Page 151 - SHBe20.vp

P. 151

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – IMB

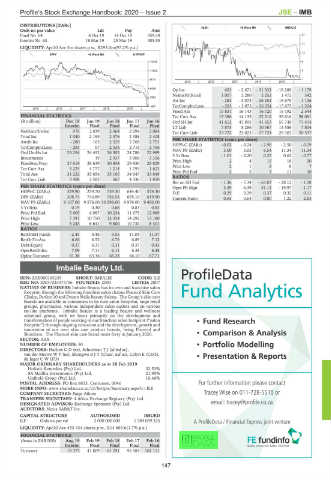

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt ALSH 40 Week MA IMBALIE

Final No 64 8 Oct 19 14 Oct 19 359.34 21

Interim No 63 18 Mar 19 25 Mar 19 385.55

17

LIQUIDITY: Apr20 Ave 5m shares p.w., R293.0m(97.2% p.a.)

13

SAPY 40 Week MA HYPROP

14045 9

11529 5

9014 1

2015 | 2016 | 2017 | 2018 | 2019 |

6498 Op Inc 623 - 2 671 - 31 332 - 19 289 - 1 179

NetIntPd(Rcvd) 1 007 2 280 2 252 1 472 342

3983

Att Inc - 283 - 3 073 - 26 254 - 15 675 - 1 126

1467 TotCompIncLoss - 283 - 3 073 - 26 254 - 15 675 - 1 204

2015 | 2016 | 2017 | 2018 | 2019 |

Fixed Ass 15 831 16 143 16 720 16 192 2 544

FINANCIAL STATISTICS Tot Curr Ass 15 386 14 135 22 216 35 616 58 061

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Ord SH Int 41 612 41 895 41 653 55 740 71 414

Interim Final Final Final Final LT Liab 7 873 8 286 10 067 13 558 7 804

NetRent/InvInc 978 2 039 2 064 2 094 2 084 Tot Curr Liab 23 722 22 023 27 724 29 303 20 537

Total Inc 1 040 2 195 2 376 2 388 2 408

PER SHARE STATISTICS (cents per share)

Attrib Inc - 280 165 2 529 2 768 2 751

TotCompIncLoss - 293 67 2 536 2 719 2 766 HEPS-C (ZARc) - 0.02 - 0.24 - 2.98 - 2.50 - 0.29

3.03

6.54

11.34

NAV PS (ZARc)

11.34

3.00

Ord UntHs Int 23 254 24 452 26 305 24 788 22 989

Investments - 19 2 937 3 006 3 316 3 Yr Beta - 1.01 2 - 0.20 4 0.37 0.62 - 0.77

20

15

Price High

18

FixedAss/Prop 27 619 28 639 30 854 29 830 28 829

Tot Curr Ass 3 225 4 777 1 214 1 793 1 622 Price Low 2 1 2 8 7

Total Ass 31 232 33 654 35 165 34 647 33 849 Price Prd End 2 2 3 11 10

RATIOS

Tot Curr Liab 3 408 2 583 567 4 336 1 850

Ret on SH Fnd - 1.36 - 7.34 - 63.03 - 28.12 - 1.58

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 3.39 - 6.39 - 51.12 - 19.97 - 1.17

HEPS-C (ZARc) 329.90 259.70 759.30 644.40 574.30 D:E 0.29 0.29 0.37 0.32 0.11

DPS (ZARc) 308.74 744.89 756.54 695.10 619.90 Current Ratio 0.65 0.64 0.80 1.22 2.83

NAV PS (ZARc) 9 107.00 9 578.00 10 298.00 9 978.00 9 450.00

3 Yr Beta 0.19 0.30 0.68 0.83 0.83

Price Prd End 5 605 6 987 10 234 11 675 12 989

Price High 7 391 10 750 12 354 14 292 13 180

Price Low 5 243 6 641 9 800 10 730 8 401

RATIOS

RetOnSH Funds - 2.45 0.46 9.55 11.04 11.97

RetOnTotAss 6.66 6.52 6.76 6.89 7.12

Debt:Equity 0.27 0.31 0.31 0.37 0.43

OperRetOnInv 7.09 7.11 6.11 6.38 6.48

OpInc:Turnover 61.38 63.36 66.28 66.10 67.71

Imbalie Beauty Ltd.

IMB

ISIN: ZAE000165239 SHORT: IMBALIE CODE: ILE

REG NO: 2003/025374/06 FOUNDED: 2003 LISTED: 2007

NATURE OF BUSINESS: Imbalie Beauty has its own and franchise salon

footprint through the following franchise salon chains: Placecol Skin Care

Clinics, Perfect 10 and Dream Nails Beauty Salons. The Group’s skin care

brands are available to consumers in its own salon footprint, large retail

groups, pharmacies, various independent salon outlets and on various

on-line platforms. Imbalie Beauty is a leading beauty and wellness

solutions group, with its focus primarily on the development and

transformation of people working in our franchise salon footprint (“salon Fund Research

footprint”) through ongoing education and the development, growth and

innovation of our own skin care product brands, being Placecol and Comparison & Analysis

Skinderm. The Placecol skin care brand turns forty in January 2020.

SECTOR: AltX

NUMBER OF EMPLOYEES: 50 Portfolio Modelling

DIRECTORS: HarlowGD(ne), SchoemanTJ(ld ind ne),

van der MerweWP(ne), ShongweBJT (Chair, ind ne), Colyn E (CEO), Presentation & Reports

de Jager C W (FD)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Holistic Remedies (Pty) Ltd. 32.53%

SA Madiba Investments (Pty) Ltd. 21.95%

Unihold Group (Pty) Ltd. 10.46%

POSTAL ADDRESS: PO Box 8833, Centurion, 0046 For further information please contact

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ILE

COMPANY SECRETARY: Paige Atkins Tracey Wise on 011-728-5510 or

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd. email: tracey@profile.co.za

AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

ILE Ords no par val 2 000 000 000 1 384 039 225 A ProfileData / Financial Express joint venture

LIQUIDITY: Apr20 Ave 453 434 shares p.w., R14 669.6(1.7% p.a.)

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final

Turnover 18 375 41 809 61 291 96 584 101 111

147