Page 177 - SHB 2020 Issue 1

P. 177

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – MAR

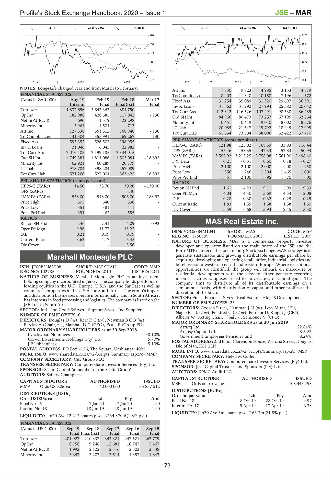

ALSH 40 Week MA LONG4LIFE SUPS 40 Week MA MARSHALL

702 2100

637 1811

571 1522

506 1232

440 943

375 654

2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

NOTES: Long4Life changed year end from March to February.

Att Inc 7 730 9 723 4 985 3 153 4 819

FINANCIAL STATISTICS TotCompIncLoss 8 403 11 340 10 158 7 196 - 572

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Mar 17 Fixed Ass 31 254 35 089 31 320 29 697 36 391

Interim Final Final(rst) Final Inv & Loans 31 662 31 292 27 994 25 382 20 042

Turnover 1 837 656 3 642 342 884 750 - Tot Curr Ass 112 812 116 526 107 491 98 538 86 489

Op Inc 182 988 428 685 117 042 - 130 Ord SH Int 84 966 80 473 73 257 67 195 62 864

NetIntPd(Rcvd) - 690 - 71 579 - 122 298 - Minority Int 10 451 10 419 9 040 8 002 8 576

Minority Int 3 964 4 504 712 - LT Liab 20 085 21 647 19 792 18 445 17 995

Att Inc 127 338 351 512 168 948 - 130 Tot Curr Liab 61 634 73 304 68 096 62 422 57 710

TotCompIncLoss 131 304 355 991 169 267 - 130

Fixed Ass 593 352 526 502 198 955 - PER SHARE STATISTICS (cents per share)

Inv & Loans 21 046 6 045 22 982 - HEPS-C (ZARc) 121.98 125.02 168.59 33.83 116.44

Tot Curr Ass 2 076 405 2 199 185 2 344 015 - DPS (ZARc) 55.46 53.35 47.33 52.83 50.93

Ord SH Int 4 749 381 4 811 086 4 503 084 - 18 893 NAV PS (ZARc) 3 592.92 3 215.25 2 758.08 2 561.90 2 498.40

Minority Int 62 921 60 289 20 779 - 3 Yr Beta 0.21 - 0.31 0.60 0.18 - 0.27

Price High 2 100 2 100 2 000 1 900 1 750

LT Liab 978 704 398 284 257 089 -

Tot Curr Liab 571 266 527 004 363 425 18 893 Price Low 1 556 1 246 1 504 1 465 1 000

Price Prd End 1 851 2 100 1 895 1 870 1 600

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 14.50 38.70 30.20 - 130.00 Ret on SH Fnd 11.61 14.23 9.11 5.99 9.33

DPS (ZARc) - - 5.40 - Oper Pft Mgn 4.04 4.40 3.69 4.34 2.08

NAV PS (ZARc) 558.00 548.00 506.00 - 188.93 D:E 0.28 0.38 0.32 0.25 0.25

Price High 505 640 838 - Current Ratio 1.83 1.59 1.58 1.58 1.50

Price Low 351 381 411 - Div Cover 5.59 6.68 3.93 2.45 3.30

Price Prd End 391 463 555 -

RATIOS

Ret on SH Fnd 5.46 7.31 4.09 0.92 MAS Real Estate Inc.

Oper Pft Mgn 9.96 11.77 13.23 - ISIN: VGG5884M1041 SHORT: MAS CODE: MSP

MAS

D:E 0.21 0.09 0.09 - REG NO: 1750199 FOUNDED: 2008 LISTED: 2009

Current Ratio 3.63 4.17 6.45 - NATURE OF BUSINESS: MAS is a commercial property investor,

Div Cover - - 5.56 - developer and operator listed on the main board of the JSE and the

Euro-MTF market of the Luxembourg Stock Exchange. MAS’ strategy is to

Marshall Monteagle PLC generate sustainable and growing distributable earnings per share by

acquiring, developing and operating retail, office, industrial, logistics and

MAR hotel assets in western, central and eastern Europe. Where exceptional

ISIN: JE00B5N88T08 SHORT: MAR SHALL CODE: MMP opportunities are identified, the group will embark on mixed-use or

REG NO: 102785 FOUNDED: 2010 LISTED: 2011 residential developments with the view to either generate recurring

NATURE OF BUSINESS: Marshall Monteagle PLC is an investment income, such as campuses leased to universities, or capital gains. The

holding company incorporated in Jersey. The company holds portfolios of company aims to distribute all of its distributable earnings on a

leading equities in the U.K., Europe, U.S.A. and the Far East as well as semi-annual basis, with distribution of capital and other profits at the

commercial properties in the U.S.A and South Africa. The group’s import discretion of the board.

and distribution businesses operate internationally, and in South Africa it

has interests in food processing and logistics. The company is listed on the SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

JSE Ltd. in South Africa. NUMBER OF EMPLOYEES: 23

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Ind Suppliers DIRECTORS: Goosen P (ne), Hamman J N (ne), Levy M (ne, UK),

NUMBER OF EMPLOYEES: 0 Nagle B T (ind ne), Pendred C (ind ne), Petrisor D, Knight J (CIO),

Alberts W (Acting Chair, ld ind ne), Semionov V (CFO)

DIRECTORS: Douglas D (ne), Kerr R C (ne), Newman B C B (ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Barclay A (Chair, ne), Marshall D C (CEO), Beale E (Group FD) Attacq Ltd. 22.84%

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2018 Argosy Capital Ltd. 8.52%

Lynchwood Nominees 58.10% Government Employees Pension Fund 8.24%

Corwil Investments Holdings (Pty) Ltd. 5.70% POSTAL ADDRESS: 2nd Floor Clarendon House, Victoria Street, Douglas,

J P Lobbenberg 5.10% Isle of Man, IM1 2LN

POSTAL ADDRESS: PO Box 4126, The Square, Umhlanga, 4021 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MSP

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MMP COMPANY SECRETARY: Helen M Cullen

COMPANY SECRETARY: City Group PLC TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

SPONSOR: Sasfin Capital (a member of the Sasfin Group) AUDITORS: KPMG Audit LLC

AUDITORS: Saffery Champness

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED MSP Ords no par value - 708 343 798

MMP Ords USD25c ea 40 000 000 35 857 512

DISTRIBUTIONS [EURc]

DISTRIBUTIONS [USDc] Ords no par value Ldt Pay Amt

Ords USD25c ea Ldt Pay Amt Final No 18 8 Oct 19 28 Oct 19 4.97

Final No 19 7 Jan 20 17 Jan 20 1.90 Interim No 17 9 Apr 19 17 Apr 19 3.78

Interim No 18 18 Jun 19 28 Jun 19 1.90

LIQUIDITY: Jan20 Ave 3m shares p.w., R63.3m(21.8% p.a.)

LIQUIDITY: Jan20 Ave 12 212 shares p.w., R234 370.6(1.8% p.a.)

FINANCIAL STATISTICS

(Amts in USD’000) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final(rst) Final Final Final

Turnover 201 922 210 337 343 321 247 521 262 779

Op Inc 8 158 9 246 12 681 10 747 5 467

NetIntPd(Rcvd) 1 992 2 122 2 316 2 502 2 338

Minority Int 3 347 3 207 2 514 1 353 1 847

173