Page 147 - SHB 2020 Issue 1

P. 147

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – GOL

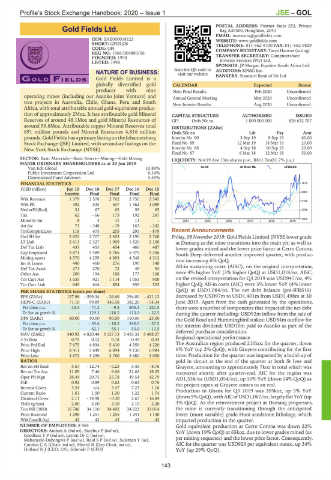

POSTAL ADDRESS: Postnet Suite 252, Private

Gold Fields Ltd. Bag X30500, Houghton, 2041

GOL EMAIL: investors@goldfields.com

ISIN: ZAE000018123 WEBSITE: www.goldfields.com

SHORT: GFIELDS TELE PHONE: 011-562-9700 FAX: 011-562-9829

CODE: GFI COMPANY SECRETARY: Taryn Harmse (acting)

REG NO: 1968/004880/06 TRANSFER SECRETARY: Computershare

FOUNDED: 1998

LISTED: 1998 Investor Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa Ltd.

Scan the QR code to

NATURE OF BUSINESS: visit our website AUDITORS: KPMG Inc.

Gold Fields Limited is a BANKERS: Standard Bank of SA Ltd.

globally di ver si fied gold CALENDAR Expected Status

producer with nine Next Final Results Feb 2020 Un con firmed

operating mines (including our Asanko Joint Venture) and Annual General Meeting May 2020 Un con firmed

two projects in Australia, Chile, Ghana, Peru and South Next Interim Results Aug 2020 Un con firmed

Africa, with total at trib ut able annual gold-equiv a lent pro duc -

tion of ap prox i mately 2Moz. It has at trib ut able gold Mineral CAPITAL STRUCTURE AUTHORISED ISSUED

Reserves of around 48.1Moz and gold Mineral Resources of GFI Ords 50c ea 1 000 000 000 828 632 707

around 96.6Moz. At trib ut able copper Mineral Reserves total DISTRIBUTIONS [ZARc]

691 million pounds and Mineral Resources 4,816 million Ords 50c ea Ldt Pay Amt

pounds. Gold Fields has a primary listing on the Jo han nes burg Interim No 90 3 Sep 19 9 Sep 19 60.00

Stock Exchange (JSE) Limited, with secondary listings on the Final No 89 12 Mar 19 18 Mar 19 20.00

New York Stock Exchange (NYSE). Interim No 88 4 Sep 18 10 Sep 18 20.00

Final No 87 6 Mar 18 12 Mar 18 50.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining LIQUIDITY: Nov19 Ave 13m shares p.w., R811.7m(81.7% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Van Eck Global 10.89% GLDX 40 Week MA GFIELDS

Public Investment Corporation Ltd. 6.34%

Dimensional Fund Advisors 5.55%

FINANCIAL STATISTICS 7812

(USD million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final Final Final 6460

Wrk Revenue 1 379 2 578 2 762 2 750 2 545

5108

Wrk Pft 392 535 657 1 362 1 089

NetIntPd(Rcd) 31 67 62 59 65 3756

Tax 62 - 66 173 192 247

Minority Int 8 3 11 11 - 2014 | 2015 | 2016 | 2017 | 2018 | 2019 2404

Att Inc 71 - 348 - 19 163 - 242

TotCompIncLoss 118 675 255 295 - 879 Recent Announcements

Ord SH Int 2 825 2 707 3 403 3 190 2 768 Friday, 08 November 2019: Gold Fields Limited (NYSE lower grade

LT Liab 2 613 2 327 1 909 1 820 2 100 at Damang as the mine tran si tions into the main pit; as well as

Def Tax Liab 433 455 454 466 487 lower grades mined and the lower price factor at Cerro Corona.

Cap Employed 5 871 5 489 5 766 5 475 5 356 South Deep delivered another improved quarter, with pro duc -

Mining assets 4 570 4 259 4 893 4 548 4 312 tion in creas ing 6% QoQ.

Inv & Loans 440 460 276 190 140

All-in sus tain ing costs (AISC), on the original in ter pre ta tion,

Def Tax Asset 271 270 72 49 54

Other Ass 200 194 188 177 168 were 4% higher YoY (3% higher QoQ) at USD1,018/oz, AISC,

Tot Curr Ass 1 035 921 1 114 1 053 908 on the revised in ter pre ta tion for Q3 2019 was USD947/oz, 4%

Tot Curr Liab 645 616 854 859 522 higher QoQ. All-in costs (AIC) were 5% lower YoY (4% lower

PER SHARE STATISTICS (cents per share) QoQ) at USD1,084/oz. The net debt balance (pre-IFRS16)

EPS (ZARc) 127.98 - 599.34 - 26.66 294.00 - 421.12 decreased by USD97m to USD1,401m from USD1,498m at 30

HEPS-C (ZARc) 71.10 99.89 346.58 382.20 - 54.34 June 2019. Apart from the cash generated by the op er a tions,

Pct chng p.a. 42.4 - 71.2 - 9.3 803.3 - 221.5 there were a number of com po nents that impacted the net debt

Tr 5yr av grwth % - 129.3 118.5 113.0 - 32.5 during the quarter including: USD92m inflow from the sale of

DPS (ZARc) 60.00 40.00 90.00 110.00 25.00 the Gold Road and Hum ming bird stakes; USD34m outflow for

Pct chng p.a. - - 55.6 - 18.2 340.0 - 37.5 the interim dividend; USD10m paid to Asanko as part of the

Tr 5yr av grwth % - 62.1 55.1 53.0 - 11.5 deferred purchase con sid er ation.

NAV (ZARc) 340.92 4 820.44 5 127.13 5 453.32 5 488.27

3 Yr Beta 0.75 0.12 0.18 - 0.49 0.34 Regional op er a tional per for mance

Price Prd End 7 675 4 934 5 410 4 359 4 220 The Aus tra lian region produced 210koz for the quarter, down

Price High 8 411 5 649 6 094 9 130 6 984 6% YoY (up 2% QoQ), with Gruyere con trib ut ing for the first

Price Low 4 672 3 290 3 760 3 680 3 000 time. Pro duc tion for the quarter was impacted by a build-up of

RATIOS gold in circuit at the end of the quarter at both St Ives and

Ret on SH fund 5.57 - 12.74 - 0.23 5.45 - 8.76 Gruyere, amounting to ap prox i mately 7koz in total which was

Ret on Tot Ass 11.09 7.46 9.06 21.62 18.25 recovered shortly after quarter-end. AIC for the region was

Oper Pft Mgn 28.44 20.75 23.78 49.54 42.79 AD1,538/oz (USD1,054/oz), up 16% YoY (down 14% QoQ) as

D:E 0.92 0.89 0.62 0.63 0.76

the project capex at Gruyere comes to an end.

Interest Cover 5.54 n/a 3.47 7.23 1.16

Current Ratio 1.61 1.50 1.30 1.22 1.74 Production in Ghana for Q3 2019 was 205koz, up 5% YoY

Dividend Cover 2.13 - 14.98 - 0.30 2.67 - 16.84 (down 5% QoQ), with AIC of USD1,067/oz, largely flat YoY (up

Yield (g/ton) 2.00 2.00 2.10 2.10 2.20 3% QoQ). As the re in vest ment project at Damang pro gresses,

Ton Mll (‘000) 16 746 34 110 34 492 34 222 33 014 the mine is currently transitioning through the anticipated

Price Received 1 298 1 251 1 255 1 241 1 140 lower (more variable) grade Huni sandstone lithology, which

WrkCost(R/kg) 42 42 43 42 43 impacted pro duc tion in the quarter.

NUMBER OF EMPLOYEES: 8 964 Gold equiv a lent pro duc tion at Cerro Corona was down 22%

DIRECTORS: Andani A (ind ne), Bacchus P (ind ne), YoY (down 19% QoQ) at 65koz, due to lower grades mined (as

Goodlace T P (ind ne), Letton Dr C (ind ne),

Mahanyele-Dabengwa P (ind ne), Reid S P (ind ne), Suleman Y (ne), per mining sequence) and the lower price factor. Con se quently,

Carolus C A (Chair, ind ne), Menell R (Dep Chair, ind ne), AIC for the quarter was USD929 per equivalent ounce, up 34%

Holland N J (CEO, UK), Schmidt P (CFO) YoY (up 29% QoQ).

143