Page 129 - SHBe20.vp

P. 129

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – EPP

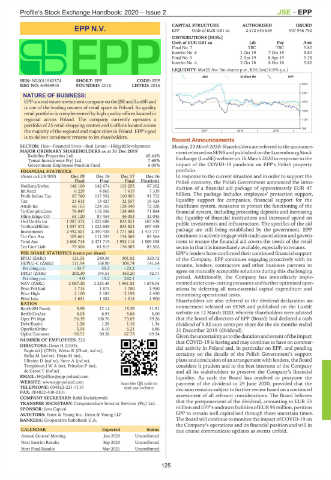

CAPITAL STRUCTURE AUTHORISED ISSUED

EPP N.V. EPP Ords of EUR 0.81 ea 2 572 645 659 907 946 792

EPP

DISTRIBUTIONS [EURc]

Ords of EUR 0.81 ea Ldt Pay Amt

Final No 7 TBC TBC 5.82

Interim No 6 1 Oct 19 7 Oct 19 5.80

Final No 5 2 Apr 19 8 Apr 19 5.78

Interim No 4 2 Oct 18 8 Oct 18 5.82

LIQUIDITY: Mar20 Ave 3m shares p.w., R56.1m(16.8% p.a.)

J863 40 Week MA EPP

ISIN: NL0011983374 SHORT: EPP CODE: EPP

REG NO: 64965945 FOUNDED: 2016 LISTED: 2016 2822

2397

NATURE OF BUSINESS:

EPPisarealestateinvestmentcompanyontheJSEandLuxSEand 1973

is one of the leading owners of retail space in Poland. Its quality

1549

retail portfolio is complemented by high quality offices located in

regional across Poland. The company currently operates a 1124

portfolio of 25 retail shopping centres and 6 offices located across

700

the majority of the regional and major cities in Poland. EPP’s goal 2017 | 2018 | 2019 |

is to deliver consistent returns to its shareholders.

Recent Announcements

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development Monday, 23 March2020: Shareholders are referred to the announce-

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 mentreleasedonSENSandpublished ontheLuxembourgStock

Redefine Properties Ltd. 45.44%

Tensai Investments Pty) Ltd. 7.68% Exchange (LuxSE) website on 16 March 2020 in response to the

Government Employees Pension Fund 6.00% impact of the COVID-19 pandemic on EPP’s Polish property

FINANCIAL STATISTICS portfolio.

(Amts in EUR’000) Dec 19 Dec 18 Dec 17 Dec 16 In response to the current situation and in order to support the

Final Final Final Final(rst) Polish economy, the Polish Government announced the intro-

NetRent/InvInc 148 100 142 674 103 255 67 302 duction of a financial aid package of approximately EUR 47

Int Recd 6 229 4 865 7 419 7 339

Profit Before Tax 87 780 137 592 160 905 91 752 billion. The package includes employees’ protection support,

Tax 21 615 13 427 32 557 19 424 liquidity support for companies, financial support for the

Attrib Inc 66 165 124 165 128 348 72 328 healthcare system, measures to protect the functioning of the

TotCompIncLoss 76 047 118 356 128 498 71 894 financial system, including protecting deposits and increasing

Hline Erngs-CO 61 120 87 454 46 053 32 045 the liquidity of financial institutions and increased spend on

Ord UntHs Int 1 087 372 1 022 688 833 821 607 438 public investments and infrastructure. The specifics of the aid

TotStockHldInt 1 087 372 1 022 688 833 821 607 438

Investments 2 492 501 2 340 435 1 771 581 1 413 717 package are still being established by the government. EPP

Tot Curr Ass 105 661 111 355 154 569 85 564 continues to actively engage with trade associations and govern-

Total Ass 2 606 715 2 471 715 1 952 114 1 509 398 ment to ensure the financial aid covers the needs of the retail

Tot Curr Liab 75 506 61 815 176 583 83 502 sectorinthatitisimmediatelyavailable,especiallytotenants.

PER SHARE STATISTICS (cents per share) EPP’s lenders have confirmed their continued financial support

EPLU (ZARc) 121.33 240.39 301.02 320.72 of the Company. EPP continues engaging proactively with its

HEPLU-C (ZARc) 111.94 168.90 108.74 141.64 tenants, lenders, contractors and other business partners to

Pct chng p.a. - 33.7 55.3 - 23.2 -

DPLU (ZARc) 202.30 194.51 163.20 42.71 agree on mutually acceptable solutions during this challenging

Pct chng p.a. 4.0 19.2 282.1 - period. Additionally, the Company has immediately imple-

NAV (ZARc) 2 067.20 2 223.45 1 961.52 1 675.04 mentedstrict cost-cuttingmeasures andfurther optimised oper-

Price Prd End 1 715 1 875 1 700 1 950 ations by deferring all non-essential capital expenditure and

Price High 2 100 2 183 2 199 2 450 minimising operational costs.

Price Low 1 631 1 382 1 315 1 900 Shareholders are also referred to the dividend declaration an-

RATIOS

RetOnSH Funds 5.99 12.14 15.39 11.91 nouncement released on SENS and published on the LuxSE

RetOnTotAss 6.05 6.93 5.68 5.00 website on 12 March 2020, wherein shareholders were advised

Oper Pft Mgn 96.39 108.76 73.09 79.26 that the board of directors of EPP (Board) had declared a cash

Debt:Equity 1.26 1.29 1.16 1.34 dividend of 5.82 euro cents per share for the six months ended

OperRetOnInv 5.94 6.10 6.21 4.86 31 December 2019 (dividend).

OpInc:Turnover 90.51 90.58 67.73 69.34

Giventheuncertaintyastothedurationandextentoftheimpact

NUMBER OF EMPLOYEES: 220 that COVID-19 is having and may continue to have on commer-

DIRECTORS: Dean H (CEO),

Baginski J (CFO), Weisz R (Chair, ind ne), cial activity in Poland and, in particular on EPP, and pending

Belka M (ind ne), Dyjas M (ne), certainty on the details of the Polish Government’s support

Ellerine D (ind ne), Steer A (ind ne), plans and conclusion of an arrangement with lenders, the Board

TempletonJWA(ne), Prinsloo P (ne), considers it prudent and in the best interests of the Company

de Groot T (ind ne) and all its stakeholders to preserve the Company’s financial

EMAIL: HQoffice@epp-poland.com liquidity. As such the Board has resolved to postpone the

WEBSITE: www.epp-poland.com Scan the QR code to payment of the dividend to 29 June 2020, provided that the

TELEPHONE: 004822-221-7110 visit our website

FAX: 004822-430-0301 decision remains subject to further review based on a continued

COMPANY SECRETARY: Rafal Kwiatkowski assessment of all relevant considerations. The Board believes

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. that the postponement of the dividend, amounting to EUR 53

SPONSOR: Java Capital millionandEPP’s undrawnfacilitiesofEUR95million,position

AUDITORS: Ernst & Young Inc., Ernst & Young LLP EPP to remain well capitalised through these uncertain times.

BANKERS: Cooperative RaboBank U.A. The Board will continue to monitor the impact of COVID-19 on

the Company’s operations and its financial position and will in

CALENDAR Expected Status due course communicate updates as events unfold.

Annual General Meeting Jun 2020 Unconfirmed

Next Interim Results Sep 2020 Unconfirmed

Next Final Results Mar 2021 Unconfirmed

125