Page 254 - SHB 2020 Issue 1

P. 254

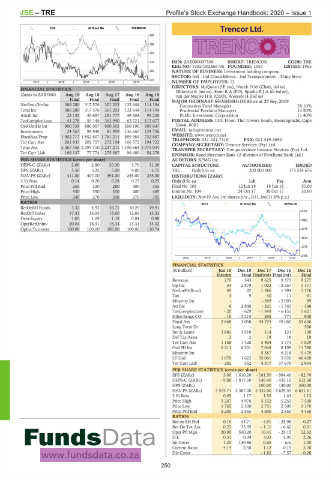

JSE – TRE Profile’s Stock Exchange Handbook: 2020 – Issue 1

Trencor Ltd.

EQII 40 Week MA TREMATON

428 TRE

392

355

319 ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE

REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955

283 NATURE OF BUSINESS: Investment holding company.

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

247 NUMBER OF EMPLOYEES: 12

2015 | 2016 | 2017 | 2018 | 2019

DIRECTORS: McQueen J E (ne), Nurek D M (Chair, ind ne),

FINANCIAL STATISTICS Oblowitz E (ind ne), Sieni R A (FD), Sparks R J A (ld ind ne),

(Amts in ZAR’000) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15 van der Merwe H R (CEO), Wessels H (ind ne)

Final Final Final Final Final MAJOR ORDINARY SHAREHOLDERS as at 27 Sep 2019

NetRent/InvInc 386 280 317 576 301 203 132 644 114 194 Coronation Fund Managers 28.10%

Total Inc 386 280 317 576 301 203 132 644 114 194 Prudential Portfolio Managers 14.90%

Attrib Inc 22 135 35 657 291 777 49 504 95 235 Public Investment Corporation 11.40%

TotCompIncLoss 41 278 59 144 363 990 62 721 117 677 POSTAL ADDRESS: 13th Floor, The Towers South, Heerengracht, Cape

Ord UntHs Int 900 739 880 057 850 305 556 190 509 647 Town, 8001

Investments 24 563 94 848 81 959 136 660 124 726 EMAIL: info@trencor.net

FixedAss/Prop 1 902 717 1 852 807 1 761 211 859 584 732 887 WEBSITE: www.trencor.net FAX: 021-419-3692

TELE PHONE: 021-421-7310

Tot Curr Ass 261 835 202 757 272 104 166 572 194 722 COMPANY SECRETARY: Trencor Services (Pty) Ltd.

Total Ass 2 367 556 2 297 710 2 237 211 1 190 664 1 075 034 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Tot Curr Liab 166 137 77 774 275 387 96 689 54 270

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

PER SHARE STATISTICS (cents per share) AUDITORS: KPMG Inc.

HEPS-C (ZARc) 2.00 2.80 20.30 1.70 11.20 CAPITAL STRUCTURE AUTHORISED ISSUED

DPS (ZARc) 5.50 5.25 5.00 4.00 3.75 TRE Ords 0.5c ea 200 000 000 173 534 676

NAV PS (ZARc) 411.00 407.00 391.00 255.00 235.00 DISTRIBUTIONS [ZARc]

3 Yr Beta 0.14 0.20 0.28 0.27 0.25 Ords 0.5c ea Ldt Pay Amt

Price Prd End 255 320 280 300 355 Final No 105 12 Jun 18 18 Jun 18 50.00

Price High 330 350 330 400 485 Interim No 104 24 Oct 17 30 Oct 17 50.00

Price Low 240 270 248 270 305 LIQUIDITY: Nov19 Ave 1m shares p.w., R31.3m(31.8% p.a.)

RATIOS

INDT 40 Week MA TRENCOR

RetOnSH Funds 3.32 4.92 36.71 10.25 19.91

8187

RetOnTotAss 17.41 14.93 15.60 12.89 13.53

Debt:Equity 1.05 1.09 1.18 0.84 0.88

6983

OperRetOnInv 20.04 16.31 16.34 13.31 13.32

OpInc:Turnover 100.00 100.00 100.00 100.00 110.74 5779

4574

3370

2166

2014 | 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final(rst) Final(rst) Final

Revenue 270 543 9 625 9 373 9 277

Op Inc 54 2 879 1 002 - 2 357 1 171

NetIntPd(Rcvd) 45 22 1 586 1 394 1 176

Tax 3 9 30 - 11 61

Minority Int - - - 289 - 2 003 89

Att Inc 6 2 848 - 321 - 1 743 - 146

TotCompIncLoss - 20 - 629 - 1 849 - 6 151 5 621

Hline Erngs-CO - 16 - 3 215 265 - 771 908

Fixed Ass 2 868 3 058 44 793 49 060 59 636

Long Term Dr - - - - 506

Inv & Loans 3 885 3 910 114 121 190

Def Tax Asset 2 2 19 18 19

Tot Curr Ass 1 168 1 426 5 404 5 773 7 829

Ord SH Int 6 211 6 231 7 048 8 199 11 780

Minority Int - - 5 387 6 218 9 479

LT Liab 1 670 1 622 35 061 5 026 46 428

Tot Curr Liab 282 552 4 817 37 679 2 904

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 3.00 1 610.20 - 181.50 - 984.40 - 82.70

HEPS-C (ZARc) - 9.00 - 1 817.50 149.40 - 435.10 512.60

DPS (ZARc) - - 100.00 130.00 300.00

NAV PS (ZARc) 3 575.71 3 587.00 5 437.00 4 629.59 6 651.61

3 Yr Beta 0.65 1.17 1.55 1.43 1.13

Price High 3 247 4 976 5 332 5 250 7 500

Price Low 1 765 2 300 2 731 2 500 3 370

Price Prd End 2 200 2 855 4 800 2 850 4 450

RATIOS

Ret on SH Fnd 0.19 45.71 - 4.91 - 25.98 - 0.27

Ret On Tot Ass 0.22 33.99 - 1.11 - 6.62 0.01

Oper Pft Mgn 20.00 530.20 10.41 - 25.15 12.62

D:E 0.31 0.34 3.03 2.90 2.26

Int Cover 1.20 130.86 0.63 n/a 1.00

Current Ratio 4.14 2.58 1.12 0.15 2.70

Div Cover - - - 1.82 - 7.57 - 0.28

250