Page 125 - SHBe20.vp

P. 125

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – EFF

has a diverse portfolio of assets spanning production in Egypt; exploration

Efficient Group Ltd. and appraisal in the Democratic Republic of Congo; midstream project

relating to crude trading in Nigeria and material downstream distribution

EFF

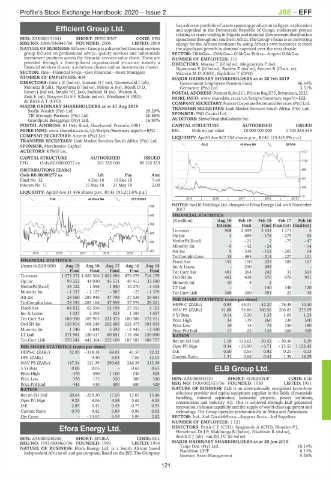

ISIN: ZAE000151841 SHORT: EFFICIENT CODE: EFG operations throughout southern Africa. The Group’s focus is on delivering

REG NO: 2006/036947/06 FOUNDED: 2006 LISTED: 2009 energy for the African continent by using Africa’s own resources to meet

NATURE OF BUSINESS: Efficient Group is a diversified financial services the significant growth in demand expected over the next decade.

group focused on professional advice, quality services and tailor-made SECTOR: Oil&Gas—Oil&Gas—Oil&Gas Prdcrs—Intgrtd Oil&Gas

investment products across the financial services value chain. These are NUMBER OF EMPLOYEES: 113

provided through a three-pillared organisational structure, namely a DIRECTORS: Masasa T (ld ind ne), Mngconkola P (ne),

financial services cluster, a solutions cluster and an investments cluster. Ngonyama V (ld ind ne), Radebe Z (ind ne), Seruwe B (Chair, ne),

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers Matroos M D (CEO), Gadzikwa T (CFO)

NUMBER OF EMPLOYEES: 409 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

DIRECTORS: CeleLZ(ind ne), GoosenOJ(ne), Groenewald I (alt), Government Employees Pension Fund 86.34%

Momoza B (alt), Ngonyama B (ind ne), Petrus A (ne), Roodt D D, Gentacure (Pty) Ltd. 3.51%

Rosen J (ind ne), SmalleNL(ne), Stefanel M (ne), Walton R, POSTAL ADDRESS:PostnetSuite211, PrivateBagX75,Bryanston,2021

Zeki E (ne), Booysen Dr S F (Chair, ind ne), Weidhase H (MD), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=EEL

de Klerk A T (CFO) COMPANY SECRETARY: FusionCorporateSecretarialServices(Pty)Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Sasfin Wealth (Pty) Ltd. 29.29% SPONSOR: PSG Capital Ltd.

TBI Strategic Partners (Pty) Ltd. 20.88%

Grondputs Beleggings (Pty) Ltd. 16.90% AUDITORS: SizweNtsalubaGobodo Inc.

POSTAL ADDRESS: 81 Dely Road, Hazelwood, Pretoria, 0081 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=EFG EEL Ords no par value 10 000 000 000 1 103 834 635

COMPANY SECRETARY: Acorim (Pty) Ltd. LIQUIDITY: Apr20 Ave 822 754 shares p.w., R142 123.4(3.9% p.a.)

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSOR: Merchantec Capital OILG 40 Week MA EFORA

AUDITORS: KPMG Inc. 1437

CAPITAL STRUCTURE AUTHORISED ISSUED

EFG Ords R0.00000277 ea 361 350 000 89 165 353 1152

DISTRIBUTIONS [ZARc] 866

Ords R0.00000277 ea Ldt Pay Amt

581

Final No 12 4 Dec 18 10 Dec 18 7.40

Interim No 11 15 May 18 21 May 18 2.00

295

LIQUIDITY: Apr20 Ave 31 496 shares p.w., R143 193.2(1.8% p.a.)

10

FINI 40 Week MA EFFICIENT 2015 | 2016 | 2017 | 2018 | 2019 |

NOTES: SacOil Holdings Ltd. changed to Efora Energy Ltd. on 8 November

728

2017.

642 FINANCIAL STATISTICS

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

556 Interim Final Final Final(rst) Final(rst)

Turnover 968 2 599 2 631 1 171 5

469

Op Inc 3 - 699 - 176 - 275 53

383 NetIntPd(Rcvd) - - 21 2 - 75 - 47

Minority Int - 6 - 42 - 24 - - 14

297 Att Inc 9 - 538 - 152 - 205 54

2015 | 2016 | 2017 | 2018 | 2019 |

TotCompIncLoss 18 - 495 - 214 - 227 101

FINANCIAL STATISTICS Fixed Ass 155 150 253 185 167

(Amts in ZAR’000) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15 Inv & Loans - 230 458 - -

Final Final Final Final Final Tot Curr Ass 481 264 242 31 503

Turnover 1 073 372 1 083 506 1 002 096 879 978 716 179 Ord SH Int 462 438 576 676 901

Op Inc 99 252 44 030 45 511 49 412 32 580 Minority Int - 10 - 4 2 - -

NetIntPd(Rcvd) 35 122 - 1 558 - 1 850 - 10 270 - 4 415 LT Liab - - 140 140 120

Minority Int - 1 327 - 2 127 - 907 - 23 - 1 379 Tot Curr Liab 368 390 591 22 35

Att Inc 28 560 - 285 946 47 798 37 538 30 681 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 29 193 - 283 166 47 959 37 576 29 201 HEPS-C (ZARc) 0.85 - 45.31 - 42.20 - 76.49 10.40

Fixed Ass 64 822 62 596 52 198 27 353 4 103

NAV PS (ZARc) 41.88 56.86 160.56 206.83 275.59

Inv & Loans 1 027 2 393 323 1 383 1 657 3 Yr Beta 0.14 0.20 1.33 1.05 1.23

Tot Curr Ass 188 950 183 903 223 475 180 588 172 411 Price High 34 139 260 330 500

Ord SH Int 130 814 108 249 262 406 222 473 191 915 Price Low 10 15 75 150 190

Minority Int 1 140 2 848 5 592 - 2 443 - 2 420 Price Prd End 17 22 138 260 300

LT Liab 271 561 120 417 60 851 116 456 129 050 RATIOS

Tot Curr Liab 270 241 442 364 252 109 187 587 186 757 Ret on SH Fnd 1.18 - 133.62 - 30.42 - 30.36 4.39

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 0.34 - 26.90 - 6.71 - 23.52 1 122.42

HEPS-C (ZARc) 32.95 - 318.18 69.01 41.53 32.32 D:E 0.50 0.55 0.92 0.21 0.13

DPS (ZARc) - 9.40 8.04 7.06 12.03 Current Ratio 1.31 0.68 0.41 1.39 14.29

NAV PS (ZARc) 147.24 121.39 290.68 246.28 212.38

3 Yr Beta 0.06 0.05 - 0.69 0.63 ELB Group Ltd.

Price High 470 450 1 100 740 525 ELB

Price Low 370 175 320 380 330 ISIN: ZAE000035101 SHORT: ELBGROUP CODE: ELR

Price Prd End 445 410 400 680 420 REG NO: 1930/002553/06 FOUNDED: 1930 LISTED: 1951

RATIOS NATURE OF BUSINESS: ELB is an internationally recognised know-how

Ret on SH Fnd 20.64 - 259.30 17.50 17.05 15.46 solutions provider and capital equipment supplier in the fields of materials

handling, mineral separation, industrial projects, power solutions,

Oper Pft Mgn 9.25 4.06 4.54 5.62 4.55 construction and Industry 4.0. This is achieved through ELB generated

D:E 2.89 3.42 0.49 0.75 0.93 innovation, in-house capability and the supply of world-class equipment and

Current Ratio 0.70 0.42 0.89 0.96 0.92 technology. The Group operates predominantly in Africa and Australasia.

Div Cover - - 33.82 6.59 5.89 2.82 SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Ind Suppliers

NUMBER OF EMPLOYEES: 1 121

Efora Energy Ltd. DIRECTORS: Pettit C E (CEO), Spagnuolo A (CFO), Blunden P J,

Herselman Dr J P, Makhunga B (ind ne), Nkabinde R (ind ne),

EFO SmithCJ(alt), van ZylJC(ld ind ne)

ISIN: ZAE000248258 SHORT: EFORA CODE: EEL

REG NO: 1993/000460/06 FOUNDED: 1993 LISTED: 1994 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

NATURE OF BUSINESS: Efora Energy Ltd. is a South African based Tanjo One (Pty) Ltd. 10.14%

independent African oil and gas company, listed on the JSE. The Company Namibian GIPF 6.13%

Investec Asset Management 5.26%

121