Page 189 - SHBe20.vp

P. 189

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – NOV

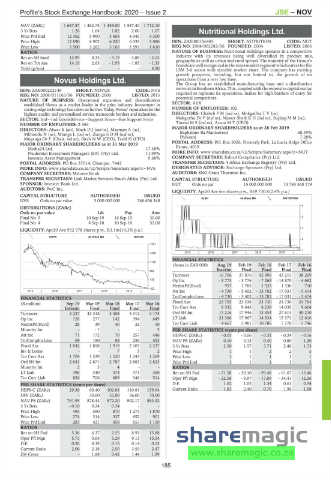

NAV (ZARc) 1 687.87 1 462.75 1 449.00 1 587.40 1 712.10

3 Yr Beta 1.26 1.64 1.82 2.00 1.67 Nutritional Holdings Ltd.

Price Prd End 12 362 5 900 3 668 4 045 4 300

NUT

Price High 12 890 6 902 6 020 6 035 5 080 ISIN: ZAE000156485 SHORT: NUTRITION CODE: NUT

Price Low 5 500 3 262 3 165 3 593 1 610 REG NO: 2004/002282/06 FOUNDED: 2004 LISTED: 2006

RATIOS NATURE OF BUSINESS: Nutritional Holdings operates in a competitive

Ret on SH fund 12.99 0.33 - 4.19 - 3.88 - 3.15 industry with its revenues being well diversified by product mix,

geography as well as urban and rural spread. The majority of the Group’s

Ret on Tot Ass 14.19 2.63 - 1.93 - 1.83 - 1.33 brandsarewellrecognizedinthemassmarketsegmentwhichcatersforthe

Yield (g/ton) - - - - 4.90 LSM 3-6 sector with sizeable market share. The company has exciting

growth prospects, including, but not limited to, the growth of its

Novus Holdings Ltd. operations from a very low base.

The Group has an established manufacturing base and a distribution

NOV

ISIN: ZAE000202149 SHORT: NOVUS CODE: NVS network in Southern Africa. This, coupled with the extensive capital outlay

REG NO: 2008/011165/06 FOUNDED: 2000 LISTED: 2015 required to replicate its operations, makes for high barriers of entry for

NATURE OF BUSINESS: Operational expansion and diversification potential competitors.

established Novus as a market leader in the print industry. Investment in SECTOR: AltX

cutting-edge technology has taken us further. Today, Novus’ reputation for the NUMBER OF EMPLOYEES: 102

highest quality and personalised service transcends borders and industries. DIRECTORS: ChabeliPM(ind ne), MokgatlhaTV(ne),

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Bus Support Srvcs Mokgothu Dr P (ind ne), Nasser SheikKH(ind ne), SupingMM(ne),

NUMBER OF EMPLOYEES: 2 364 TinawiMS(ind ne), Azum M T (CEO)

DIRECTORS: Alwar K (alt), MackDJ(ind ne), Mayman A (ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Mkhondo N (ne), Mtanga L (ind ne), ZunguSDM(ind ne), Baphalane Ba Mantserred 68.39%

Mnganga Dr P (Chair, ind ne), Birch N W (CEO), Todd H (CFO) Philisani 7.28%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 POSTAL ADDRESS: P.O. Box 5026, Frosterly Park, La Lucia Ridge Office

Media24 Ltd. 17.48% Estate, 4019

Prudential Investment Managers (SA) (Pty) Ltd. 11.99% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NUT

Investec Asset Management 9.68% COMPANY SECRETARY: Eshcol Compliance (Pty) Ltd.

POSTAL ADDRESS: PO Box 37014, Chempet, 7442 TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NVS DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd.

COMPANY SECRETARY: Melonie Brink AUDITORS: SNG Grant Thornton Inc.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Investec Bank Ltd. NUT Ords no par 15 000 000 000 13 743 368 179

AUDITORS: PwC Inc.

LIQUIDITY: Apr20 Ave 6m shares p.w., R69 730.8(2.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

ALSH 40 Week MA NUTRITION

NVS Ords no par value 3 000 000 000 346 656 348

4

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 5 10 Sep 19 16 Sep 19 30.00 3

Final No 4 4 Sep 18 10 Sep 18 52.00

LIQUIDITY: Apr20 Ave 952 978 shares p.w., R3.1m(14.3% p.a.) 2

SUPS 40 Week MA NOVUS

2

1781

1

1456 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

1130

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final

804

Turnover 16 706 37 876 42 496 43 215 38 269

479 Op Inc - 3 773 - 3 776 - 7 263 - 14 870 - 4 692

NetIntPd(Rcvd) 957 1 785 1 535 1 336 710

153

2015 | 2016 | 2017 | 2018 | 2019 | Att Inc - 4 730 - 5 402 - 13 782 - 17 031 - 5 414

FINANCIAL STATISTICS TotCompIncLoss - 4 730 - 5 402 - 13 782 - 17 031 - 5 474

(R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 Fixed Ass 23 755 23 336 23 730 24 730 24 764

Interim Final Final Final Final Tot Curr Ass 8 532 9 643 8 239 14 035 9 664

Turnover 2 227 43 318 4 308 4 312 4 175 Ord SH Int 13 216 17 946 13 854 27 615 40 210

Op Inc 128 277 142 394 649 LT Liab 21 366 17 967 14 334 15 371 12 616

NetIntPd(Rcvd) 28 39 40 32 10 Tot Curr Liab 4 667 3 981 10 786 7 170 5 746

Minority Int - - 1 - - 3 PER SHARE STATISTICS (cents per share)

Att Inc 71 172 70 257 446 HEPS-C (ZARc) - 0.03 - 0.06 - 0.31 - 0.24 - 0.16

TotCompIncLoss 69 180 68 256 453 NAV PS (ZARc) 0.10 0.12 0.40 0.80 1.20

Fixed Ass 1 842 1 858 1 919 2 103 2 237 3 Yr Beta 2.50 1.57 3.71 2.40 1.73

Inv & Loans - - 7 3 2 Price High 1 1 2 2 5

Tot Curr Ass 1 704 1 539 1 520 1 243 1 269 Price Low 1 1 1 1 1

Ord SH Int 2 641 2 671 2 787 2 883 2 823 Price Prd End 1 1 1 1 2

Minority Int 2 3 4 - - RATIOS

LT Liab 398 340 374 371 360 Ret on SH Fnd - 71.58 - 30.10 - 99.48 - 61.67 - 13.46

Tot Curr Liab 826 706 609 346 514 Oper Pft Mgn - 22.58 - 9.97 - 17.09 - 34.41 - 12.26

PER SHARE STATISTICS (cents per share) D:E 1.62 1.05 1.34 0.61 0.34

HEPS-C (ZARc) 29.38 60.40 102.88 110.81 139.94 Current Ratio 1.83 2.40 0.76 1.96 1.68

DPS (ZARc) - 30.00 52.00 56.00 70.00

NAV PS (ZARc) 761.95 878.44 872.20 902.17 883.32

3 Yr Beta - 0.10 0.24 0.34 - -

Price High 495 590 870 1 275 1 870

Price Low 274 314 337 652 901

Price Prd End 283 421 458 855 1 150

RATIOS

Ret on SH Fnd 5.36 6.37 2.55 8.91 15.88

Oper Pft Mgn 5.73 0.64 3.29 9.13 15.54

D:E 0.26 0.19 0.15 0.14 0.13

Current Ratio 2.06 2.18 2.50 3.59 2.47

Div Cover - 1.88 0.42 1.44 1.99

185