Page 170 - SHB 2020 Issue 1

P. 170

JSE – KAY Profile’s Stock Exchange Handbook: 2020 – Issue 1

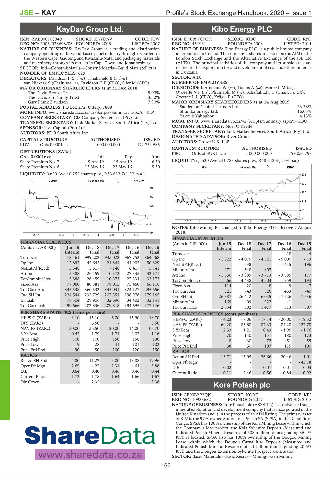

KayDav Group Ltd. Kibo Energy PLC

KAY KIB

ISIN: ZAE000108940 SHORT: KAYDAV CODE: KDV ISIN: IE00B97C0C31 SHORT: KIBO CODE: KBO

REG NO: 2006/038698/06 FOUNDED: 2006 LISTED: 2007 REG NO: 451931 FOUNDED: 2008 LISTED: 2011

NATURE OF BUSINESS: KayDav Group is a trading and distribution NATURE OF BUSINESS: Kibo Energy PLC is a public limited company

company operating in the wood-based panel industry through its outlets in incorporated in Ireland. The company’s shares are listed on the AIM of the

the Western Cape, Gauteng and KwaZulu-Natal and packaging materials London Stock Exchange and the Alternative Exchange of the JSE Ltd.

and machinery through its outlets in Cape Town and Johannesburg. (ALTX). The principal activities of the company and its subsidiaries are

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs related to the exploration for and development of coal and other minerals

NUMBER OF EMPLOYEES: 629 in Tanzania.

DIRECTORS: Davidson F (ind ne), Tlhabanelo B (ind ne), SECTOR: AltX

van Niekerk S (Chair, ind ne), Davidson G F (CEO), Slier M (CFO) NUMBER OF EMPLOYEES: 16

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 DIRECTORS: Kerremans W (ne), Lianos A (ne), Maree L M (ne),

The David Brouze Trust 45.00% O’Keeffe N F (ne), Phumaphi M (ne), Schaffalitzky C (Chair, ne, UK),

The Davidson Family Trust 33.50% Coetzee L L (CEO), Krügel P (CFO)

Gary Frank Davidson 7.90% MAJOR ORDINARY SHAREHOLDERS as at 14 Aug 2019

POSTAL ADDRESS: PO Box 272, Ottery, 7808 Sanderson Capital Partners Ltd. 23.38%

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=KDV Shumba Energy Ltd. 16.03%

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. Yakoub Yakoubov 4.13%

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=KBO

SPONSOR: Java Capital (Pty) Ltd. COMPANY SECRETARY: Noel O’Keeffe

AUDITORS: BDO South Africa Inc. TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

DESIGNATED ADVISOR: River Group

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Crowe U.K. LLP

KDV Ords 0.0001c ea 1 000 000 000 172 751 585

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] KBO Ords of EUR1.5c ea 1 000 000 000 799 053 798

Ords 0.0001c ea Ldt Pay Amt

Share Premium No 7 9 Apr 19 15 Apr 19 6.50 LIQUIDITY: Jan20 Ave 241 783 shares p.w., R48 642.3(1.6% p.a.)

Share Premium No 6 13 May 16 23 May 16 5.50 MINI 40 Week MA KIBO

LIQUIDITY: Jan20 Ave 40 252 shares p.w., R33 612.7(1.2% p.a.) 273

CONM 40 Week MA KAYDAV

220

190

167

156

114

122

61

87

8

2015 | 2016 | 2017 | 2018 | 2019

53

NOTES: Kibo Mining Plc changed to Kibo Energy PLC effective 7 August

19 2018.

2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in GBP’000) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

(Amts in ZAR’000) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Interim Final Final Final Final

Interim Final Final Final Final Turnover - - - 18 44

Turnover 478 461 999 202 945 022 967 752 864 568 Op Inc - 1 822 - 4 075 - 4 521 - 5 000 - 19

Op Inc 12 892 42 645 21 841 44 903 50 829 NetIntPd(Rcvd) - 1 - 38 - 1 - 1 415 - 196

NetIntPd(Rcvd) 5 348 5 617 7 148 6 417 5 741 Minority Int - 271 - 648 - 807 - -

Att Inc 5 388 26 459 10 373 27 335 32 171 Att Inc - 1 550 - 3 389 - 3 713 - 3 585 177

TotCompIncLoss 5 388 26 459 10 373 27 334 32 172 TotCompIncLoss - 1 666 - 4 438 - 4 503 - 1 959 194

Fixed Ass 77 060 80 381 78 015 75 460 66 116 Fixed Ass 114 20 8 9 7

Tot Curr Ass 345 538 360 533 345 031 324 127 295 656 Tot Curr Ass 321 743 826 433 740

Ord SH Int 224 544 235 729 207 351 196 978 179 145 Ord SH Int 26 387 26 412 16 025 17 526 17 536

LT Liab 78 304 28 906 32 696 34 402 32 141 Minority Int 169 409 927 - 1 -

Tot Curr Liab 199 666 202 836 209 818 194 695 177 146 Tot Curr Liab 2 834 302 1 477 513 807

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 3.10 15.10 6.00 15.90 18.70 HEPS-C (ZARc) - 4.23 - 7.06 - 17.14 - 20.00 - 19.52

DPS (ZARc) - 6.50 - - 5.50 NAV PS (ZARc) 69.20 85.60 87.33 84.28 127.78

NAV PS (ZARc) 130.00 136.50 120.00 114.00 103.70 3 Yr Beta 2.33 1.21 0.43 - 1.95 - 1.76

3 Yr Beta 0.42 1.79 1.71 2.02 1.16 Price High 70 140 137 180 173

Price High 100 100 150 158 190 Price Low 8 30 72 51 55

Price Low 19 28 41 101 102 Price Prd End 38 50 107 115 100

Price Prd End 90 50 100 120 150 RATIOS

RATIOS Ret on SH Fnd - 13.71 - 15.05 - 26.66 - 20.46 1.01

Ret on SH Fnd 4.80 11.22 5.00 13.88 17.96

Oper Pft Mgn - - - - - 43.18

Oper Pft Mgn 2.69 4.27 2.31 4.64 5.88 D:E 0.02 - 0.07 0.01 0.03

D:E 0.64 0.40 0.46 0.46 0.44 Current Ratio 0.11 2.46 0.56 0.84 0.92

Current Ratio 1.73 1.78 1.64 1.66 1.67

Div Cover - 2.35 - - 3.38

Kore Potash plc

KOR

ISIN: GB00BYP2QJ94 SHORT: KORE CODE: KP2

REG NO: 10933682 FOUNDED: 2017 LISTED: 2018

NATURE OF BUSINESS: Kore Potash plc (ASX:KP2) is an advanced stage

mineral exploration and development company that is incorporated in the

United Kingdom and is in the process of an AIM listing. The primary asset

of KP2 is the 97%-owned Sintoukola Potash SA (SPSA) in the Republic of

Congo. SPSA has 100% ownership of the Kola Mining Lease within which

the Company’s lead project, the Kola Sylvinite Deposit (Measured and

Indicated Potash Mineral Resource of 508 million tonnes grading 35.4%

KCl) is located. SPSA also has 100% ownership of the Dougou Mining

Lease within which the Dougou Carnallitite Deposit (Measured and

Indicated Potash Mineral Resource of 1.1 billion tonnes grading 20.6%

KCl) and the Dougou Extension Sylvinite Prospect are situated.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

166