Page 145 - SHB 2020 Issue 1

P. 145

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – GAI

FINANCIAL STATISTICS Tot Curr Liab 1 705 1 794 6 138 1 783 2 305

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 PER SHARE STATISTICS (cents per share)

Final Final(rst) Final(rst) Final Final HEPS-C (ZARc) 18.06 56.09 78.36 65.59 21.54

NetRent/InvInc 3 628 3 633 3 894 1 557 555 DPS (ZARc) 25.00 39.64 66.84 63.50 -

Total Inc 4 169 4 165 4 332 2 208 807 NAV PS (ZARc) 1 045.00 1 042.00 1 053.00 1 063.00 997.00

Attrib Inc 2 618 - 4 904 4 426 - 5 372 2 564 3 Yr Beta - 0.44 - 0.46 - - -

TotCompIncLoss 2 593 - 4 706 4 326 - 5 407 2 564 Price High 650 748 1 000 1 000 1 020

Ord UntHs Int 34 897 36 951 45 074 40 924 13 461 Price Low 500 550 600 750 625

Investments 2 505 2 310 14 591 14 594 6 349 Price Prd End 549 600 600 850 870

FixedAss/Prop 25 193 24 851 24 849 24 286 6 452 RATIOS

Tot Curr Ass 1 403 2 032 1 922 1 396 597 Ret on SH Fnd 3.45 5.38 7.44 6.17 0.74

Total Ass 53 450 56 644 62 066 55 167 18 397 Oper Pft Mgn 41.59 63.92 70.24 83.61 51.59

Tot Curr Liab 3 760 4 623 2 002 2 190 1 901

Current Ratio 34.54 31.19 13.10 47.54 239.64

PER SHARE STATISTICS (cents per share) Div Cover 0.72 1.41 1.17 1.03 -

HEPS-C (ZARc) 104.12 19.71 165.79 181.38 249.50

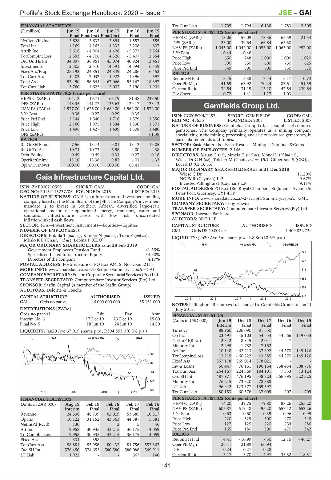

DPS (ZARc) 148.35 141.77 135.63 129.17 123.13 Gemfields Group Ltd.

NAV PS (ZARc) 1 977.00 1 626.00 1 689.00 1 562.00 1 572.00

GEM

3 Yr Beta 0.36 0.27 0.29 0.35 - ISIN: GG00BG0KTL52 SHORT: GEMFIELDS CODE: GML

Price Prd End 2 144 1 540 1 716 1 579 1 550 REG NO: 47656 FOUNDED: 2007 LISTED: 2008

Price High 2 160 1 975 1 894 1 830 1 871 NATURE OF BUSINESS: Gemfields Group Ltd. is a supplier of coloured

Price Low 1 496 1 427 1 499 1 308 1 480 gemstones. The Company primarily operates as a mining company,

DPS (ZARc) - - - - 61.38 specializing in the mining, processing, and sale of coloured gemstones, in

RATIOS particular emeralds and rubies.

RetOnSH Funds 7.56 - 13.14 9.81 - 13.13 19.05 SECTOR: Basic Materials—Basic Resrcs—Mining—Diamonds&Gems

RetOnTotAss 10.71 10.73 6.98 4.00 4.38 NUMBER OF EMPLOYEES: 2 166

Debt:Equity 0.49 0.49 0.31 0.27 0.18 DIRECTORS: Malan C (ne), Mmela K (ind ne), Mondi L (ld ind ne),

OperRetOnInv 13.10 13.38 9.87 4.01 4.33 Wiese Dr C H (ne), Tolcher M (Chair, ind ne, UK), Gilbertson S (CEO),

OpInc:Turnover 100.00 100.00 100.00 68.41 - Lovett D (CFO, UK)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

Wiese C Dr 11.20%

Gaia Infrastructure Capital Ltd. NGPMR (Cayman) L.P. 9.67%

Investec Pallinghurst (Cayman) L.P. 9.11%

GAI

ISIN: ZAE000210555 SHORT: GAIA CODE: GAI POSTAL ADDRESS: PO Box 186, Royal Chambers, St. Julian’s Avenue,St.

REG NO: 2015/115237/06 FOUNDED: 2015 LISTED: 2015 Peter Port, Guernsey, GY1 4HP

NATURE OF BUSINESS: GAIA is an infrastructure investment holding MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=GML

company listed on the Main Board of the JSE. The Company’s investment COMPANY SECRETARY: Toby Hewitt

mandate is to invest in Southern African, diversified large-scale TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

operational and/or near-operational energy, transport, water and

sanitation infrastructure assets with low risk, uncorrelated SPONSOR: Investec Bank Ltd.

inflation-linked cash flows. AUDITORS: BDO LLP

SECTOR: Fins—Investment Instruments—Equities—Equities CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 0 GML Ords USD0.001c ea - 1 409 832 739

DIRECTORS: Bukula T (ind ne), Kimber N (ind ne), Tuku S (ind ne),

Mbalo K E (Chair, ind ne), Lebina P (CEO) LIQUIDITY: Jan20 Ave 5m shares p.w., R8.8m(18.6% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 MINI 40 Week MA GEMFIELDS

Government Employees Pension Fund 41.35%

761

Specialised Listed Infrastructure Equity 34.90%

Directors of the company 4.17% 637

POSTAL ADDRESS: Postnet Suite 6, PO Box 92418, Norwood, 2117

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=GAI 513

COMPANY SECRETARY: Fusion Corporate Secretarial Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 388

SPONSOR: Sasfin Capital (a member of the Sasfin Group)

264

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 140

2015 | 2016 | 2017 | 2018 | 2019

GAI Ords no par val 6 000 000 000 55 151 000

NOTES: Pallinghurst Resources Ltd. changed to Gemfields Group Ltd. on 11

DISTRIBUTIONS [ZARc] July 2018.

Ords no par val Ldt Pay Amt FINANCIAL STATISTICS

Interim No 6 17 Dec 19 23 Dec 19 25.00 (Amts in USD’000) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Final No 5 18 Jun 19 24 Jun 19 14.80 Interim Final Final Final Final

LIQUIDITY: Jan20 Ave 67 019 shares p.w., R394 853.0(6.3% p.a.) Turnover 88 960 206 090 81 650 - -

Op Inc 23 497 - 45 103 54 654 44 566 - 149 053

FINA 40 Week MA GAIA

NetIntPd(Rcvd) 2 312 8 845 2 011 - 7 - 1

Minority Int 2 295 1 782 7 162 - -

Att Inc 10 148 - 62 213 37 892 44 570 - 149 126

880

TotCompIncLoss 13 219 - 60 222 43 885 44 570 - 149 126

Fixed Ass 367 178 365 014 378 021 - -

766

Inv & Loans 50 447 76 161 196 164 358 484 308 716

651 Tot Curr Ass 254 167 224 369 184 101 7 353 13 124

Ord SH Int 487 971 476 195 538 723 366 895 322 325

537 Minority Int 76 215 73 920 78 388 - -

LT Liab 96 942 123 377 169 597 - -

422

| 2016 | 2017 | 2018 | 2019 Tot Curr Liab 80 153 60 576 37 009 207 709

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 HEPS-C (ZARc) 14.20 - 39.75 - 79.80 88.26 - 255.20

Interim Final Final Final Final NAV PS (ZARc) 605.87 519.48 495.20 657.12 652.26

Revenue 24 338 48 739 62 019 53 685 10 817 3 Yr Beta - 0.63 - 0.60 0.39 0.96 0.95

Op Inc 10 122 31 152 43 563 44 887 5 581 Price High 220 329 500 470 548

NetIntPd(Rcvd) 130 - 2 5 46 Price Low 127 125 220 254 286

Att Inc 9 958 30 935 43 215 36 175 4 059 Price Prd End 165 180 300 470 342

TotCompIncLoss 9 958 30 935 43 215 36 175 4 059 RATIOS

Fixed Ass 331 358 - - - Ret on SH Fnd 4.41 - 10.99 7.30 12.15 - 46.27

Tot Curr Ass 58 884 55 956 80 432 84 756 552 362 Oper Pft Mgn 26.41 - 21.89 66.94 - -

Ord SH Int 576 450 574 653 580 580 586 086 549 911 D:E 0.24 0.27 0.28 - -

LT Liab 1 922 - - 567 146 Current Ratio 3.17 3.70 4.97 35.52 18.51

141