Page 132 - SHBe20.vp

P. 132

JSE – EXX Profile’s Stock Exchange Handbook: 2020 – Issue 2

Exxaro Resources Ltd. CALENDAR Expected Status

Annual General Meeting May 2020 Unconfirmed

EXX

Next Interim Results Aug 2020 Unconfirmed

Next Final Results Mar 2021 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 358 706 754

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Final No 34 21 Apr 20 28 Apr 20 566.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Interim No 33 8 Oct 19 14 Oct 19 864.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001

Special No 4 8 Oct 19 14 Oct 19 897.00

Final No 32 6 May 19 13 May 19 555.00

NATURE OF BUSINESS:

Exxaro, a public company incorporated in South Africa and LIQUIDITY: Apr20 Ave 6m shares p.w., R802.1m(81.5% p.a.)

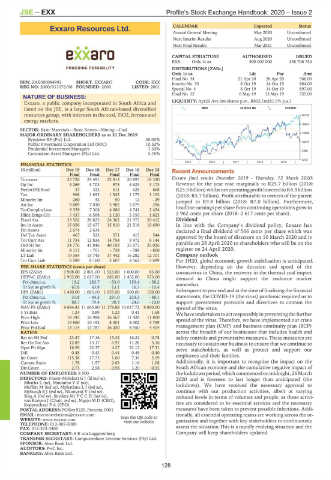

listed on the JSE, is a large South African-based diversified MINI 40 Week MA EXXARO

resources group, with interests in the coal, TiO2, ferrous and 20126

energy markets.

16943

SECTOR: Basic Materials—Basic Resrcs—Mining—Coal

13760

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Eyesizwe RF (Pty) Ltd. 30.00%

Public Investment Corporation Ltd (SOC) 10.52% 10577

Prudential Investment Managers 7.30%

Coronation Asset Managers (Pty) Ltd. 5.76% 7395

4212

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Recent Announcements

Final Final Final Final Final

Turnover 25 726 25 491 22 813 20 897 18 330 Exxaro final results December 2019 - Thursday, 12 March 2020:

Op Inc 4 269 5 703 975 4 623 3 173 Revenue for the year rose marginally to R25.7 billion (2018:

NetInt(Pd)Rcvd 37 322 611 628 668 R25.5billion)whilst netoperatingprofitloweredtoR4.3billion

Tax 968 1 653 1 542 1 179 1 102 (2018: R5.7 billion). Profit attributable to owners of the parent

Minority Int 260 32 50 12 - 29 jumped to R9.8 billion (2018: R7.0 billion). Furthermore,

Att Inc 9 809 7 030 5 982 5 679 296 headline earnings per share from continuing operations grew to

TotCompIncLoss 9 359 7 308 4 680 4 741 2 434

Hline Erngs-CO 7 437 6 568 2 120 5 155 1 623 2 962 cents per share (2018: 2 617 cents per share).

Fixed Ass 33 562 28 825 24 362 21 972 20 412 Dividend

Inv in Assoc 15 056 15 477 15 810 21 518 19 690 In line with the Company’s dividend policy, Exxaro has

Fin Assets 2 674 2 634 - - - declared a final dividend of 566 cents per share which was

Def Tax Asset 467 523 571 415 544 approved by the board of directors on 10 March 2020 and is

Tot Curr Ass 11 734 12 824 14 754 9 972 6 144

Ord SH Int 34 776 41 846 40 103 35 875 35 026 payable on 28 April 2020 to shareholders who will be on the

Minority Int 8 111 - 701 - 738 - 788 - 800 register on 24 April 2020.

LT Liab 19 364 15 745 17 442 16 282 12 701 Company outlook

Tot Curr Liab 6 589 8 160 5 607 8 562 5 699 For 1H20, global economic growth stabilisation is anticipated.

PER SHARE STATISTICS (cents per share) However, depending on the duration and speed of the

EPS (ZARc) 3 908.00 2 801.00 1 923.00 1 600.00 83.00 coronavirus in China, the recovery in the thermal coal import

HEPS-C (ZARc) 2 962.00 2 617.00 682.00 1 452.00 573.00 demand in China might support the seaborne market

Pct chng p.a. 13.2 283.7 - 53.0 153.4 - 58.2

Tr 5yr av grwth % 67.8 63.8 13.1 16.7 - 10.4 somewhat.

DPS (ZARc) 1 430.00 1 085.00 1 955.00 500.00 150.00 Subsequent to year end and at the time of finalising the financial

Pct chng p.a. 31.8 - 44.5 291.0 233.3 - 68.1 statements, the COVID-19 (the virus) pandemic required us to

Tr 5yr av grwth % 88.7 79.4 90.3 24.6 - 10.0 support government protocols and directives to contain the

NAV PS (ZARc) 9 694.83 11 665.80 11 179.88 10 017.72 9 800.00 spread of the virus.

3 Yr Beta 1.24 0.89 1.23 0.41 1.68 We have undertaken to act responsibly in preventing the further

Price High 18 345 16 988 16 567 11 428 11 800 spread of the virus. Therefore, we have implemented our crisis

Price Low 10 860 10 192 8 301 4 002 3 769

Price Prd End 13 114 13 787 16 250 8 950 4 404 management plan (CMP) and business continuity plan (BCP)

RATIOS across the breadth of our businesses that includes health and

Ret on SH Fnd 23.47 17.16 15.32 16.22 0.78 safety controls and preventative measures. These measures are

Ret On Tot Ass 12.89 13.17 6.92 11.28 3.16 necessary to sustain our business to ensure that we continue to

Oper Pft Mgn 16.59 22.37 4.27 22.12 17.31 serve stakeholders, as well as protect and support our

D:E 0.48 0.43 0.44 0.48 0.40 employees and their families.

Int Cover 115.38 17.73 1.60 7.36 5.19

Current Ratio 1.78 1.57 2.63 1.16 1.08 Additionally, it is important to recognise the impact on the

Div Cover 2.73 2.58 0.98 3.20 0.55 South African economy and the cumulative negative impact of

NUMBER OF EMPLOYEES: 8 500 the lockdownperiod, which commencedonmidnight, 26 March

DIRECTORS: Fraser-MoleketiGJ(ld ind ne), 2020 and is foreseen to last longer than anticipated (the

Mbatha L (ne), MntamboVZ(ne), lockdown). We have received the necessary approval to

Moffett M (ind ne), MphatlaneLI(ind ne),

MyburghEJ(ind ne), Nkonyeni V (ind ne), continue with our production activities, albeit at varying

Sing A (ind ne), Snyders MrPCCH(ind ne), reduced levels in terms of volumes and people, as these activi-

van Rooyen J (Chair, ind ne), Mgojo M D (CEO),

Koppeschaar P A (CFO) ties are considered to be essential services and the necessary

POSTAL ADDRESS:POBox9229, Pretoria,0001 measures have been taken to prevent possible infections. Addi-

EMAIL: investorrelations@exxaro.com tionally, all essential operating teams are working across the or-

WEBSITE: www.exxaro.com Scan the QR code to ganisation and together with key stakeholders to continuously

visit our website

TELEPHONE: 012-307-5000 assess the situation.This is a rapidly evolving situation and the

FAX: 012-323-3400

COMPANY SECRETARY: S E van Loggerenberg Company will keep shareholders updated.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Absa Bank Ltd.

AUDITORS: PwC Inc.

BANKERS: Absa Bank Ltd.

128