Page 154 - SHBe20.vp

P. 154

JSE – IMP Profile’s Stock Exchange Handbook: 2020 – Issue 2

Imperial Logistics Ltd. WEBSITE: www.imperiallogistics.com

TELEPHONE: 011-372-6500

COMPANY SECRETARY: R A Venter

IMP

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: Deloitte & Touche

BANKERS: First National Bank, Nedbank,

Standard Bank

Scan the QR code to

visit our website

CALENDAR Expected Status

Next Final Results 25 Aug 2020 Confirmed

Annual General Meeting 9 Nov 2020 Confirmed

Next Interim Results 23 Feb 2021 Confirmed

ISIN: ZAE000067211 SHORT: IMPERIAL CODE: IPL

REG NO: 1946/021048/06 FOUNDED: 1946 LISTED: 1987

CAPITAL STRUCTURE AUTHORISED ISSUED

NATURE OF BUSINESS: IPL Ords 4c ea 394 999 000 201 242 919

Imperial is an African and European focused logistics provider DISTRIBUTIONS [ZARc]

of outsourced, integrated freight management, contract Ords 4c ea Ldt Pay Amt

logistics and market access services. Ranked amongthe top 30 Interim No 60 17 Mar 20 23 Mar 20 167.00

global logistics providers, the group is listed on the JSE in Final No 59 23 Sep 19 30 Sep 19 109.00

Interim No 58 18 Mar 19 25 Mar 19 135.00

South Africa and employs over 27 000 people in 32 countries. Final No 57 25 Sep 18 1 Oct 18 387.00

With a focus on five key industry verticals - automotive, LIQUIDITY: Mar20 Ave 6m shares p.w., R379.3m(148.8% p.a.)

chemicals, consumer, healthcare and industrial - the group’s

INDT 40 Week MA IMPERIAL

deep experience and ability to customise solutions ensures

the ongoing relevance and competitiveness of its clients. 11425

9720

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

CONTROLLED BY: None 8015

MAJOR ORDINARY SHAREHOLDERS as at 21 Feb 2020

Public Investment Corporation Ltd. 11.46% 6309

M&G Prudential PLC 10.60%

Ukhamba Holdings 7.89% 4604

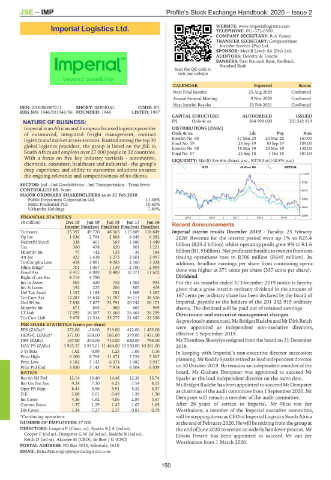

FINANCIAL STATISTICS 2015 | 2016 | 2017 | 2018 | 2019 | 2899

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final(rst) Final(rst) Final(rst) Final(rst) Recent Announcements

Turnover 25 397 49 720 48 565 115 889 118 849 Imperial interim results December 2019 - Tuesday, 25 February

Op Inc 1 636 2 764 2 868 6 049 6 382 2020: Revenue for the interim period went up 1% to R25.4

NetIntPd(Rcvd) 338 661 569 1 680 1 440 billion (R25.2 billion) whilst operating profit grew 9% to R1.6

Tax 360 478 620 901 1 221

Minority Int 77 142 135 - 36 184 billion (R1.5 billion). Net profit attributable to owners from con-

Att Inc 423 3 438 3 273 2 601 2 997 tinuing operations rose to R706 million (R649 million). In

TotCompIncLoss 458 3 891 4 063 2 160 3 328 addition, headline earnings per share from continuing opera-

Hline Erngs* 701 1 067 1 139 2 700 2 994

Fixed Ass 8 417 8 099 8 400 10 371 11 602 tions was higher at 371 cents per share (337 cents per share).

Right of use Ass 4 714 4 780 - - - Dividend

Inv in Assoc 503 520 752 1 002 993 For the six months ended 31 December 2019 notice is hereby

Inv & Loans 192 225 206 805 404 given that a gross interim ordinary dividend in the amount of

Def Tax Asset 1 157 1 185 783 1 509 1 387

Tot Curr Ass 13 284 14 618 51 787 36 114 38 526 167 cents per ordinary share has been declared by the board of

Ord SH Int 7 858 7 877 22 791 20 742 20 173 Imperial, payable to the holders of the 201 242 919 ordinary

Minority Int 871 895 900 667 909 shares. The dividend will be paid out of retained earnings.

LT Liab 17 095 16 587 11 660 26 464 26 299 Directorate and executive management changes

Tot Curr Liab 9 678 11 314 35 277 21 687 23 320

Aspreviously announced,MsBridget RadebeandMrDirk Reich

PER SHARE STATISTICS (cents per share) were appointed as independent non-executive directors,

EPS (ZARc)* 372.00 -16.00 519.00 412.00 1 453.00

effective 1 September 2019.

HEPS-C (ZARc)* 371.00 550.00 585.00 379.00 1 451.00

DPS (ZARc) 167.00 244.00 710.00 650.00 795.00 Ms Thembisa Skweyiya resigned from the board on 31 December

NAV PS (ZARc) 3 905.57 3 915.01 11 464.00 10 550.00 10 261.00 2019.

3 Yr Beta 1.02 0.89 1.25 1.06 1.16 In keeping with Imperial’s non-executive director succession

Price High 6 300 8 764 11 671 7 724 7 567

Price Low 4 182 5 143 6 374 5 482 3 937 planning, Mr Roddy Sparks retired as lead independent director

Price Prd End 5 850 5 143 7 914 6 504 6 039 on 30 October 2019. He remains an independent member of the

RATIOS board. Mr Graham Dempster was appointed to succeed Mr

Ret on SH Fnd 12.14 10.40 14.46 12.39 15.74 Sparks as the lead independent director on the same date.

Ret On Tot Ass 9.24 7.30 8.25 7.54 8.15 Ms Bridget Radebe has been appointed to succeed Mr Dempster

Oper Pft Mgn 6.44 5.56 5.91 5.22 5.37 as chairman of the audit committee from 1 September 2020. Mr

D:E 2.08 2.01 0.49 1.28 1.30

Int Cover 4.36 1.82 4.06 2.84 3.67 Dempster will remain a member of the audit committee.

Current Ratio 1.37 1.29 1.47 1.67 1.65 After 26 years of service to Imperial, Mr Nico van der

Div Cover 1.34 7.27 2.37 0.83 0.79 Westhuizen, a member of the Imperial executive committee,

*Continuing operations will be stepping down as CEO of Imperial Logistics South Africa

NUMBER OF EMPLOYEES: 27 000 atthe end ofFebruary 2020. He will be retiring fromthe group at

DIRECTORS: Langeni P (Chair, ne), SparksRJA(ind ne), the end of June 2020 to ensure an orderly handover process. Mr

Cooper P (ind ne), DempsterGW(ld ind ne), Radebe B (ind ne), Edwin Hewitt has been appointed to succeed Mr van der

Reich D (ind ne), Akoojee M (CEO), de Beer J G (CFO)

Westhuizen from 1 March 2020.

POSTAL ADDRESS: PO Box 3013, Edenvale, 1610

EMAIL: Esha.Mansingh@imperiallogistics.com

150