Page 178 - SHB 2020 Issue 1

P. 178

JSE – MAS Profile’s Stock Exchange Handbook: 2020 – Issue 1

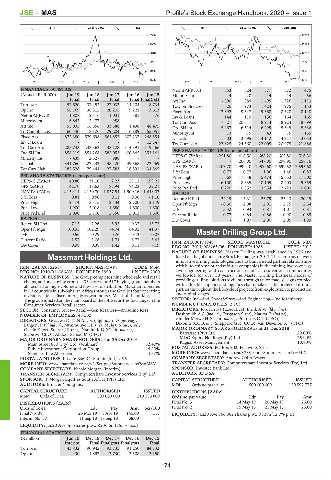

ALSH 40 Week MA MAS GERE 40 Week MA MASSMART

3300 17903

2959 15128

2618 12352

2277 9577

1936 6801

1595 4026

2015 | 2016 | 2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS NetIntPd(Rcvd) 353 624 577 572 475

(Amts in EUR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Minority Int 4 - 20 14 14 56

Final Final Final Final Final(rst) Att Inc - 590 889 1 495 1 326 1 113

Turnover 57 620 37 453 27 032 14 204 8 734

TotCompIncLoss - 626 973 1 424 975 1 153

Op Inc 58 169 38 312 20 205 9 221 3 613 Fixed Ass 17 392 9 647 9 368 8 628 8 118

NetIntPd(Rcvd) - 1 807 - 2 416 1 031 381 576 Inv & Loans 144 119 156 164 165

Minority Int 6 843 2 477 988 - - Tot Curr Ass 17 521 20 617 18 914 18 924 18 699

Att Inc 55 035 16 856 33 588 1 498 48 475 Ord SH Int 5 267 6 514 6 299 5 645 5 636

TotCompIncLoss 60 540 18 126 29 204 - 10 889 55 051 Minority Int 13 15 43 75 155

Fixed Ass 872 380 579 698 564 852 307 237 248 554 LT Liab 11 503 3 695 4 142 4 917 3 053

Inv & Loans - - - - 12 347 Tot Curr Liab 22 825 24 560 22 005 20 975 21 886

Tot Curr Ass 285 748 243 363 48 128 114 391 119 466

Ord SH Int 858 119 854 268 582 053 400 845 353 141 PER SHARE STATISTICS (cents per share)

Minority Int 7 439 2 527 988 - - HEPS-C (ZARc) - 251.80 416.50 688.20 605.80 516.30

LT Liab 341 760 222 243 148 420 49 868 22 469 DPS (ZARc) - 208.00 347.00 298.90 258.16

Tot Curr Liab 182 528 79 444 27 583 16 891 34 845 NAV PS (ZARc) 2 403.70 2 999.40 2 900.60 2 599.52 2 595.60

3 Yr Beta 0.77 0.77 1.06 1.46 0.87

PER SHARE STATISTICS (cents per share) Price High 11 669 17 848 15 474 15 653 17 500

HEPS-C (ZARc) 40.80 31.10 2.23 25.11 199.21 Price Low 6 100 8 635 10 105 8 203 9 559

DPS (ZARc) 142.70 118.63 87.94 74.22 32.21 Price Prd End 6 220 10 352 13 954 12 723 10 000

NAV PS (ZARc) 2 159.14 2 150.70 1 857.54 1 900.16 1 648.02 RATIOS

3 Yr Beta 0.81 0.50 0.11 0.38 - 1.10 Ret on SH Fnd - 22.19 13.31 23.79 23.43 20.19

Price High 2 474 3 375 2 434 2 700 2 149 Oper Pft Mgn - 0.30 2.08 2.91 2.75 2.54

Price Low 1 900 2 018 1 680 1 600 1 600 D:E 3.32 0.94 0.87 1.07 0.81

Price Prd End 2 090 2 100 2 350 2 012 1 600 Current Ratio 0.77 0.84 0.86 0.90 0.85

RATIOS Div Cover - 1.97 2.00 2.05 1.99

Ret on SH Fnd 7.15 2.26 5.93 0.37 13.73

Oper Pft Mgn 100.95 102.29 74.74 64.92 41.37

D:E 0.56 0.29 0.26 0.13 0.07 Master Drilling Group Ltd.

MAS

Current Ratio 1.57 3.06 1.74 6.77 3.43 ISIN: ZAE000171948 SHORT: MASTDRILL CODE: MDI

Div Cover 0.98 0.38 1.42 0.11 7.19 REG NO: 2011/008265/06 FOUNDED: 1986 LISTED: 2012

NATURE OF BUSINESS: Master Drilling was established in 1986 and

Massmart Holdings Ltd. listed on the Johannesburg Stock Exchange in 2012. The company delivers

innovative drilling technologies and has built trusted partner relationships

MAS

ISIN: ZAE000152617 SHORT: MASSMART CODE: MSM with blue-chip major and mid-tier companies in the mining, hydro-energy,

REG NO: 1940/014066/06 FOUNDED: 1990 LISTED: 2000 civil engineering and construction sectors across various commodities

NATURE OF BUSINESS: The Group comprises nine wholesale and retail worldwide for over 30 years. The Master Drilling business model of

chains, and one buying group – 436 stores and 517 buying group members providing drilling solutions to clients through tailor-made designs coupled

all focused on high-volume and low-cost distribution. Massmart operates with a flexible support and logistics chain makes it the preferred drilling

in 13 countries in sub-Saharan Africa through the Group’s four operating partner throughout the lifecycle of projects from exploration to production

divisions – Massdiscounters, Masswarehouse, Massbuild and Masscash. and capital stages.

The group is listed on the main board of the JSE Securities Exchange in the SECTOR: Ind—Ind Goods&Srvcs—Ind Engineering—Ind Machinery

Consumer Services-Retail sector. NUMBER OF EMPLOYEES: 2 163

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets DIRECTORS: Jordaan B J (Executive), Brink A W (ld ind ne),

NUMBER OF EMPLOYEES: 48 500 Deshmukh A A (ind ne), Ferguson S (ne), Matloa O (ind ne),

DIRECTORS: Gwagwa Dr N N (ind ne), Ighodaro O (ne, Nig), van der Merwe H (Chair, ind ne), Pretorius D C (CEO),

Langeni P (ld ind ne), Mthimunye L E (ne), Muigai S (ne, Can), Dixon E (COO, alt), Sheppard G R (COO), van Deventer A J (CFO)

Ostalé E (ne), Suarez J P (ne), Dlamini K D (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

Slape M (CEO), Abdool-Samad M (CFO) Barrange (Pty) Ltd. 29.00%

MAJOR ORDINARY SHAREHOLDERS as at 25 Oct 2019 MDG Equity Holdings (Pty) Ltd. 25.90%

Main Street 830 (Pty) Ltd. (Walmart) 52.40% Kagiso Asset Management 10.80%

Public Investment Corporation Group 4.90% POSTAL ADDRESS: PO Box 902, Fochville, 2515

Standard Life Aberdeen 4.37% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MDI

POSTAL ADDRESS: Private Bag X4, Sunninghill, 2196 COMPANY SECRETARY: Andrew Colin Beaven

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MSM TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Nicole Morgan (Interim) SPONSOR: Investec Bank Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: BDO SA

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Ernst & Young Inc. MDI Ords no par value 500 000 000 150 592 777

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

MSM Ords of 1c ea 500 000 000 219 138 809 Ords no par value Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 3 14 May 19 20 May 19 26.00

Ords of 1c ea Ldt Pay Amt Scr/100 Final No 2 15 May 18 21 May 18 26.00

Final No 38 26 Mar 19 1 Apr 19 140.00 1.57 LIQUIDITY: Jan20 Ave 366 382 shares p.w., R3.9m(12.7% p.a.)

Interim No 37 11 Sep 18 17 Sep 18 68.00 -

LIQUIDITY: Jan20 Ave 3m shares p.w., R236.6m(75.5% p.a.)

FINANCIAL STATISTICS

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final(rst) Final(rst) Final

Turnover 43 832 90 942 93 735 91 250 84 732

Op Inc - 130 1 892 2 730 2 508 2 150

174