Page 127 - SHBe20.vp

P. 127

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – EMI

FINANCIAL STATISTICS Investments 2 357 2 316 1 106 - -

(R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 FixedAss/Prop 11 139 11 566 11 583 13 065 13 070

Interim Final(rst) Final(rst) Final(rst) Final(rst) Tot Curr Ass 350 399 2 314 1 576 1 209

Turnover 1 231 2 359 2 318 2 303 2 416 Total Ass 14 406 14 805 15 171 14 733 14 294

Op Inc 147 175 - 1 518 242 261 Tot Curr Liab 1 567 1 629 2 979 2 368 1 468

NetIntPd(Rcvd) 11 25 37 48 43 PER SHARE STATISTICS (cents per share)

Minority Int 31 35 - 34 56 - 25 HEPS-C (ZARc) 85.34 159.51 176.09 101.10 164.75

Att Inc 66 48 - 1 579 105 - 64 DPS (ZARc) 74.10 151.34 146.80 143.18 146.10

TotCompIncLoss 103 80 - 1 620 93 - 57 NAV PS (ZARc) 1 787.40 1 790.80 1 757.50 1 734.70 1 734.90

Fixed Ass 859 848 784 942 1 014 3 Yr Beta 0.20 0.19 0.39 0.55 0.82

Tot Curr Ass 1 528 1 380 1 631 1 583 1 259 Price Prd End 1 321 1 380 1 434 1 386 1 354

Ord SH Int 4 629 4 601 4 562 6 155 6 103 Price High 1 397 1 719 1 700 1 538 1 901

Minority Int 1 037 1 004 997 1 027 988 Price Low 1 160 1 000 1 249 1 330 1 221

LT Liab 752 650 684 878 990 RATIOS

Tot Curr Liab 875 891 1 114 1 146 955

RetOnSH Funds 8.71 9.87 9.46 8.06 7.23

PER SHARE STATISTICS (cents per share) RetOnTotAss 8.34 8.73 7.93 6.76 7.90

HEPS-C (ZARc) 15.70 16.13 1.97 18.35 7.33 Debt:Equity 0.57 0.61 0.64 0.61 0.56

DPS (ZARc) 10.00 8.00 - - - OperRetOnInv 6.09 6.61 8.32 7.54 8.55

NAV PS (ZARc) 1 044.00 1 038.00 1 027.00 1 384.00 1 369.00 OpInc:Turnover 53.35 54.40 59.60 57.23 62.20

3 Yr Beta 0.52 0.88 - 0.03 - 0.02 1.93

Price High 350 420 769 1 200 1 460 enX Group Ltd.

Price Low 234 244 262 633 786

ENX

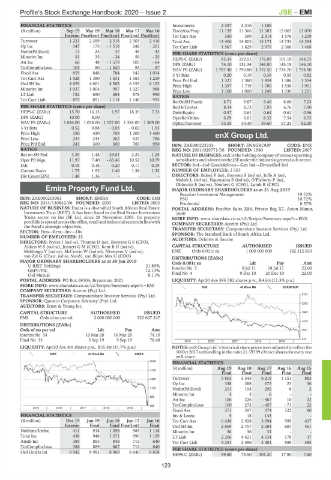

Price Prd End 243 300 300 769 950 ISIN: ZAE000222253 SHORT: ENXGROUP CODE: ENX

RATIOS REG NO: 2001/029771/06 FOUNDED: 1980 LISTED: 2007

Ret on SH Fnd 3.39 1.48 - 29.01 2.24 - 1.25 NATURE OF BUSINESS: enX is the holding company of various operating

Oper Pft Mgn 11.97 7.40 - 65.46 10.52 10.79 subsidiariesandislistedontheJSEundertheIndustrialgeneralsub-sector.

D:E 0.18 0.18 0.20 0.17 0.19 SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind

Current Ratio 1.75 1.55 1.46 1.38 1.32 NUMBER OF EMPLOYEES: 2 503

Div Cover(EPS) 1.48 1.36 - - - DIRECTORS: Baloyi P (ne), Booysen S (ind ne), Joffe A (ne),

Molefe L (ind ne), Ngonyama B (ind ne), O’Flaherty P (ne),

Oblowitz E (ind ne), Neubert G (CEO), Lumb R (CFO)

Emira Property Fund Ltd. MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

EMI Beaufort Investment Management 19.72%

ISIN: ZAE000203063 SHORT: EMIRA CODE: EMI PSG 10.72%

REG NO: 2014/130842/06 FOUNDED: 2003 LISTED: 2003 Prudential 8.57%

NATURE OF BUSINESS: Emira is a diversified South African Real Estate POSTAL ADDRESS: PostNet Suite X86, Private Bag X7, Aston Manor,

Investment Trust (REIT). It has been listed in the Real Estate Investment 1630

Trusts sector on the JSE Ltd. since 28 November 2003. Its property MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ENX

portfolioisspreadacrossthe office, retail andindustrialsectorsinlinewith COMPANY SECRETARY: Acorim (Pty) Ltd.

the Fund’s strategic objectives. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: Fins—Rest—Inv—Div SPONSOR: The Standard Bank of South Africa Ltd.

NUMBER OF EMPLOYEES: 25 AUDITORS: Deloitte & Touche

DIRECTORS: Nyker J (ind ne), Thomas D (ne), Booyens G S (CFO),

AitkenMS(ind ne), Jennett G M (CEO), KentBH(ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Mahlangu V (ind ne), McCurrie W (ind ne), Nkonyeni V (ind ne), ENX Ords 0.001c ea 1 000 000 000 182 312 650

van Zyl G (Chair, ind ne, Namb), van Biljon Mrs U (COO) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 Ords 0.001c ea Ldt Pay Amt

U REIT Holdings 21.89% Interim No 5 8 Jul 11 18 Jul 11 22.00

GEPF/PIC 12.13%

Old Mutual 8.11% Final No 4 9 Dec 10 20 Dec 10 22.00

POSTAL ADDRESS: PO Box 69104, Bryanston, 2021 LIQUIDITY: Apr20 Ave 396 382 shares p.w., R4.6m(11.3% p.a.)

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=EMI IIND 40 Week MA ENXGROUP

COMPANY SECRETARY: Acorim (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 2724

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: Ernst & Young Inc. 2293

CAPITAL STRUCTURE AUTHORISED ISSUED 1862

EMI Ords of no par val 2 000 000 000 522 667 247

1432

DISTRIBUTIONS [ZARc]

Ords of no par val Ldt Pay Amt 1001

Interim No 34 10 Mar 20 16 Mar 20 74.10

Final No 33 3 Sep 19 9 Sep 19 78.48 2015 | 2016 | 2017 | 2018 | 2019 | 570

LIQUIDITY: Apr20 Ave 4m shares p.w., R55.4m(41.7% p.a.) NOTES: enX Group Ltd.’s historical share prices were adjusted to reflect the

10 Oct 2017 unbundling in the ratio 21.39799 eXtract shares for every one

SAPY 40 Week MA EMIRA

enX share.

2049

FINANCIAL STATISTICS

(R million) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15

1759

Final Final Final Final Final

1469 Turnover 5 803 5 345 6 218 1 151 883

Op Inc 338 388 673 23 36

1179 NetIntPd(Rcvd) 213 194 292 8 2

Minority Int 3 5 6 - -

889

Att Inc 106 226 - 467 10 22

599 TotCompIncLoss 100 272 - 457 - 71 22

2015 | 2016 | 2017 | 2018 | 2019 |

Fixed Ass 371 397 374 122 80

FINANCIAL STATISTICS Inv & Loans 5 18 143 - -

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Tot Curr Ass 6 438 2 928 3 094 999 637

Interim Final Final Final(rst) Final Ord SH Int 2 869 2 757 2 684 687 461

NetRent/InvInc 411 918 1 056 985 1 118 Minority Int 36 36 31 - -

Total Inc 438 948 1 071 996 1 129 LT Liab 2 206 4 421 4 534 178 37

Attrib Inc 389 883 848 712 640 Tot Curr Liab 5 251 2 496 2 401 559 385

TotCompIncLoss 386 889 867 712 640 PER SHARE STATISTICS (cents per share)

Ord UntHs Int 8 942 8 983 8 969 8 840 8 858

HEPS-C (ZARc) 99.80 73.50 - 301.20 17.90 7.60

123