Page 257 - SHB 2020 Issue 1

P. 257

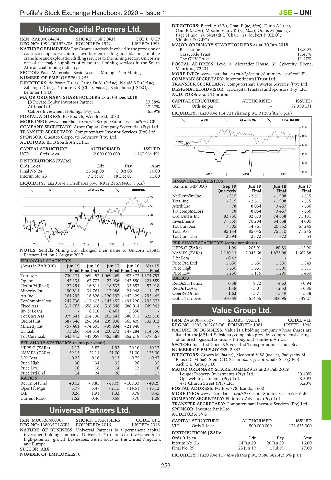

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – UNI

DIRECTORS: Birrell A (UK), Chan F (ne, Mau), Dunn A J (ne),

Unicorn Capital Partners Ltd. Gain P (ind ne), Moothoosamy K (ne, Mau), Ooms M (ind ne),

Page N (ind ne), Nestadt L (Chair, ne), Joubert P (CEO),

UNI

ISIN: ZAE000244745 SHORT: UNI CORN CODE: UCP Vinokur D (CFO)

REG NO: 1992/001973/06 FOUNDED: 1972 LISTED: 1993 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

NATURE OF BUSINESS: The Group is actively involved in the provision of Blackstone 13.82%

contracted opencast mining, overburden drilling and blasting, mobile Cassycode Trust 11.47%

crane hire and exploration drilling services to the mining sector. Unicorn is The GHV Trust 11.47%

one of the major suppliers of outsourced mining services in the South POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene,

African coal mining industry. Mauritius, 72201

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=UPL

NUMBER OF EMPLOYEES: 1 253 COMPANY SECRETARY: Intercontinental Trust Ltd.

DIRECTORS: de Bruyn T (ne), Gama Dr M (ind ne), Naudé S P (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Zihlangu D (ne), Patmore R B (Chair, ind ne), Badenhorst J (CEO), DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Lemmer J (FD) AUDITORS: Grant Thornton

MAJOR ORDINARY SHAREHOLDERS as at 03 Dec 2019

JB Private Equity Investors Partner 37.38% CAPITAL STRUCTURE AUTHORISED ISSUED

Afrimat Ltd. 27.27% UPL Ords no par - 72 350 131

Calibre Investment Holdings (Pty) Ltd. 6.39% LIQUIDITY: Jan20 Ave 114 721 shares p.w., R1.9m(8.2% p.a.)

POSTAL ADDRESS: PO Box 76, Woodmead, 2080

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=UCP ALSH 40 Week MA UPARTNERS

COMPANY SECRETARY: Arbor Capital Company Secretarial (Pty) Ltd. 2114

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. 1914

AUDITORS: BDO South Africa Inc.

1714

CAPITAL STRUCTURE AUTHORISED ISSUED

UCP Ords 1c ea 2 000 000 000 1 167 564 491 1515

DISTRIBUTIONS [ZARc]

1315

Ords 1c ea Ldt Pay Amt

Final No 24 26 Sep 08 6 Oct 08 10.00 1115

Interim No 23 7 Dec 07 18 Dec 07 11.00 2017 | 2018 | 2019

FINANCIAL STATISTICS

LIQUIDITY: Jan20 Ave 11m shares p.w., R912 296.9(49.5% p.a.)

(Amts in GBP’000) Sep 19 Jun 19 Jun 18 Jun 17

METL 40 Week MA UNICORN Quarterly Final Final Final

NetRent/InvInc - 315 - 2 611 - 1 908 - 615

39

Total Inc - 315 - 2 611 - 1 908 - 615

34 Attrib Inc 78 8 034 3 457 - 666

TotCompIncLoss 78 8 034 3 457 - 666

28

Ord UntHs Int 82 750 82 673 74 638 71 181

Investments 77 339 70 284 54 658 4 000

23

Tot Curr Ass 7 805 14 761 20 852 67 245

Total Ass 85 144 85 045 75 510 71 245

17

Tot Curr Liab 2 394 2 372 872 64

12 PER SHARE STATISTICS (cents per share)

2015 | 2016 | 2017 | 2018 | 2019

HEPS-C (ZARc) 1.99 203.91 80.83 - 15.90

NOTES: Sentula Mining Ltd. changed their name to Unicorn Capital

Partners Ltd. on 2 August 2017. NAV PS (ZARc) 2 130.13 2 043.68 1 873.08 1 667.88

3 Yr Beta - 0.42 - - -

FINANCIAL STATISTICS Price Prd End 1 650 1 650 1 550 1 549

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Mar 15 Price High 1 650 1 651 1 600 1 811

Final Final(rst) Final Final(rst) Final

Turnover 730 171 969 453 1 069 269 982 373 1 374 753 Price Low 1 250 1 115 1 290 1 450

RATIOS

Op Inc 42 134 62 702 - 22 936 - 142 550 - 221 589 RetOnSH Funds 0.38 9.72 4.63 - 0.94

NetIntPd(Rcvd) 22 294 16 811 18 533 35 652 52 918 RetOnTotAss - 1.48 - 3.07 - 2.53 - 0.86

Minority Int 90 811 - 34 761 - 17 986 - 21 948 - 1 467

Att Inc 161 292 16 826 - 120 197 - 447 429 - 293 445 OperRetOnInv - 1.63 - 3.71 - 3.49 - 15.38

TotCompIncLoss 247 736 - 17 403 - 143 457 - 491 220 - 292 573 OpInc:Turnover - 370.59 - 614.35 - 300.95 - 149.27

Fixed Ass 317 763 656 606 516 548 586 014 749 942

Inv & Loans - 8 110 6 461 2 850 - Value Group Ltd.

Tot Curr Ass 979 841 204 738 262 841 388 911 622 818 VAL

Ord SH Int 687 346 256 864 239 938 365 409 732 012 ISIN: ZAE000016507 SHORT: VALUE CODE: VLE

Minority Int - 57 461 - 74 695 - 39 934 - 21 948 - REG NO: 1997/002203/06 FOUNDED: 1981 LISTED: 1998

LT Liab 73 266 304 814 200 273 147 284 114 856 NATURE OF BUSINESS: Value is a holding company whose shares are

Tot Curr Liab 643 415 448 058 455 389 552 218 577 567 listed on the JSE Ltd. Subsidiary companies provide a comprehensive range

of tailored logistical solutions throughout southern Africa.

PER SHARE STATISTICS (cents per share) SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

HEPS-C (ZARc) 1.17 3.87 - 1.93 - 20.10 - 40.17 NUMBER OF EMPLOYEES: 2 843

NAV PS (ZARc) 59.15 22.11 21.00 31.00 123.00 DIRECTORS: Groves M (ind ne), Mcobothi V W (ind ne), Padiyachy M,

3 Yr Beta - 0.25 0.16 0.13 - 0.75 - 0.47 Phosa Dr M (ne), Stein C D (Chair, ind ne), Gottschalk S D (CEO),

Price High 30 34 35 26 35 Sack C L (Group FD)

Price Low 10 18 14 12 16 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Price Prd End 14 24 26 17 17 Lougot Property Investments (Pty) Ltd. 50.40%

RATIOS Opsiweb Investments (Pty) Ltd. 8.50%

Ret on SH Fnd 40.02 - 9.85 - 69.09 - 109.33 - 40.29 471 Church Street (Pty) Ltd. 5.20%

Oper Pft Mgn 5.77 6.47 - 2.15 - 14.51 - 16.12 POSTAL ADDRESS: PO Box 778, Isando, 1600

D:E 0.26 1.91 1.33 0.78 0.45 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=VLE

Current Ratio 1.52 0.46 0.58 0.70 1.08 COMPANY SECRETARY: Fluidrock Advisory (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Universal Partners Ltd. SPONSOR: Investec Bank Ltd.

AUDITORS: SVG

UNI

ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL CAPITAL STRUCTURE AUTHORISED ISSUED

REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016 VLE Ords 0.1c ea 500 000 000 172 635 000

NATURE OF BUSINESS: Universal Partners is a permanent capital

investmentholding company. Universal Partners seek investments in DISTRIBUTIONS [ZARc]

high-potential, growth businesses, with a focus on the United Kingdom, Ords 0.1c ea Ldt Pay Amt

and Europe. Interim No 26 14 Jan 20 20 Jan 20 16.00

SECTOR: AltX Final No 25 25 Jun 19 1 Jul 19 27.00

NUMBER OF EMPLOYEES: 0 LIQUIDITY: Jan20 Ave 117 494 shares p.w., R686 682.4(3.5% p.a.)

253