Page 142 - SHB 2020 Issue 1

P. 142

JSE – FAI Profile’s Stock Exchange Handbook: 2020 – Issue 1

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Rests&Bars

Fairvest Property Holdings Ltd. NUMBER OF EMPLOYEES: 4 805

FAI DIRECTORS: Adami N J (ind ne), Boulle C H (alt), Fredericks D (ind ne),

ISIN: ZAE000203808 SHORT: FAIRVEST CODE: FVT Halamandres J L (ne), Halamandris N (ne), Maditse A (ind ne),

REG NO: 1998/005011/06 FOUNDED: 1998 LISTED: 1998 Mashilwane E (ind ne), Richards N, Botha S (Chair, ld ind ne), Hele D

NATURE OF BUSINESS: Fairvest Property Holdings Ltd. is listed in the (Group CE), Ntlha K (Group FD)

Retail REIT sector of the JSE Ltd. Fairvest’s objective is to build a MAJOR ORDINARY SHAREHOLDERS as at 05 Nov 2019

retail-focused property fund weighted toward non-metropolitan shopping Coronation Asset Management (Pty) Ltd. 25.05%

centres and including convenience, community and regional shopping Government Employees Pension Fund 10.23%

centres servicing the lower LSM market in high-growth nodes close to BMO LGM Asset Management Group 7.76%

commuter networks. POSTAL ADDRESS: PO Box 2884, Halfway House, 1685

SECTOR: Fins—Rest—Inv—Ret MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=FBR

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Celeste Appollis

DIRECTORS: Andrag L W (ld ind ne), Cohen T J (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mkhize N (ind ne), Nkuna K R (ind ne), Wiese Adv J D (ind ne),

du Toit J F (Chair, ne), Wilder D W (CEO), Kriel B J (CFO), SPONSOR: Standard Bank

Marcus A (COO, alt) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Vukile Property Fund Ltd. 26.56% FBR Ords 1c ea 200 000 000 100 083 547

Nedbank Group 11.23%

STANLIB 11.19% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: Postnet Suite 30, Private Bag X3, Roggebaai, 8012 Ords 1c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=FVT Interim No 45 3 Dec 19 9 Dec 19 90.00

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd. Final No 44 2 Jul 19 8 Jul 19 100.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan20 Ave 559 314 shares p.w., R51.0m(29.1% p.a.)

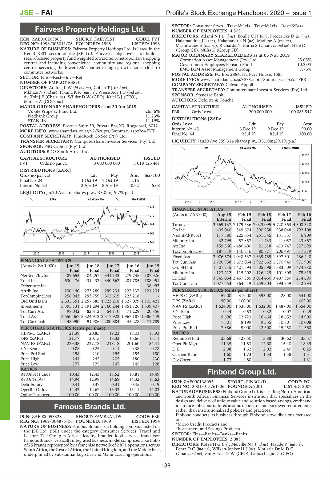

SPONSOR: PSG Capital (Pty) Ltd. TRAV 40 Week MA FAMBRANDS

AUDITORS: BDO South Africa Inc.

16652

CAPITAL STRUCTURE AUTHORISED ISSUED

FVT Ords no par val 3 000 000 000 1 018 125 441 14516

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt Scr/100 12380

Final No 24 1 Oct 19 7 Oct 19 11.16 - 10243

Interim No 23 2 Apr 19 8 Apr 19 10.62 5.08

LIQUIDITY: Jan20 Ave 4m shares p.w., R8.0m(19.7% p.a.) 8107

SAPY 40 Week MA FAIRVEST 5971

2015 | 2016 | 2017 | 2018 | 2019

236

FINANCIAL STATISTICS

212 (Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final

189 Turnover 3 569 137 7 179 536 7 023 095 5 720 363 4 308 318

Op Inc 405 040 849 674 890 258 938 048 792 108

165

NetIntPd(Rcvd) 117 380 225 634 251 345 131 557 6 909

Minority Int 32 795 57 857 41 733 41 057 23 867

142

Att Inc 159 566 - 480 400 21 618 413 747 527 699

118 TotCompIncLoss 187 319 - 140 716 80 871 206 497 617 319

2015 | 2016 | 2017 | 2018 | 2019

Fixed Ass 2 076 674 1 048 537 1 339 789 1 397 601 286 448

FINANCIAL STATISTICS Tot Curr Ass 1 720 958 1 672 064 1 922 662 1 570 940 971 906

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Ord SH Int 1 501 715 1 421 594 1 505 598 1 383 509 1 474 780

Final Final Final Final Final Minority Int 123 212 115 202 126 429 101 805 75 819

NetRent/InvInc 489 653 404 257 331 142 279 735 187 926 LT Liab 3 345 034 2 467 885 3 014 460 3 407 380 214 690

Total Inc 530 476 431 432 340 562 281 785 188 951

Debenture Int - - - - 38 992 Tot Curr Liab 1 077 653 964 519 1 259 304 993 759 642 994

Attrib Inc 230 440 273 289 299 234 222 137 121 204 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 256 943 293 759 302 619 223 218 - HEPS-C (ZARc) 159.00 319.00 393.00 428.00 541.00

Ord UntHs Int 2 335 351 2 257 385 1 723 218 1 327 079 1 105 421 DPS (ZARc) 90.00 100.00 - - 405.00

Investments 3 395 131 3 191 294 2 160 244 1 851 726 1 339 407 NAV PS (ZARc) 1 624.00 1 536.00 1 632.00 1 487.00 1 554.00

Tot Curr Ass 98 042 82 812 54 110 71 229 20 856 3 Yr Beta - 0.44 - 0.53 - 0.32 0.07 0.29

Total Ass 3 550 067 3 324 972 2 317 922 1 967 187 1 386 449 Price High 9 696 12 723 16 464 18 652 14 900

Tot Curr Liab 148 990 491 906 280 884 45 228 71 789 Price Low 7 501 8 199 9 355 10 801 10 008

PER SHARE STATISTICS (cents per share) Price Prd End 7 886 9 000 12 300 15 450 11 560

HEPS-C (ZARc) 21.39 20.85 19.23 18.03 15.93 RATIOS

DPS (ZARc) 21.77 20.15 18.33 16.66 15.11 Ret on SH Fnd 23.68 - 27.50 3.88 30.62 35.57

NAV PS (ZARc) 229.38 227.78 218.18 201.60 184.41 Oper Pft Mgn 11.35 11.83 12.68 16.40 18.39

3 Yr Beta - 0.08 - 0.25 0.11 0.38 0.28 D:E 2.08 1.62 2.02 2.40 0.25

Price Prd End 198 210 195 155 180 Current Ratio 1.60 1.73 1.53 1.58 1.51

Price High 244 245 205 180 230 Div Cover 1.77 - 4.80 - - 1.31

Price Low 177 175 147 145 128

RATIOS

RetOnSH Funds 10.43 12.43 17.52 16.81 14.49 Finbond Group Ltd.

FIN

RetOnTotAss 14.94 12.98 14.69 14.32 13.63 ISIN: ZAE000138095 SHORT: FINBOND CODE: FGL

Debt:Equity 0.41 0.37 0.31 0.45 0.19 REG NO: 2001/015761/06 FOUNDED: 2001 LISTED: 2007

OperRetOnInv 14.42 12.67 15.33 15.11 14.03 NATURE OF BUSINESS: Finbond Group Ltd. is a leading North-American

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 and South African Financial Services institution that specializes in the

design and delivery of unique value and solution based savings, credit and

Famous Brands Ltd. insurance solutions tailored around depositor and borrower requirements

rather than institutionalized policies and practices.

FAM

ISIN: ZAE000053328 SHORT: FAMBRANDS CODE: FBR Finbond conducts its business through Finbond’s two divisions focussed

REG NO: 1969/004875/06 FOUNDED: 1969 LISTED: 1994 on:

NATURE OF BUSINESS: Famous Brands is a holding company listed on *Micro Credit Products and

the JSE Ltd. (JSE) under the category Consumer Services: Travel and *Investment and Savings Products

Leisure. The Group is Africa’s leading branded food services franchisor. SECTOR: Fins—Banks—Banks—Banks

Famous Brands’ vertically integrated business model comprises a portfolio NUMBER OF EMPLOYEES: 2 083

of 25 brands represented by a franchise network of 2 871 operations across DIRECTORS: Kotzé H G (ne), Melville N J (ind ne), Naude P (ind ne),

South Africa, the Rest of Africa, the United Kingdom, and the Middle East, Pentz D C (ind ne), Wilken-Jonker H J (ne), Motlatla Dr M D C

underpinned by substantial Logistics and Manufacturing operations. (Chair, ind ne), van Aardt Dr W (CEO), Labuschagne G (CFO)

138