Page 167 - SHB 2020 Issue 1

P. 167

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – ITA

NetIntPd(Rcvd) - 3 276 - 4 195 - 4 149 - 2 586 - 2 944 Inv & Loans - - - - 97

Att Inc 13 729 29 957 21 222 29 749 19 315 Tot Curr Ass 2 953 2 455 1 388 1 481 1 079

TotCompIncLoss 13 729 29 957 21 222 29 749 19 315 Ord SH Int 5 607 5 279 3 713 3 292 2 672

Fixed Ass 9 864 9 980 10 162 10 427 10 552 Minority Int 251 246 60 61 62

Inv & Loans 2 516 24 101 26 297 27 084 25 843 LT Liab 923 132 24 18 44

Tot Curr Ass 59 102 83 863 73 966 73 460 43 682 Tot Curr Liab 644 670 366 419 324

Ord SH Int 47 925 95 354 86 610 80 940 60 551 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 28 386 26 357 26 624 32 187 23 121 HEPS-C (ZARc) 101.80 95.00 85.10 86.90 71.60

PER SHARE STATISTICS (cents per share) DPS (ZARc) 91.00 68.00 30.00 29.00 25.00

HEPS-C (ZARc) 8.80 19.20 13.60 19.10 12.20 NAV PS (ZARc) 480.00 486.00 402.00 362.00 296.00

DPS (ZARc) - 39.20 13.60 10.00 6.00 3 Yr Beta 0.37 0.16 0.49 0.64 0.39

NAV PS (ZARc) 30.70 61.10 55.50 51.90 38.80 Price High 1 555 1 639 1 515 1 380 1 350

3 Yr Beta - 1.00 - 0.86 - 0.37 0.01 0.35 Price Low 1 200 1 149 1 200 1 035 705

Price High 209 140 180 150 92 Price Prd End 1 480 1 320 1 250 1 370 1 160

Price Low 126 85 95 75 22 RATIOS

Price Prd End 140 135 98 145 82 Ret on SH Fnd 22.52 20.74 23.32 25.38 26.74

RATIOS Oper Pft Mgn 25.76 25.03 28.96 29.58 29.05

Ret on SH Fnd 57.29 31.42 24.50 36.75 31.90 D:E 0.16 0.02 0.01 0.01 0.02

Oper Pft Mgn 30.12 30.31 21.82 27.24 26.29 Current Ratio 4.59 3.66 3.79 3.53 3.33

Current Ratio 2.08 3.18 2.78 2.28 1.89 Div Cover 1.13 1.40 2.99 3.03 3.04

Div Cover - 0.49 1.00 1.91 2.03

Jasco Electronics Holdings Ltd.

Italtile Ltd. JAS

ISIN: ZAE000003794 SHORT: JASCO CODE: JSC

ITA

ISIN: ZAE000099123 SHORT: ITLTILE CODE: ITE REG NO: 1987/003293/06 FOUNDED: 1976 LISTED: 1987

REG NO: 1955/000558/06 FOUNDED: 1955 LISTED: 1988 NATURE OF BUSINESS: Jasco is a South African company that delivers

NATURE OF BUSINESS: Italtile is a leading retailer and manufacturer of tiles, technologies across Information and Communication Technology,

bathroomware and related products. The Group operates as a national Security and Fire, and Power and Renewables. Jasco is a distributor,

franchisor of its three high profile retail brands, Italtile Retail, CTM and TopT. reseller, systems integrator and service provider that delivers innovative

The retail operations are underpinned by an extensive property portfolio and solutions.

a vertically integrated supply chain comprising International Tap Distributors SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

(ITD) (an importer and distributor of brassware and accessories) and Cedar NUMBER OF EMPLOYEES: 612

Point (an importer of shower enclosures, laminated boards, cabinets, DIRECTORS: Bawa S (ind ne), da Silva A M F (alt), Petje T, Radebe P F

sanitaryware, décor and tiling tools). The Group holds controlling interests in (ind ne), Zondi T P (ind ne), Mokgokong Dr A T M (Chair, ne),

both businesses as well as in its key suppliers, tile and sanitaryware Madungandaba M J (Dep Chair, ne), van Vuuren M (CEO),

manufacturer, Ceramic Industries (Pty) Ltd. and adhesives and related Prinsloo W A (CFO)

products manufacturer, Ezee Tile. MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Home Improves Community Investment Holdings (Pty) Ltd. 31.68%

NUMBER OF EMPLOYEES: 2 545 Goldsol II (Pty) Ltd. 21.80%

DIRECTORS: du Toit S M (ld ind ne), Khoza N (ind ne), TMM Holdings (Pty) Ltd. 10.69%

Medupe N (ind ne), Mtetwa G (ind ne), Nyanga Z (ind ne), Pretorius S G POSTAL ADDRESS: PO Box 860, Wendywood, 2144

(ind ne), Wood B, Ravazzotti G A M (Chair, ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=JSC

Ravazzotti Langenhoven L (Dep Chair, ne), Potgieter J (CEO), Mhlanga COMPANY SECRETARY: Mdyesha Ndema Attorneys

T (CFO) TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 SPONSOR: Grindrod Bank Ltd.

Rallen (Pty) Ltd. 57.06%

Old Mutual Group 7.79% AUDITORS: PwC Inc.

The Italtile and Ceramic Foundation Trust 3.23% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 1689, Randburg, 2125 JSC Ords no par value 750 000 000 229 319 191

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ITE DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: E J Willis Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 23 3 Oct 17 9 Oct 17 1.00

SPONSOR: Merchantec Capital (Pty) Ltd. Final No 22 11 Oct 16 17 Oct 16 2.00

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jan20 Ave 94 662 shares p.w., R33 221.9(2.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

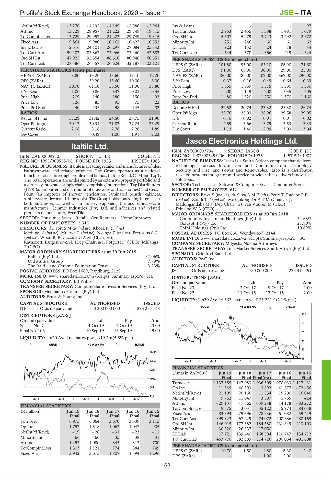

ITE Ords no par value 3 300 000 000 1 295 254 148 SCOM 40 Week MA JASCO

DISTRIBUTIONS [ZARc] 113

Ords no par value Ldt Pay Amt

Special No 7 1 Oct 19 7 Oct 19 23.00 93

Final No 106 10 Sep 19 16 Sep 19 19.00 74

LIQUIDITY: Jan20 Ave 1m shares p.w., R19.7m(5.6% p.a.)

54

GERE 40 Week MA ITLTILE

35

1549

15

1383 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

1218

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final(rst) Final Final

1052

Turnover 1 137 355 1 147 083 1 036 509 1 070 033 1 117 431

887 Op Inc 11 349 40 393 3 892 41 677 - 72 456

NetIntPd(Rcvd) 21 195 20 166 11 534 15 200 16 046

721 Minority Int 9 762 11 047 3 807 1 765 424

2015 | 2016 | 2017 | 2018 | 2019

Att Inc - 29 137 - 7 665 - 39 248 14 178 - 83 272

FINANCIAL STATISTICS TotCompIncLoss - 19 375 3 031 - 35 122 15 974 - 84 038

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Fixed Ass 83 393 79 596 78 936 61 082 59 419

Final Final Final Final Final Tot Curr Ass 399 823 467 229 474 072 408 686 488 169

Turnover 6 975 6 064 3 670 3 539 3 115 Ord SH Int 146 015 177 382 184 580 231 849 213 103

Op Inc 1 797 1 518 1 063 1 047 905 Minority Int 30 520 26 837 17 050 - -

NetIntPd(Rcvd) - 19 - 26 - 31 - 23 - 11 LT Liab 17 721 139 440 168 504 110 747 134 712

Minority Int 66 66 35 38 31 Tot Curr Liab 463 770 382 389 314 726 290 064 401 608

Att Inc 1 253 1 080 845 813 700

TotCompIncLoss 1 303 1 121 774 884 749 PER SHARE STATISTICS (cents per share) - 4.80 6.30 2.40

- 1.50

HEPS-C (ZARc)

- 10.70

Fixed Ass 3 942 3 675 1 807 1 594 1 296

DPS (ZARc) - - 1.00 2.00 -

163