SECRETARY: Sarah Radema

UNUM-Welkom Investments 13.31% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Investec Asset Management 7.63%

Investec Securities 6.29% SPONSOR: PSG Capital (Pty) Ltd.

POSTAL ADDRESS: PO Box 12394, Aston Manor, 1630 AUDITORS: Deloitte Accountants B.V.

EMAIL: holdings@stefstocks.com CAPITAL STRUCTURE AUTHORISED ISSUED

WEBSITE: www.stefanuttistocks.com SNH Ords of 50c ea 17 500 000 000 4 309 727 144

TELEPHONE: 011-571-4300 FAX: 011-976-3487 DISTRIBUTIONS [EURc]

COMPANY SECRETARY: William Somerville Ords of 50c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 17 14 Mar 17 20 Mar 17 3.00

SPONSOR: Bridge Capital Advisors (Pty) Ltd. Final No 16 29 Nov 16 6 Dec 16 12.00

AUDITORS: Mazars Inc.

LIQUIDITY: Apr20 Ave 27m shares p.w., R37.6m(32.5% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

SSK Ords 0.00025c ea 400 000 000 188 080 746 ALSH 40 Week MA STEINHOFF N.V.

DISTRIBUTIONS [ZARc] 9508

Ords 0.00025c ea Ldt Pay Amt

Final No 7 29 Jun 12 9 Jul 12 12.00 7622

Interim No 6 2 Dec 11 12 Dec 11 12.00 5736

LIQUIDITY: Mar20 Ave 2m shares p.w., R1.3m(53.5% p.a.)

3851

CONM 40 Week MA STEFSTOCK

1965

823

79

660 2015 | 2016 | 2017 | 2018 | 2019 |

NOTES: Steinhoff changed its financial year-end from 30 June to 30

497

September.

334 FINANCIAL STATISTICS

(EUR million) Mar 19 Sep 18 Sep 17 Sep 16 Jun 16

171 Interim Final Final(rst) Final(rst) Final

Turnover 6 862 12 827 12 493 16 130 13 059

8

2015 | 2016 | 2017 | 2018 | 2019 | Op Inc 212 80 - 150 278 1 461

NetIntPd(Rcvd) 444 587 372 391 143

FINANCIAL STATISTICS

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Minority Int 46 55 42 42 5

Interim Final Final(rst) Final(rst) Final Att Inc - 617 - 1 247 - 4 036 - 279 1 168

Turnover 4 470 9 898 10 390 9 150 9 737 TotCompIncLoss - 450 - 1 165 - 4 182 - 1 043 - 104

Op Inc - 973 - 158 - 506 - 106 392 Fixed Ass 2 107 2 146 3 430 3 860 4 789

NetIntPd(Rcvd) 42 57 34 41 26 Inv & Loans 133 134 106 198 843

Tax 34 - 36 49 44 120 Tot Curr Ass 5 725 6 834 4 441 4 558 8 109

Minority Int - - - 4 - 13 4 Ord SH Int - 994 - 521 924 5 500 12 592

Att Inc - 1 041 - 111 - 543 - 137 182 Minority Int 1 166 1 162 1 166 590 49

TotCompIncLoss - 998 - 53 - 592 - 161 220 LT Liab 2 924 2 949 1 387 1 967 7 050

Hline Erngs-CO - 1 016 - 118 115 19 157 Tot Curr Liab 11 997 12 780 14 028 12 967 4 613

Fixed Ass 1 404 1 502 1 484 1 212 1 100

Inv in Assoc 298 280 209 190 189 PER SHARE STATISTICS (cents per share)

Def Tax Asset 208 212 134 74 28 HEPS-C (ZARc) - 183.93 - 230.17 - 76.80 - 107.33 501.02

Tot Curr Ass 3 874 3 996 4 057 3 960 3 947 DPS (ZARc) - - - 221.40 180.18

Ord SH Int 751 1 746 1 794 2 387 2 601 NAV PS (ZARc) - 375.48 - 187.91 346.65 2 345.97 5 480.60

Minority Int - 17 - 14 - 4 4 8 3 Yr Beta 1.66 1.33 0.41 0.92 1.06

LT Liab 508 419 480 366 232 Price High 254 6 244 7 967 9 700 9 700

Tot Curr Liab 4 977 4 297 4 074 3 766 3 672 Price Low 140 107 5 455 6 950 6 950

PER SHARE STATISTICS (cents per share) Price Prd End 188 230 6 003 7 855 8 427

EPS (ZARc) - 622.35 - 65.99 - 317.77 - 79.34 104.31 RATIOS

HEPS-C (ZARc) - 607.72 - 70.12 67.51 10.94 89.62 Ret on SH Fnd - 663.95 - 185.96 - 191.10 - 3.11 8.97

NAV PS (ZARc) 448.90 1 043.95 1 058.49 1 385.65 1 498.48 Oper Pft Mgn 3.09 0.62 - 1.20 1.72 11.19

3 Yr Beta - 0.99 - 0.66 1.60 1.45 1.45 D:E 68.17 17.65 5.23 1.67 0.57

Price High 260 420 460 528 750 Current Ratio 0.48 0.53 0.32 0.35 1.76

Price Low 35 140 170 335 230 Div Cover - - - - 0.55 2.76

Price Prd End 45 260 182 440 345

RATIOS

Ret on SH Fnd - 283.50 - 6.43 - 30.56 - 6.26 7.13 Stellar Capital Partners Ltd.

Ret On Tot Ass - 34.81 - 2.46 - 8.47 - 1.94 7.31 ISIN: ZAE000198586 SHORT: STELLAR CODE: SCP

STE

Oper Pft Mgn - 21.78 - 1.60 - 4.87 - 1.16 4.03 REG NO: 1998/015580/06 FOUNDED: 1998 LISTED: 1998

D:E 0.89 0.27 0.28 0.15 0.14 NATURE OF BUSINESS: Stellar is a JSE listed investment holding

Int Cover n/a n/a n/a n/a 14.86 company. Stellar Capital has appointed Thunder Securitisations (Pty) Ltd.

Current Ratio 0.78 0.93 1.00 1.05 1.07 as its dedicated investment manager to manage the portfolio of the

229