Page 80 - SHB 2020 Issue 1

P. 80

JSE – ABS Profile’s Stock Exchange Handbook: 2020 – Issue 1

WEBSITE: www.absa.africa/absaafrica

Absa Group Ltd. TELE PHONE: 011-350-4000

ABS COMPANY SECRETARY: Nadine R Drutman

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSORS: Absa Bank Ltd., JP Morgan Equities

South Africa (Pty) Ltd.

AUDITORS: Ernst & Young Inc.

BANKERS: Absa Bank Ltd.

Scan the QR code to

visit our Investor

Centre

CALENDAR Expected Status

Next Final Results Mar 2020 Un con firmed

ISIN: ZAE000255915 SHORT: ABSA CODE: ABG

REG NO: 1986/003934/06 FOUNDED: 1986 LISTED: 1986 Annual General Meeting Jun 2020 Un con firmed

Next Interim Results Aug 2020 Un con firmed

NATURE OF BUSINESS:

Absa Group is a di ver si fied financial services provider offering CAPITAL STRUCTURE AUTHORISED ISSUED

an in te grated set of products and services across personal and ABG Ords 200c ea 880 467 500 847 750 679

business banking, credit cards, corporate and investment DISTRIBUTIONS [ZARc]

banking, wealth and in vest ment man age ment and insurance. Ords 200c ea Ldt Pay Amt

With its long-standing presence in 12 African markets and its Interim No 66 10 Sep 19 16 Sep 19 505.00

9 Apr 19

regional and global expertise, the Group a strong platform to Final No 65 11 Sep 18 15 Apr 19 620.00

490.00

Interim No 64

17 Sep 18

capture the growth op por tu nity in Africa. Final No 63 10 Apr 18 16 Apr 18 595.00

SECTOR: Fins—Banks—Banks—Banks LIQUIDITY: Nov19 Ave 13m shares p.w., R2 197.4m(80.2% p.a.)

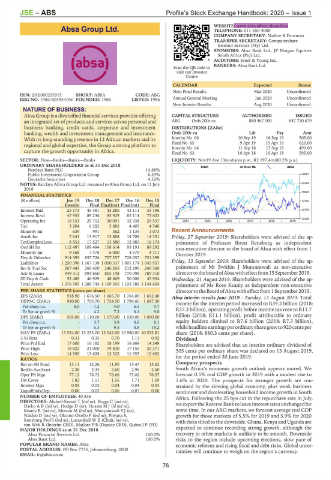

ORDINARY SHAREHOLDERS as at 31 Dec 2018 BANK 40 Week MA ABSA

Barclays Bank PLC 14.88%

Public Investment Corporation Group 6.29% 24881

Deutsche Securities 4.32%

NOTES: Barclays Africa Group Ltd. renamed to Absa Group Ltd. on 11 July 22354

2018

19828

FINANCIAL STATISTICS

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 17302

Interim Final Final(rst) Final(rst) Final

Interest Paid 25 173 45 481 43 285 43 111 35 196 14775

Interest Rcvd 47 953 89 236 85 929 85 114 73 603

12249

Operating Inc 16 153 29 712 30 091 32 438 29 537 2014 | 2015 | 2016 | 2017 | 2018 | 2019

Tax 3 204 6 282 5 882 4 405 4 540

Minority Int 639 991 362 1 139 1 073 Recent Announcements

Attrib Inc 7 641 13 917 13 888 14 708 14 331 Friday, 27 September 2019: Share hold ers were advised of the ap -

TotCompIncLoss 8 551 17 527 13 580 12 685 16 174 pointment of Professor Ihron Rensburg as independent

Ord SH Int 112 497 109 484 108 614 93 191 89 292 non-executive director to the board of Absa with effect from 1

Minority Int 9 168 7 478 6 000 4 579 4 711 October 2019.

Dep & OtherAcc 914 395 857 726 757 257 728 057 751 399

Liabilities 1 250 396 1 167 138 1 050 337 1 001 174 1 045 957 Friday, 13 September 2019: Share hold ers were advised of the ap -

Inv & Trad Sec 267 443 266 400 246 265 212 296 240 360 pointment of Mr Swithin J Munyantwali as non-executive

Adv & Loans 949 312 894 860 805 198 770 098 789 310 director to the board of Absa with effect from 15 September 2019.

ST Dep & Cash 52 489 46 929 48 669 50 006 45 904 Wednesday, 21 August 2019: Share hold ers were advised of the ap -

Total Assets 1 376 705 1 288 744 1 169 595 1 103 588 1 144 604 point ment of Ms Rose Keanly as in de pend ent non-executive

PER SHARE STATISTICS (cents per share) director to the Board of Absa with effect from 1 September 2019.

EPS (ZARc) 918.90 1 676.50 1 665.70 1 764.00 1 692.40 Absa interim results June 2019 - Tuesday, 13 August 2019: Total

HEPS-C (ZARc) 920.00 1 703.70 1 724.50 1 796.60 1 687.20 income for the interim period increased to R39.2 billion (2018:

Pct chng p.a. 8.0 - 1.2 - 4.0 6.5 9.7 R37.3 billion), operating profit before income tax rose to R11.7

Tr 5yr av grwth % - 4.2 7.2 6.1 9.0

DPS (ZARc) 505.00 1 110.00 1 070.00 1 030.00 1 000.00 billion (2018: R11.1 billion), profit attributable to ordinary

Pct chng p.a. - 3.7 3.9 3.0 8.1 equity holders climbed to R7.6 billion (2018: R7.3 billion),

Tr 5yr av grwth % - 6.3 9.5 8.8 18.2 while headline earnings per ordinary share grew to 920 cents per

NAV PS (ZARc) 13 534.00 13 233.00 13 042.00 10 980.00 10 532.81 share (2018: 880.3 cents per share).

3 Yr Beta 0.31 0.35 0.70 1.13 0.92 Dividend

Price Prd End 17 600 16 182 18 199 16 869 14 349 Share hold ers are advised that an interim ordinary dividend of

Price High 18 822 21 000 19 830 17 155 20 371 505 cents per ordinary share was declared on 13 August 2019,

Price Low 14 950 13 628 13 322 11 955 10 662 for the period ended 30 June 2019.

RATIOS

Ret on SH Fund 13.11 12.26 11.95 15.47 15.62 Company prospects

RetOn AveAsset 2.38 2.34 2.60 2.96 2.60 South Africa’s economic growth outlook appears muted. We

Oper Pft Mgn 77.12 78.72 76.66 73.02 76.57 forecast 0.5% real GDP growth in 2019 with a modest rise to

Div Cover 1.82 1.51 1.56 1.71 1.69 1.6% in 2020. The prospects for stronger growth are con-

Interest Mgn 0.03 0.03 0.04 0.04 0.03 strained by the slowing global economy, plus weak business

LiquidFnds:Dep 0.06 0.05 0.06 0.07 0.06

sentiment and de cel er at ing household income growth in South

NUMBER OF EMPLOYEES: 40 856 Africa. Following the 25 bps cut in the re pur chase rate in July,

DIRECTORS: Abdool-Samad T (ind ne), Beggs C (ind ne),

Darko A B (ind ne), Hodge D (ne), Husain M J (ld ind ne), we expect the Reserve Bank to leave interest rates unchanged for

Keanly R (ind ne), Merson M (ind ne), Munyantwali S J (ne), some time. In our ARO markets, we forecast average real GDP

Naidoo D (ind ne), Okomo-Okello F (ind ne), Pityana S, growth for those markets of 5.5% for 2019 and 5.9% for 2020

Rensburg Prof I (ind ne), Lucas-Bull W E (Chair, ind ne), with risks tilted to the downside. Ghana, Kenya and Uganda are

van Wyk R (Interim CEO), Matlare P B (Deputy CEO), Quinn J P (FD)

MAJOR HOLDINGS as at 31 Dec 2018 expected to continue recording strong growth, although the

Absa Financial Services Ltd. 100.0% recovery in other markets is unlikely to be smooth. Downside

Absa Bank Ltd. 100.0% risks to the region include upcoming elections, slow pace of

POPULAR BRAND NAMES: Absa economic reforms and rising fiscal and debt risks. Global un cer -

POSTAL ADDRESS: PO Box 7735, Johannesburg, 2000 tain ties will continue to weigh on the region’s currency.

EMAIL: ir@absa.co.za

76