Page 235 - SHBe20.vp

P. 235

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – SUN

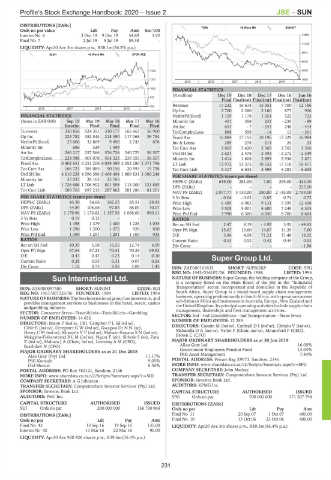

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Scr/100 TRAV 40 Week MA SUNINT

Interim No 8 3 Dec 19 9 Dec 19 54.89 3.92 13890

Final No 7 2 Jul 19 8 Jul 19 55.38 -

11432

LIQUIDITY: Apr20 Ave 3m shares p.w., R38.1m(36.2% p.a.)

8974

ALSH 40 Week MA STOR-AGE

6516

1402 4058

1247 1600

2015 | 2016 | 2017 | 2018 | 2019 |

1092 FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Jun 16

937

Final Final(rst) Final(rst) Final(rst) Final(rst)

782 Revenue 17 232 16 614 15 351 7 700 12 186

| 2016 | 2017 | 2018 | 2019 |

Op Inc 2 700 2 260 2 160 877 926

FINANCIAL STATISTICS NetIntPd(Rcvd) 1 159 1 178 1 054 522 723

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 Minority Int 401 358 231 - 235 - 89

Interim Final Final Final Final Att Inc 653 - 7 - 243 248 - 414

Turnover 330 856 524 351 310 177 166 663 56 900 TotCompIncLoss 888 558 - 14 13 - 301

Op Inc 223 782 352 544 218 390 117 068 39 784 Fixed Ass 16 884 17 155 18 196 17 329 16 984

NetIntPd(Rcvd) 23 006 32 869 9 490 2 743 878 Inv & Loans 289 278 214 24 23

Minority Int 686 329 1 499 - - Tot Curr Ass 2 865 3 420 2 369 2 765 3 506

Att Inc 240 217 257 566 576 726 240 725 56 507 Ord SH Int 2 621 2 478 - 2 593 - 2 272 - 2 549

TotCompIncLoss 224 988 401 078 454 323 239 359 56 507 Minority Int 1 614 1 808 2 899 2 936 3 671

Fixed Ass 6 402 651 6 251 206 4 039 399 2 052 280 1 371 796 LT Liab 13 972 13 375 18 532 17 118 16 471

Tot Curr Ass 166 723 384 085 90 156 20 593 19 798 Tot Curr Liab 5 417 6 635 5 598 6 283 6 635

Ord SH Int 4 610 258 4 596 586 3 468 494 1 889 831 1 380 248 PER SHARE STATISTICS (cents per share)

Minority Int 27 037 28 165 25 765 - - HEPS-C (ZARc) 619.00 281.00 7.00 295.00 - 424.00

LT Liab 1 726 686 1 706 902 801 598 113 000 131 885 DPS (ZARc) - - - - 225.00

Tot Curr Liab 589 763 697 213 287 862 281 286 81 201

NAV PS (ZARc) 2 077.77 3 130.00 280.00 2 145.00 2 759.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta - 0.04 - 0.03 0.85 0.74 0.72

HEPS-C (ZARc) 43.50 54.66 162.35 85.51 29.93 Price High 6 489 6 983 9 131 9 599 12 408

DPS (ZARc) 54.89 106.68 97.83 88.05 30.07 Price Low 3 505 5 001 4 600 7 249 6 305

NAV PS (ZARc) 1 179.96 1 176.82 1 157.56 1 068.00 990.11 Price Prd End 3 990 6 300 6 046 8 700 8 604

3 Yr Beta 0.19 0.13 - - - RATIOS

Price High 1 498 1 379 1 400 1 225 1 035 Ret on SH Fnd 2.47 8.19 - 3.92 3.92 - 44.83

Price Low 1 290 1 200 1 075 920 850 Oper Pft Mgn 15.67 13.60 14.07 11.39 7.60

Price Prd End 1 390 1 291 1 291 1 100 935 D:E 3.96 4.08 71.21 31.48 18.32

RATIOS Current Ratio 0.53 0.52 0.42 0.44 0.53

Ret on SH Fnd 10.39 5.58 16.55 12.74 4.09 Div Cover - - - - - 1.88

Oper Pft Mgn 67.64 67.23 70.41 70.24 69.92

D:E 0.43 0.42 0.23 0.14 0.10 Super Group Ltd.

Current Ratio 0.28 0.55 0.31 0.07 0.24

SUP

Div Cover 1.12 0.75 2.56 2.06 1.45 ISIN: ZAE000161832 SHORT: SUPRGRP CODE: SPG

REG NO: 1943/016107/06 FOUNDED: 1986 LISTED: 1996

Sun International Ltd. NATURE OF BUSINESS: Super Group, the holding company of the Group,

is a company listed on the Main Board of the JSE in the “Industrial

SUN

ISIN: ZAE000097580 SHORT: SUNINT CODE: SUI Transportation” sector, incorporated and domiciled in the Republic of

REG NO: 1967/007528/06 FOUNDED: 1984 LISTED: 1984 South Africa. Super Group is a broad-based supply chain management

NATURE OF BUSINESS: The Sun International group has interests in, and business, operating predominantly in South Africa, with operations across

provides management services to businesses in the hotel, resort, casino sub-Saharan Africa and businesses in Australia, Europe, New Zealand and

andgambling industry. the United Kingdom. Its principal operating activities include supply chain

management, dealerships and fleet management activities.

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Gambling

NUMBER OF EMPLOYEES: 14 632 SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

DIRECTORS: Bacon P (ind ne, UK), CampherPL(ld ind ne), NUMBER OF EMPLOYEES: 12 289

Cibie E (ind ne), DempsterGW(ind ne), Gwagwa DrNN(ne), DIRECTORS: Cassim M (ind ne), CathrallDI(ind ne), Chitalu V (ind ne),

HenryCM(ind ne), KhanyileVP(ind ne), Mabaso-KoyanaSN(ind ne), MabandlaOA(ind ne), Vallet P (Chair, ind ne), Mountford P (CEO),

Brown C (CFO)

Makgabo-FiskerstrandBLM(ind ne), Ngara T (alt), Sithole S (ne), Zatu

Z(ind ne), Mabuza J A (Chair, ind ne), Leeming A M (CEO), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Basthdaw N (CFO) Allan Gray Ltd. 16.05%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 Government Employees Pension Fund 13.04%

Alan Gray (Pty) Ltd. 11.17% PSG Asset Management 7.84%

PSG Konsult 9.05% POSTAL ADDRESS: Private Bag X9973, Sandton, 2146

Old Mutual 6.56% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SPG

POSTAL ADDRESS: PO Box 782121, Sandton, 2146 COMPANY SECRETARY: John Mackay

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SUI TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: A G Johnston SPONSOR: Investec Bank Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: KPMG Inc.

SPONSOR: Investec Bank Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc. SPG Ords no par 700 000 000 371 507 794

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

SUI Ords no par 200 000 000 136 730 964 Ords no par Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 11 20 Sep 07 1 Oct 07 400.00

Ords no par Ldt Pay Amt Final No 10 13 Oct 06 23 Oct 06 400.00

Final No 43 13 Sep 16 19 Sep 16 135.00 LIQUIDITY: Apr20 Ave 3m shares p.w., R89.3m(43.4% p.a.)

Interim No 42 11 Mar 16 22 Mar 16 90.00

LIQUIDITY: Apr20 Ave 920 428 shares p.w., R39.6m(35.0% p.a.)

231