Page 156 - SHBe20.vp

P. 156

JSE – INS Profile’s Stock Exchange Handbook: 2020 – Issue 2

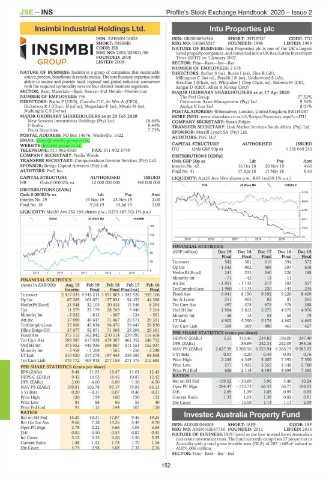

Insimbi Industrial Holdings Ltd. Intu Properties plc

INS INT

ISIN: ZAE000116828 ISIN: GB0006834344 SHORT: INTUPLC CODE: ITU

SHORT: INSIMBI REG NO: UK3685527 FOUNDED: 1998 LISTED: 1999

CODE: ISB NATURE OF BUSINESS: Intu Properties plc is one of the UK’s largest

REG NO: 2002/029821/06 listedpropertycompanies,andconvertedintoaUKRealEstateInvestment

FOUNDED: 2008 Trust (REIT) on 1 January 2007.

LISTED: 2008 SECTOR: Fins—Rest—Inv—Ret

NUMBER OF EMPLOYEES: 2 578

NATURE OF BUSINESS: Insimbi is a group of companies that sustainably DIRECTORS: Barber S (ne), Burke I (ne), Fine R (alt),

source,process,beneficiate&recyclemetals.Thecorebusinessexpertiseisthe Millington C (ind ne), ParekhJR(ne), Underwood S (alt),

ability to source and provide local, regional and global industrial consumers Strachan J (Chair, ne), Whittaker J (Dep Chair, ne), Roberts M (CE),

with the required commodity over its four distinct business segments. Sangar D (CIO), Allen R (Group CFO)

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Nonferrous MAJOR ORDINARY SHAREHOLDERS as at 17 Apr 2020

NUMBER OF EMPLOYEES: 746 The Peel Group 27.32%

DIRECTORS: Botha F (CEO), Coombs C C, de Wet A (CFO), Coronation Asset Management (Pty) Ltd. 9.54%

Dickerson R I (Chair, ld ind ne), Mogotlane P (ne), Mwale N (ne), Auriga V Lux Sarl 8.01%

NtshingilaCS(ind ne) POSTAL ADDRESS:40Broadway,London,UnitedKingdom,SW1H0BT

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ITU

New Seasons Investments Holdings (Pty) Ltd. 18.64% COMPANY SECRETARY: Susan Folger

F Botha 8.44% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Pruta Securities 7.73% SPONSOR: Merrill Lynch SA (Pty) Ltd.

POSTAL ADDRESS: PO Box 14676, Wadeville, 1422 AUDITORS: PwC LLP

EMAIL: cosec@insimbi-group.co.za.

WEBSITE: insimbi-group.co.za CAPITAL STRUCTURE AUTHORISED ISSUED

TELEPHONE: 011-902-6930 FAX: 011-902-5749 ITU Ords GBP 50p ea - 1 355 040 243

COMPANY SECRETARY: Nadia Winde DISTRIBUTIONS [GBPp]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords GBP 50p ea Ldt Pay Amt

SPONSOR: Bridge Capital Advisors (Pty) Ltd. Interim No 42 16 Oct 18 20 Nov 18 4.60

AUDITORS: PwC Inc. Final No 41 17 Apr 18 17 May 18 9.40

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Apr20 Ave 10m shares p.w., R95.1m(39.1% p.a.)

ISB Ords 0.000025c ea 12 000 000 000 440 000 000

FINI 40 Week MA INTUPLC

DISTRIBUTIONS [ZARc]

Ords 0.000025c ea Ldt Pay Amt 7416

Interim No 19 19 Nov 19 25 Nov 19 2.00

5948

Final No 18 9 Jul 19 15 Jul 19 2.00

4480

LIQUIDITY: Mar20 Ave 252 156 shares p.w., R273 387.7(3.1% p.a.)

INDM 40 Week MA INSIMBI 3011

160

1543

130

75

2015 | 2016 | 2017 | 2018 | 2019 |

100

FINANCIAL STATISTICS

(GBP million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

69

Final Final Final Final Final

39 Turnover 542 581 616 594 572

Op Inc - 1 543 - 992 409 397 618

9

2015 | 2016 | 2017 | 2018 | 2019 | NetIntPd(Rcvd) 241 235 240 226 188

Minority Int - 71 - 42 - 13 - 11 -

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Att Inc - 1 951 - 1 132 217 183 517

Interim Final Final Final(rst) Final TotCompIncLoss - 1 980 - 1 133 220 143 235

Turnover 2 417 034 4 545 214 3 491 803 1 342 526 955 106 Fixed Ass 6 041 8 150 9 192 9 220 8 409

Op Inc 67 265 101 071 127 831 54 433 44 388 Inv & Loans 251 402 82 81 265

NetIntPd(Rcvd) 21 548 32 105 30 434 15 546 8 294 Tot Curr Ass 497 378 679 378 388

Tax 11 579 25 179 28 769 9 440 7 264 Ord SH Int 1 904 3 812 5 075 4 979 4 976

Minority Int - 2 022 - 813 - 307 - 124 - 561 Minority Int - 58 13 54 68 79

Att Inc 37 890 46 647 71 467 29 571 29 391 LT Liab 4 902 5 250 5 176 4 862 4 665

TotCompIncLoss 35 868 45 834 94 476 29 447 28 830 Tot Curr Liab 369 369 490 461 427

Hline Erngs-CO 37 677 52 871 71 368 29 206 29 361

Fixed Ass 375 115 362 842 270 514 239 095 116 658 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 599 587 617 038 479 307 461 352 246 752 HEPS-C (ZARc) 5.53 310.46 234.82 196.00 247.40

Ord SH Int 473 952 445 926 398 867 311 551 152 037 DPS (ZARc) - 89.69 242.31 242.05 295.16

Minority Int - 3 458 - 1 268 - 565 - 258 - 2 248 NAV PS (ZARc) 2 627.39 5 208.56 6 323.94 6 266.19 9 283.92

LT Liab 310 820 317 278 197 443 239 385 64 858 3 Yr Beta 0.07 0.20 0.49 0.93 0.76

Tot Curr Liab 379 772 404 918 277 158 271 475 212 685 Price High 2 245 4 349 5 007 7 392 7 550

PER SHARE STATISTICS (cents per share) Price Low 577 1 925 3 555 4 348 5 780

EPS (ZARc) 9.48 11.93 18.47 11.01 12.43 Price Prd End 626 2 114 4 195 4 698 7 392

HEPS-C (ZARc) 9.42 13.52 18.45 10.87 12.42 RATIOS

DPS (ZARc) 2.00 4.00 6.00 1.50 4.50 Ret on SH Fnd - 109.52 - 30.69 3.96 3.40 10.24

NAV PS (ZARc) 109.81 103.78 97.17 75.93 63.13 Oper Pft Mgn - 284.47 - 170.73 66.33 66.77 108.05

3 Yr Beta 0.20 - 0.11 0.07 0.40 0.21 D:E 2.69 1.39 1.05 0.99 0.95

Price High 120 159 160 150 112 Current Ratio 1.35 1.03 1.39 0.82 0.91

Price Low 85 88 96 55 40 Div Cover - - 16.58 1.14 1.13 2.59

Price Prd End 91 113 144 107 110

RATIOS Investec Australia Property Fund

Ret on SH Fnd 15.25 10.31 17.87 9.46 19.25

INV

Ret On Tot Ass 9.66 7.18 13.26 5.49 9.70 ISIN: AU0000046005 SHORT: IAPF CODE: IAP

Oper Pft Mgn 2.78 2.22 3.66 4.05 4.65 REG NO: ARSN162067736 FOUNDED: 2012 LISTED: 2013

D:E 0.82 0.90 0.52 0.87 0.43 NATURE OF BUSINESS: IAPF listed as the first inward listed Australian

Int Cover 3.12 3.15 4.20 3.50 5.35 real estate investment trust. The fund currently comprises 27 properties in

Current Ratio 1.58 1.52 1.73 1.70 1.16 Australia with a total gross lettable area (GLA) of 285 1465m² valued at

Div Cover 4.74 2.98 3.08 7.34 2.76 AUD1 006 million.

SECTOR: Fins—Rest—Inv—Ind

152