Page 230 - SHBe20.vp

P. 230

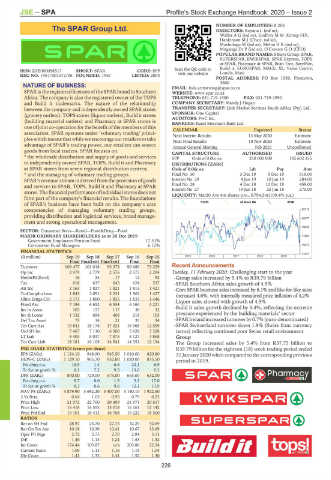

JSE – SPA Profile’s Stock Exchange Handbook: 2020 – Issue 2

NUMBER OF EMPLOYEES: 8 206

The SPAR Group Ltd. DIRECTORS: Koyana L (ind ne),

SPA WallerAG(ind ne), Godfrey M W (Group FD),

Hankinson M J (Chair, ind ne),

Mashologu M (ind ne), MehtaHK(ind ne),

Mnganga Dr P (ind ne), O’Connor G O (CEO)

POPULAR BRAND NAMES: S Buys Group, SPAR,

SUPERSPAR, KWIKSPAR, SPAR Express, TOPS

at SPAR, Pharmacy at SPAR, Bean Tree, SaveMor,

Scan the QR code to Build it, EUROSPAR, MACE, XL, Value Centre,

ISIN: ZAE000058517 SHORT: SPAR CODE: SPP Londis, Maxi

REG NO: 1967/001572/06 FOUNDED: 1967 LISTED: 2004 visit our website

POSTAL ADDRESS: PO Box 1589, Pinetown,

3600

NATURE OF BUSINESS: EMAIL: kyla.armstrong@spar.co.za

SPAR is the registered licensee of the SPAR brand in Southern WEBSITE: www.spar.co.za

Africa. The company is also the registered owner of the TOPS TELEPHONE: 031-719-1900 FAX: 031-719-1990

and Build it trademarks. The nature of the relationship COMPANY SECRETARY: Mandy J Hogan

between the company and independently owned SPAR stores TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

(grocery outlets), TOPS stores (liquor outlets), Build it stores SPONSOR: One Capital

AUDITORS: PwC Inc.

(building material outlets) and Pharmacy at SPAR stores is BANKERS: Rand Merchant Bank Ltd.

one of joint co-operation for the benefit of the members of this

CALENDAR Expected Status

association. SPAR operates under ‘voluntary trading’ princi- Next Interim Results 13 May 2020 Estimate

pleswhich meansthatwhileweencourageourretailerstotake Next Final Results 18 Nov 2020 Estimate

advantage of SPAR’s trading power, our retailers can source Annual General Meeting Feb 2021 Unconfirmed

goods from local traders. SPAR focuses on: CAPITAL STRUCTURE AUTHORISED ISSUED

* the wholesale distribution and supply of goods and services SPP Ords of 0.06c ea 250 000 000 192 602 355

to independently owned SPAR, TOPS, Build it and Pharmacy DISTRIBUTIONS [ZARc]

at SPAR stores from seven regional distribution centres; Ords of 0.06c ea Ldt Pay Amt

* and the managing of voluntary trading groups. Final No 30 3 Dec 19 9 Dec 19 516.00

SPAR’s revenue stream is derived from the provision of goods Interim No 29 4 Jun 19 10 Jun 19 284.00

and services to SPAR, TOPS, Build it and Pharmacy at SPAR Final No 28 4 Dec 18 10 Dec 18 459.00

Interim No 27 19 Jun 18 25 Jun 18 270.00

stores. The financialperformanceofindividual storesdoesnot LIQUIDITY: Mar20 Ave 4m shares p.w., R794.5m(109.4% p.a.)

form part of the company’s financial results. The foundations

of SPAR’s business have been built on the company’s core FOOR 40 Week MA SPAR

competencies of managing voluntary trading groups, 22112

providing distribution and logistical services, brand manage-

20577

ment and strong operational management.

19042

SECTOR: Consumer Srvcs—Retail—Food&Drug—Food

MAJOR ORDINARY SHAREHOLDERS as at 30 Dec 2019 17507

Government Employees Pension Fund 17.51%

Coronation Fund Managers 6.12% 15972

FINANCIAL STATISTICS

14437

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 2015 | 2016 | 2017 | 2018 | 2019 |

Final Final(rst) Final(rst) Final Final

Turnover 109 477 101 018 95 373 90 689 73 259 Recent Announcements

Op Inc 2 979 2 779 2 576 2 577 2 294 Tuesday, 11 February 2020: Challenging start to the year

NetIntPd(Rcvd) 16 24 - 17 12 92 -Group sales increased by 5.4% to R39.79 billion

Tax 618 637 645 624 537 -SPAR Southern Africa sales growth of 4.9%

Att Inc 2 163 1 827 1 821 1 815 1 421 -Core SPAR business sales increased by 6.1% and like-for-like sales

TotCompIncLoss 1 843 2 091 2 231 1 562 1 427 increased 4.6%, with internally measured price inflation of 4.2%

Hline Erngs-CO 2 173 1 860 1 835 1 833 1 446 -Liquor sales slowed with growth of 4.5%

Fixed Ass 7 184 6 652 6 554 6 160 3 221

Inv in Assoc 103 157 117 38 32 -Build It sales growth declined by 3.4%, reflecting the extreme

Inv & Loans 1 132 696 406 218 103 pressure experienced by the building materials’ sector

Def Tax Asset 75 14 21 37 34 -SPARIrelandincreasedturnoverby0.7%(euro-denominated)

Tot Curr Ass 19 841 18 176 17 021 16 968 12 559 -SPAR Switzerland turnover down 1.9% (Swiss franc currency

Ord SH Int 7 467 7 110 6 560 5 628 3 328 terms) reflecting continued poor Swiss retail environment

LT Liab 8 405 8 037 7 875 8 127 3 868 Group

Tot Curr Liab 18 181 16 108 14 541 14 351 12 134 The Group increased sales by 5.4% from R37.75 billion to

PER SHARE STATISTICS (cents per share) R39.79 billion for the eighteen (18) week trading period ended

EPS (ZARc) 1 124.10 948.90 945.50 1 010.00 820.80 31 January 2020 when compared to the corresponding previous

HEPS-C (ZARc) 1 129.10 965.70 952.80 1 020.00 835.50 period in 2019.

Pct chng p.a. 16.9 1.4 - 6.6 22.1 6.9

Tr 5yr av grwth % 8.1 7.2 9.5 13.0 9.3

DPS (ZARc) 800.00 729.00 675.00 665.00 632.00

Pct chng p.a. 9.7 8.0 1.5 5.2 17.0

Tr 5yr av grwth % 8.3 8.6 9.6 12.1 11.9

NAV PS (ZARc) 3 879.90 3 692.20 3 407.00 3 140.10 1 922.60

3 Yr Beta 0.64 1.05 0.95 0.79 0.23

Price High 21 072 22 700 20 499 21 971 20 617

Price Low 16 418 16 553 15 018 16 161 12 142

Price Prd End 19 101 18 413 16 708 19 222 18 500

RATIOS

Ret on SH Fnd 28.97 25.70 27.75 32.25 42.69

Ret On Tot Ass 10.18 10.36 10.41 10.67 13.69

Oper Pft Mgn 2.72 2.75 2.70 2.84 3.13

D:E 1.46 1.13 1.24 1.53 1.32

Int Cover 174.44 105.87 n/a 203.86 22.24

Current Ratio 1.09 1.13 1.16 1.18 1.04

Div Cover 1.41 1.32 1.41 1.52 1.30

226