Page 149 - SHB 2020 Issue 1

P. 149

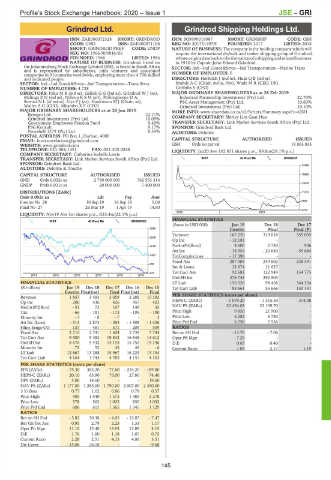

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – GRI

Grindrod Ltd. Grindrod Shipping Holdings Ltd.

GRI GRI

ISIN: ZAE000072328 SHORT: GRINDROD ISIN: SG9999019087 SHORT: GRINSHIP CODE: GSH

CODE: GND ISIN: ZAE000071106 REG NO: 201731497H FOUNDED: 2017 LISTED: 2018

SHORT: GRINDROD PREF CODE: GNDP NATURE OF BUSINESS: The company is the holding company which will

REG NO: 1966/009846/06 acquire the international drybulk and tanker shipping group of Grindrod,

FOUNDED: 1966 LISTED: 1986 whose origins date back to the formation of a shipping and related business

NATURE OF BUSINESS: Grindrod, listed on in 1910 by Captain John Edward Grindrod.

the Johannesburg Stock Exchange Limited (JSE), is based in South Africa SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Marine Trans

and is represented by subsidiaries, joint ventures and associated NUMBER OF EMPLOYEES: 0

companies in 31countries worldwide, employing more than 4 700 skilled

and dedicated people. DIRECTORS: Herholdt J (ind ne), Huat Q B (ind ne),

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs Brahde A C (Chair, ind ne, Nor), Wade M R (CEO, UK),

NUMBER OF EMPLOYEES: 4 728 Griffiths S (CFO)

DIRECTORS: Faku M R (ind ne), Gelink G G (ind ne), Grindrod W J (ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Malinga Z N (ind ne), Ndlovu R S M (alt), Polkinghorne D A, Industrial Partnership Investments (Pty) Ltd. 22.70%

Sowazi N L (ld ind ne), Uys P J (ne), Hankinson M J (Chair, ne), PSG Asset Management (Pty) Ltd. 10.60%

Waller A G (CEO), Mbambo X F (CFO) Grindrod Investments (Pty) Ltd. 10.10%

MAJOR ORDINARY SHAREHOLDERS as at 28 Jun 2019 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=GSH

Remgro Ltd. 22.71% COMPANY SECRETARY: Shirley Lim Guat Hua

Grindrod Investments (Pty) Ltd. 10.09%

Government Employees Pension Fund 9.49% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

PSG Konsult 9.17% SPONSOR: Grindrod Bank Ltd.

Newshelf 1279 (Pty) Ltd. 8.39% AUDITORS: Deloitte

POSTAL ADDRESS: PO Box 1, Durban, 4000

EMAIL: investorrelations@grindrod.com CAPITAL STRUCTURE AUTHORISED ISSUED

WEBSITE: www.grindrod.com GSH Ords no par val - 19 063 833

TELE PHONE: 031-304-1451 FAX: 031-305-2848 LIQUIDITY: Jan20 Ave 102 851 shares p.w., R9.8m(28.1% p.a.)

COMPANY SECRETARY: Catherina Isabella Lewis

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. INDT 40 Week MA GRINSHIP

SPONSOR: Grindrod Bank Ltd. 17899

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 15669

GND Ords 0.002c ea 2 750 000 000 762 553 314

13439

GNDP Prefs 0.031c ea 20 000 000 7 400 000

DISTRIBUTIONS [ZARc] 11210

Ords 0.002c ea Ldt Pay Amt

Interim No 28 10 Sep 19 16 Sep 19 5.00 8980

Final No 27 26 Mar 19 1 Apr 19 14.60

6750

2018 | 2019

LIQUIDITY: Nov19 Ave 3m shares p.w., R23.4m(22.1% p.a.)

FINANCIAL STATISTICS

INDT 40 Week MA GRINDROD

(Amts in USD’000) Jun 19 Dec 18 Dec 17

3080 Interim Final Final (P)

Turnover 167 220 319 018 355 035

2549

Op Inc - 12 183 - -

2018 NetIntPd(Rcvd) 4 600 2 730 906

Att Inc - 18 954 - 20 640 - 59 684

1487 TotCompIncLoss - 17 390 - -

Fixed Ass 287 505 249 602 238 591

956

Inv & Loans 12 674 11 627 -

425 Tot Curr Ass 92 681 122 949 154 775

2014 | 2015 | 2016 | 2017 | 2018 | 2019

Ord SH Int 276 743 292 503 -

FINANCIAL STATISTICS LT Liab 156 526 98 458 344 554

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Tot Curr Liab 88 661 56 666 130 141

Interim Final(rst) Final Final(rst) Final

Revenue 1 857 3 493 3 059 3 288 10 192 PER SHARE STATISTICS (cents per share)

Op Inc 206 436 426 457 423 HEPS-C (ZARc) - 1 079.20 - 1 315.50 - 374.08

NetInt(Pd)Rcvd - 51 72 167 149 33 NAV PS (ZARc) 20 454.03 22 109.70 -

Tax - 66 - 181 - 173 - 195 - 190 Price High 9 850 21 900 -

Minority Int - 3 - 8 - 7 - 3 Price Low 6 282 6 780 -

Att Inc (Loss) - 513 2 873 - 583 - 1 908 - 1 426 Price Prd End 6 750 7 536 -

Hline Erngs-CO 137 481 571 209 559 RATIOS

Fixed Ass 2 710 2 741 1 604 5 739 7 744 Ret on SH Fnd - 13.70 - 7.06 -

Tot Curr Ass 9 500 9 383 19 842 16 848 14 612 Oper Pft Mgn - 7.29 - -

Ord SH Int 8 676 9 432 14 153 15 752 19 146 D:E 0.63 0.40 -

Minority Int 72 52 45 49 - 6 Current Ratio 1.05 2.17 1.19

LT Liab 12 867 13 288 15 967 16 223 13 154

Tot Curr Liab 4 164 3 744 4 785 4 155 4 163

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 75.30 382.20 - 77.60 - 254.20 - 189.80

HEPS-C (ZARc) 20.10 63.90 76.00 27.80 74.40

DPS (ZARc) 5.00 14.60 - - 19.60

NAV PS (ZARc) 1 177.00 1 285.00 1 790.00 2 007.00 2 450.00

3 Yr Beta 0.77 1.02 0.86 0.78 0.57

Price High 905 1 540 1 575 1 485 2 278

Price Low 578 562 1 025 850 1 032

Price Prd End 606 615 1 365 1 345 1 129

RATIOS

Ret on SH Fnd - 5.83 30.38 - 4.05 - 12.07 - 7.47

Ret On Tot Ass 0.95 2.79 2.23 1.33 1.17

Oper Pft Mgn 11.10 12.48 13.93 13.89 4.15

D:E 1.76 1.60 1.18 1.07 0.75

Current Ratio 2.28 2.51 4.15 4.06 3.51

Div Cover - 15.06 26.18 - - - 9.68

145