Page 165 - SHB 2020 Issue 1

P. 165

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – INV

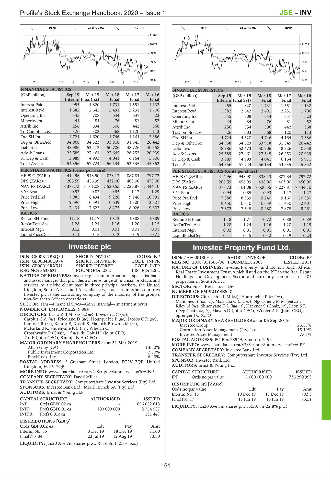

GENF 40 Week MA INVLTD GENF 40 Week MA INVPLC

11968

10974 11053

9979 10036

8985 9018

7991 8001

6996 6984

2015 | 2016 | 2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS FINANCIAL STATISTICS

(GBP million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 (GBP million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final(rst) Final Final Final Interim Final(rst) Final Final Final

Interest Paid 955 1 820 1 731 1 551 1 132 Interest Paid 955 1 820 1 731 1 551 1 132

Interest Rcvd 1 382 2 642 2 491 2 231 1 706 Interest Rcvd 1 382 2 642 2 491 2 231 1 706

Operating Inc 345 708 644 637 523 Operating Inc 345 708 644 637 523

Minority Int 44 84 76 81 52 Minority Int 44 84 76 81 52

Attrib Inc 256 534 506 442 368 Attrib Inc 256 534 506 442 368

TotCompIncLoss 326 303 568 1 120 113 TotCompIncLoss 326 303 568 1 120 113

Ord SH Int 4 724 4 620 4 746 4 164 3 386 Ord SH Int 4 724 4 620 4 746 4 164 3 386

Dep & OtherAcc 34 968 34 323 33 918 31 845 26 442 Dep & OtherAcc 34 968 34 323 33 918 31 845 26 442

Liabilities 48 986 52 473 50 706 48 726 40 358 Liabilities 48 986 52 473 50 706 48 726 40 358

Adv & Loans 25 589 27 461 27 645 26 253 20 939 Adv & Loans 25 589 27 461 27 645 26 253 20 939

ST Dep & Cash 3 989 4 993 4 041 6 164 5 506 ST Dep & Cash 3 989 4 993 4 041 6 164 5 971

Total Assets 54 356 57 724 56 134 53 535 45 352 Total Assets 54 356 57 724 56 134 53 535 45 352

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 414.96 948.90 838.13 887.84 797.72 HEPS-C (ZARc) 414.96 948.90 838.13 887.84 797.72

DPS (ZARc) 205.59 456.99 432.00 403.00 473.00 DPS (ZARc) 205.59 456.99 438.00 403.00 450.00

NAV PS (ZARc) 8 378.73 8 161.08 7 520.55 7 227.87 7 444.10 NAV PS (ZARc) 8 378.73 8 161.08 7 520.55 7 227.87 7 444.10

3 Yr Beta 0.93 0.83 0.95 1.17 1.29 3 Yr Beta 0.94 0.85 0.93 1.17 1.27

Price Prd End 7 985 8 434 9 228 9 146 10 991 Price Prd End 7 886 8 339 9 240 9 160 10 880

Price High 9 596 10 591 10 639 11 300 12 321 Price High 9 450 10 610 10 639 11 430 12 401

Price Low 7 434 7 625 8 275 8 026 9 302 Price Low 7 372 7 645 8 280 7 875 9 261

RATIOS RATIOS

Ret on SH Fund 11.18 11.77 10.72 10.88 10.89 Ret on SH Fund 11.18 11.77 10.72 10.88 10.89

RetOnTotalAss 1.28 1.24 1.16 1.20 1.15 RetOnTotalAss 1.28 1.24 1.16 1.20 1.15

Interest Mgn 0.02 0.01 0.01 0.01 0.01 Interest Mgn 0.02 0.01 0.01 0.01 0.01

LiquidFnds:Dep 0.11 0.15 0.12 0.19 0.21 LiquidFnds:Dep 0.11 0.15 0.12 0.19 0.23

Investec plc Investec Property Fund Ltd.

INV

INV

ISIN: GB00B17BBQ50 SHORT: INVPLC CODE: INP ISIN: ZAE000180915 SHORT: INVPROP CODE: IPF

ISIN: GB00B4B0Q974 SHORT: INVPREFR CODE: INPPR REG NO: 2008/011366/06 FOUNDED: 2008 LISTED: 2011

ISIN: GB00B19RX541 SHORT: INVPREF CODE: INPP NATURE OF BUSINESS: Investec Property Fund Ltd. is a South African

REG NO: 3633621 FOUNDED: 2002 LISTED: 2002 Real Estate Investment Trust, which listed on the JSE in the Real Estate

NATURE OF BUSINESS: Investec plc is an international, specialist bank Holdings and Development Sector and currently comprises of 105

and asset manager that provides a diverse range of financial products and properties in South Africa.

services to a niche client base in three principal markets, the United SECTOR: Fins—Rest—Inv—Div

Kingdom, South Africa, and Australia as well as certain other countries. NUMBER OF EMPLOYEES: 0

Investec plc is the controlling company of the majority of the group’s DIRECTORS: Giuricich L L M (ne), Hourquebie P (ind ne),

non-Southern African operations.

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs Mahomed S (ind ne), Mashaba C (ind ne), Ngoasheng M M (ind ne),

Riley N (ne), Shuenyane K L (ind ne), Hackner S (Chair, ne), Leon S R

NUMBER OF EMPLOYEES: 9 884 (Dep Chair, ne, It), Mayers D (Joint CEO), Wooler A R (Joint CEO),

DIRECTORS: Bassa Z B M (snr ind ne), Bowden L C (ne), Sprenger J C (CFO)

Carolus C A (ne), Friedland D (ne), Hourquebie P (ne), Jacobs C R (ne), MAJOR ORDINARY SHAREHOLDERS as at 06 Sep 2019

Kantor I R (ne), Kantor B, Koseff S, Malloch-Brown L M (ne), Investec Group 26.57%

McFarland K, Shuenyane K L (ne), Whelan C, Coronation Asset Management (Pty) Ltd. 15.19%

Crosthwaite P (Chair, ind ne), du Toit H J (Joint CEO), Investec Asset Management 7.61%

Titi F (Joint CEO), Samujh N A (CFO) POSTAL ADDRESS: PO Box 78949, Sandton, 2196

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=IPF

Allan Gray (ZA) 13.60%

Public Investment Corporation Ltd. 7.50% COMPANY SECRETARY: Investec Bank Ltd.

BlackRock, Inc. 6.40% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: 2 Gresham Street, London, EC2V 7QP, United SPONSOR: Investec Bank Ltd.

Kingdom, EC2V 7QP AUDITORS: Ernst & Young Inc.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=INP CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: David Miller IPF Ords no par value 1 000 000 000 736 290 993

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSORS: Investec Bank Ltd., Merrill Lynch SA (Pty) Ltd. Ords no par value Ldt Pay Amt

AUDITORS: Ernst & Young LLP Interim No 18 10 Dec 19 17 Dec 19 70.93

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 17 11 Jun 19 18 Jun 19 73.51

INP Ords GBP0.02 ea - 696 082 618 LIQUIDITY: Jan20 Ave 3m shares p.w., R50.7m(22.8% p.a.)

INPP Prefs GBP0.01 ea 100 000 000 2 754 587

INPPR Prefs 0.01c ea - 131 447

DISTRIBUTIONS [GBPp]

Ords GBP0.02 ea Ldt Pay Amt

Interim No 35 3 Dec 19 18 Dec 19 11.00

Final No 34 23 Jul 19 12 Aug 19 13.50

LIQUIDITY: Jan20 Ave 7m shares p.w., R616.8m(50.8% p.a.)

161