Page 174 - SHB 2020 Issue 1

P. 174

JSE – LIB Profile’s Stock Exchange Handbook: 2020 – Issue 1

Liberty Holdings Ltd. Liberty Two Degrees

LIB LIB

ISIN: ZAE000127148 SHORT: LIB-HOLD CODE: LBH ISIN: ZAE000260576 SHORT: LIBERTY2D CODE: L2D

ISIN: ZAE000004040 SHORT: LIBHOLD11 CODE: LBHP REG NO: 2007/029492/07 FOUNDED: 2016 LISTED: 2016

REG NO: 1968/002095/06 FOUNDED: 1968 LISTED: 1968 NATURE OF BUSINESS: Liberty Two Degrees is a portfolio created under

NATURE OF BUSINESS: Liberty is a financial services group that offers an the Liberty Two Degrees Scheme in terms of the CISCA to afford investors

extensive, market-leading range of products and services to help growth in income and capital by investing at fair prices in a balanced spread

customers build and protect their wealth and lifestyle. These include life of immovable properties and related assets permitted by the Trust Deed.

and health related insurance, investment management and financial The Liberty Two Degrees Scheme was registered by the Registrar on 28

support for retirement. October 2016 and is to be managed by STANLIB REIT Fund Managers.

SECTOR: Fins—Insurance—Life Insurance—Life Insurance Liberty Two Degrees will invest in the Liberty Property Portfolio

NUMBER OF EMPLOYEES: 10 563 immediately prior to the listing.

DIRECTORS: Criticos N (ind ne), Cunningham A P (ind ne), Hlahla SECTOR: Fins—Rest—Inv—Div

M W (ind ne), Khan N (ind ne), Ridley S (ne), Roskruge C (ind ne), NUMBER OF EMPLOYEES: 0

Roskruge Cele C L (ne), Sibisi Dr S P (ind ne), Skweyiya T (ind ne), DIRECTORS: Adams Z (ne), Band A (ind ne), Cesman W E (ld ind ne),

Suleman Y (ind ne), Sutcliffe J H (ind ne, UK), Walker H (ind ne), Munro D C (ne), Ntuli L (ind ne), Beattie A (CEO), Snyders J (FD)

Wharton-Hood P G (ne), Maree J H (Chair, ne), Munro D C (CEO), Band A MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

W B (Acting Chair, ld ind ne), Maharaj Y (FD) Liberty Group 58.87%

MAJOR ORDINARY SHAREHOLDERS as at 09 Mar 2018 Government Employees Pension Fund 16.62%

Standard Bank Group Ltd. 54.00% Coronation Fund Managers 9.59%

PIC 5.04% POSTAL ADDRESS: PO Box 202, Melrose Arch, Johannesburg, 2076

Citiclient Nominees 3.00% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=L2D

POSTAL ADDRESS: PO Box 10499, Johannesburg, 2000 COMPANY SECRETARY: Ben Swanepoel

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=LBH TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Jill Parratt SPONSOR: Standard Bank of South Africa Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: PwC Inc.

SPONSOR: Merrill Lynch SA (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc.

L2D Ords no par val - 908 443 334

CAPITAL STRUCTURE AUTHORISED ISSUED

LBH Ords 8.33c ea 400 000 000 286 202 373 DISTRIBUTIONS [ZARc]

LBHP Prefs 10c ea 15 000 000 15 000 000 Units no par val Ldt Pay Amt

Special No 5 26 Oct 18 14 Nov 18 18.00

DISTRIBUTIONS [ZARc] Interim No 4 21 Aug 18 27 Aug 18 29.31

Ords 8.33c ea Ldt Pay Amt LIQUIDITY: Jan20 Ave 2m shares p.w., R14.6m(11.4% p.a.)

Interim No 103 27 Aug 19 2 Sep 19 276.00

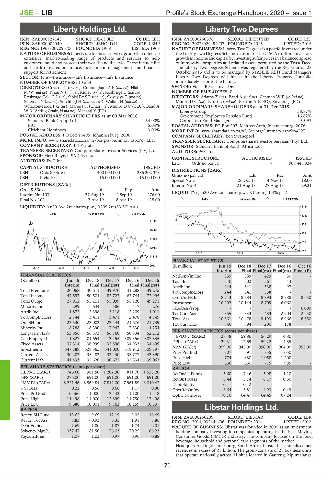

Final No 102 2 Apr 19 8 Apr 19 415.00 SAPY 40 Week MA LIBERTY2D

LIQUIDITY: Jan20 Ave 2m shares p.w., R209.2m(33.5% p.a.) 1154

LIFE 40 Week MA LIB-HOLD

1053

17005

953

15587

852

14168

751

12750

650

2017 | 2018 | 2019

11331

FINANCIAL STATISTICS

9913 (R million) Jun 19 Dec 18 Dec 17 Dec 16 Oct 16

2015 | 2016 | 2017 | 2018 | 2019

Interim Final Final(rst) Final(rst) Final (P)

FINANCIAL STATISTICS NetRent/InvInc 339 589 429 30 -

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Total Inc 340 602 567 44 -

Interim Final Final(rst) Final Final(rst) Attrib Inc 244 641 538 97 -

Total Premiums 20 068 40 611 39 970 41 288 39 245 TotCompIncLoss 244 641 538 - -

Total Income 47 597 50 504 82 722 62 744 73 995 Ord UntHs Int 8 713 8 584 8 993 8 788 8 650

Total Outgo 27 912 55 211 55 099 55 120 49 271 Investments 10 202 10 144 8 709 6 060 -

Minority Int 299 644 586 417 276 FixedAss/Prop - - 1 - 6 000

Attrib Inc 1 872 2 398 3 118 2 209 4 011 Tot Curr Ass 355 333 483 2 904 2 650

TotCompIncLoss 2 144 3 411 3 471 2 478 4 349 Total Ass 10 561 10 478 9 193 8 966 8 650

Ord SH Int 23 530 23 003 22 444 21 676 21 739 Tot Curr Liab 846 894 200 178 -

Minority Int 8 288 8 390 7 947 7 330 4 254

Long-Term Liab 53 856 56 573 56 760 50 534 52 212 PER SHARE STATISTICS (cents per share)

Cap Employed 411 827 401 654 413 455 389 356 387 835 HEPLU-C (ZARc) 28.48 59.86 56.29 4.80 -

Fixed Assets 37 314 36 999 35 896 34 933 34 499 DPLU (ZARc) 29.31 12.69 59.22 4.85 -

Investments 347 789 328 365 341 000 318 912 309 797 NAV (ZARc) 959.00 945.00 990.00 964.00 952.00 -

691

835

707

1 050

Price Prd End

Current Assets 30 202 35 482 33 430 35 777 42 890

Current Liab 41 433 35 620 30 672 32 534 39 062 Price High 774 880 1 058 1 200 -

Price Low 636 660 775 985 -

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 746.60 981.50 1 202.90 811.70 1 528.20 RetOnSH Funds 5.60 7.46 5.98 1.10 -

DPS (ZARc) 276.00 691.00 691.00 691.00 691.00

RetOnTotAss 6.44 5.74 6.17 0.50 -

NAV PS (ZARc) 8 221.46 8 569.84 7 842.00 7 961.89 8 040.43 Debt:Equity 0.11 0.12 - - -

3 Yr Beta 0.22 0.56 0.66 1.17 0.90 OperRetOnInv 6.64 5.81 4.93 0.49 -

Price Prd End 10 566 11 000 12 443 11 100 11 518 OpInc:Turnover 70.10 64.47 64.45 67.24 -

Price High 11 498 14 000 12 899 14 750 17 498

Price Low 9 680 10 001 9 763 10 259 10 537

RATIOS Libstar Holdings Ltd.

Ret on SH Fund 13.65 9.69 12.19 9.05 16.49 ISIN: ZAE000250239 SHORT: LIBSTAR CODE: LBR

LIB

Ret on Tot Ass 8.83 - 0.93 6.35 1.91 5.86 REG NO: 2014/032444/06 FOUNDED: 2014 LISTED: 2018

Debt:Equity 1.69 1.80 1.87 1.74 2.01 NATURE OF BUSINESS: Libstar was founded in 2005 as an investment

Solvency Mgn% 337.47 81.50 76.03 70.25 66.23 holding company investing in companies operating in the Fast Moving

Payouts:Prem 1.07 1.03 0.97 0.96 0.88 Consumer Goods (FMCG) industry. The company focuses on the food,

beverage, household and personal care segments of the market.

Headquartered in Johannesburg, South Africa, Libstar has annualised net

revenues in excess of R7 billion. The group consists of 28 business units

that operate nationally across 31 sites located in Gauteng, Mpumalanga,

170